- The FIFA Club World Cup is boosting hotel occupancy in several host markets.

- Occupancy increases vary by market and by match within markets.

- The tournament may be hit by falling international arrivals.

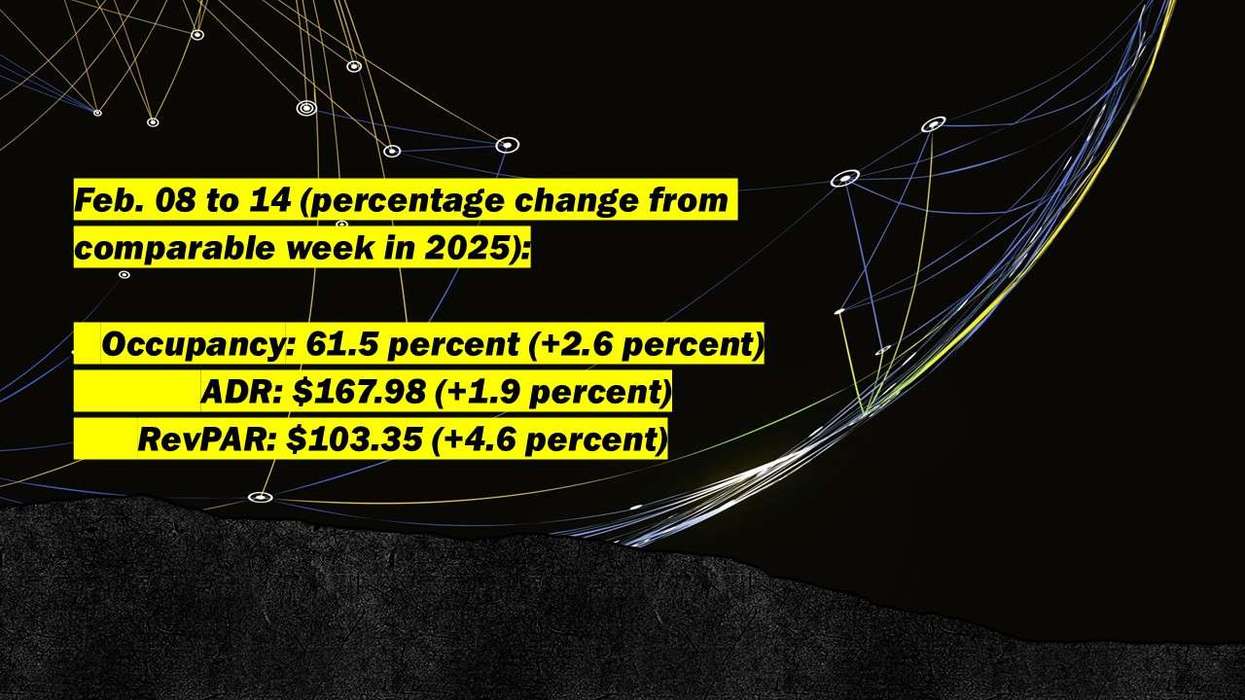

THE FIFA CLUB World Cup is driving hotel occupancy increases in some of the tournament’s 11 host markets, according to STR. The tournament, which began June 11, serves as a precursor to next year’s World Cup in the U.S.

The Club World Cup includes matches in Atlanta; Charlotte, North Carolina; Cincinnati; Los Angeles; Miami; Nashville, Tennessee; New York City; Orlando, Florida; Philadelphia; Seattle; and Washington, D.C.

Undersold hotel rooms for later-stage matches are expected, as participating teams are still unknown, STR said in an article . The uneven impact on host city hotel markets may also reflect recent patterns of last-minute booking and broader challenges in U.S. travel.

Occupancy increases vary by market and even by match within the same market, STR’s Forward STAR data shows. Philadelphia, Charlotte and Miami show more consistent gains across matches. Philadelphia leads with a 13.2 percent year-over-year occupancy increase during the group stage, followed by Charlotte at 8 percent and Miami at 5.7 percent.

Thousands of tickets remain unsold for most matches, which STR noted is expected given that teams have not advanced and travelers are booking closer to travel dates.

The tournament, which includes teams from several countries, could also be affected by a recent decline in international arrivals to the U.S.—one of several factors potentially limiting future bookings. Domestically, economic uncertainty and a drop in discretionary travel are also contributing.

Next summer’s World Cup is expected to boost demand, though the impact will depend on room supply and proximity to other markets. Based on data from past tournaments, STR projects corporate sponsors and high-spending fans will push ADR premiums in host cities up by 5 to 25 percent.

In March, a report commissioned by the U.S. Travel Association found the U.S. unprepared for the 2026 World Cup at Los Angeles’s SoFi Stadium and the 2028 Olympics, citing outdated air travel systems, visa delays, and aging infrastructure.