Summary:

- AHLA’s survey finds reduced hotel development and renovation plans.

- Only 8 percent of property owners are moving forward with new investments.

- Survey participants included 387 property owners and operators.

ABOUT 32 PERCENT of U.S. hotel owners and operators are delaying development projects and 24 percent are scaling back plans, according to a recent survey by the American Hotel & Lodging Association. About 8 percent have canceled projects entirely.

The survey also found that 8 percent reported moving forward with new investments.

“Hotels are eager to invest in their properties and communities but rising costs and uncertain demand are forcing many to put projects on hold,” said AHLA President and CEO Rosanna Maietta. “It’s been a tough year for hotel operators, especially our small business owners. As Congress gets back to work, we’ll focus on advancing policies to spur travel, ease operational pressures and provide our industry the certainty it needs to grow, create jobs and strengthen local economies nationwide.”

The workforce challenges further compound pressures, with nearly half of the respondents, 49 percent, reporting understaffed properties. On the demand side, leisure travel continues to decline. Thirty percent of hotels reported declines in completed leisure stays, while 26 percent saw drops in upcoming bookings compared with the same period last year.

Business, group and government travel also showed weakness, with 15 to 17 percent of properties experiencing decreases in bookings.

The AHLA survey, conducted between Aug. 21 and 29, included responses from 387 property owners and operators across the U.S., representing all hotel segments.

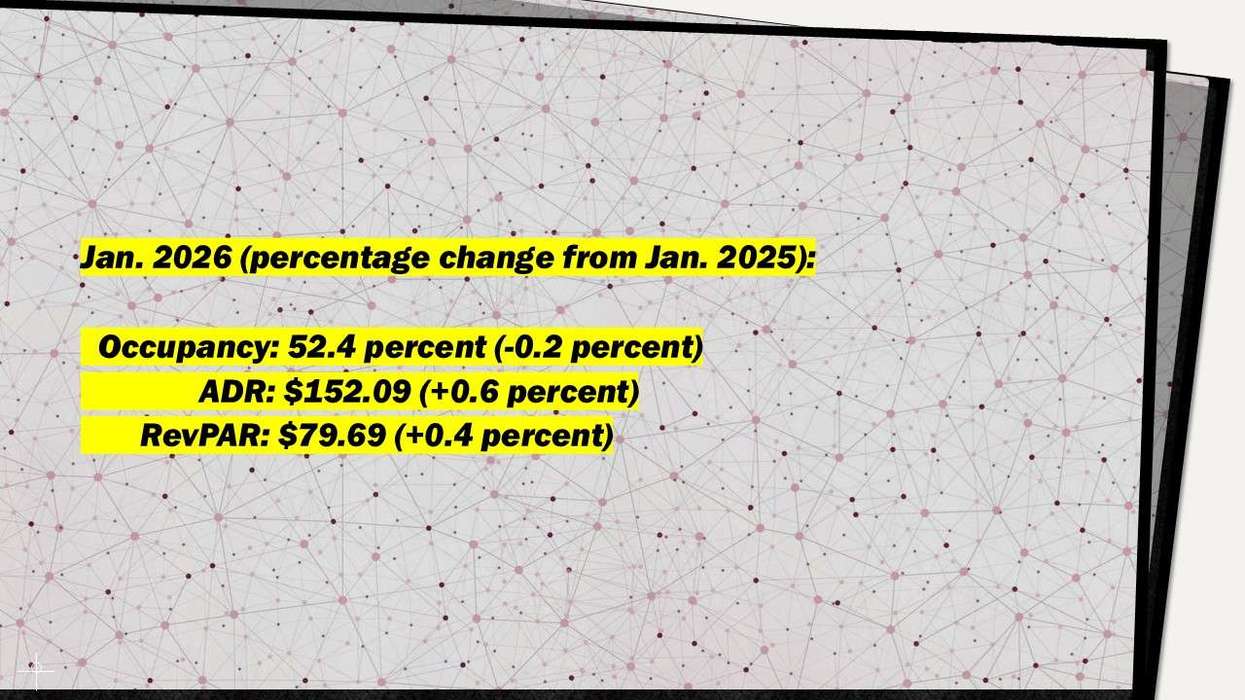

In another recent survey by the Hospitality Asset Managers Association, more than 70 percent of respondents expect a 1 to 3 percent RevPAR increase in the fourth quarter of 2025.