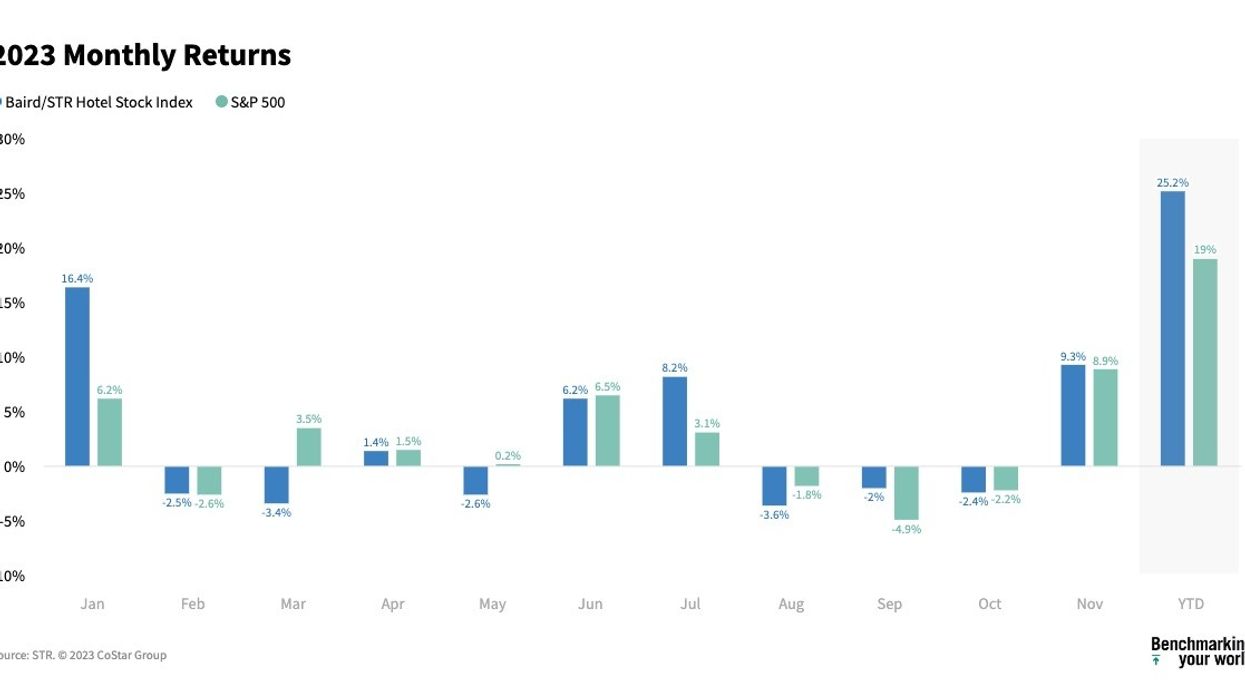

THE BAIRD/STR HOTEL Stock Index rose by 9.3 percent in November to 6,119, driven by lower interest rates for real estate stocks and overall investor sentiments, according to STR. However, U.S. hotel demand experienced a decline attributed to reduced group travel during Thanksgiving week.

"Hotel stocks rose sharply in November, breaking a three-month losing streak, with performance closely aligning with the benchmarks," said Michael Bellisario, senior hotel research analyst and director at Baird. "The gains in the month were predominantly propelled by lower interest rates, especially for real estate stocks, contributing to an overall improvement in investor sentiment. Year to date, the hotel REIT sub-index has shifted to positive, rising by 7.6 percent, while the hotel brand sub-index, up by 30.6 percent, continues to be a relative outperformer.”

However, U.S. hotel demand saw an expected dip resulting from reduced group travel during Thanksgiving week, said Amanda Hite, STR president.

“The industry stands to benefit from an extended break between Thanksgiving and Christmas, providing an opportunity for business travelers and groups to make one final visit before the year's end,” Hite said.

STR recently upgraded the 2023 ADR and RevPAR forecast, reflecting the sustained buoyancy of travelers.

"We anticipate ongoing RevPAR growth in the new year, supported by robust room rates," Hite said.

In November, the Baird/STR Index outpaced the S&P 500, which rose 8.9 percent, yet lagged behind the MSCI US REIT Index, which rose by 10.2 percent. The hotel brand sub-index rose 8.6 percent to 11,627, while the hotel REIT sub-index surged 12.1 percent to 1,117.

In October, the Baird/STR Index dropped 2.4 percent to 5,600, marking the third consecutive monthly decline. The decrease was influenced by rising interest rates impacting real estate stocks and investor sentiment. Moreover, U.S. hotel demand experienced a 1.3 percent dip, partially attributed to a calendar shift.