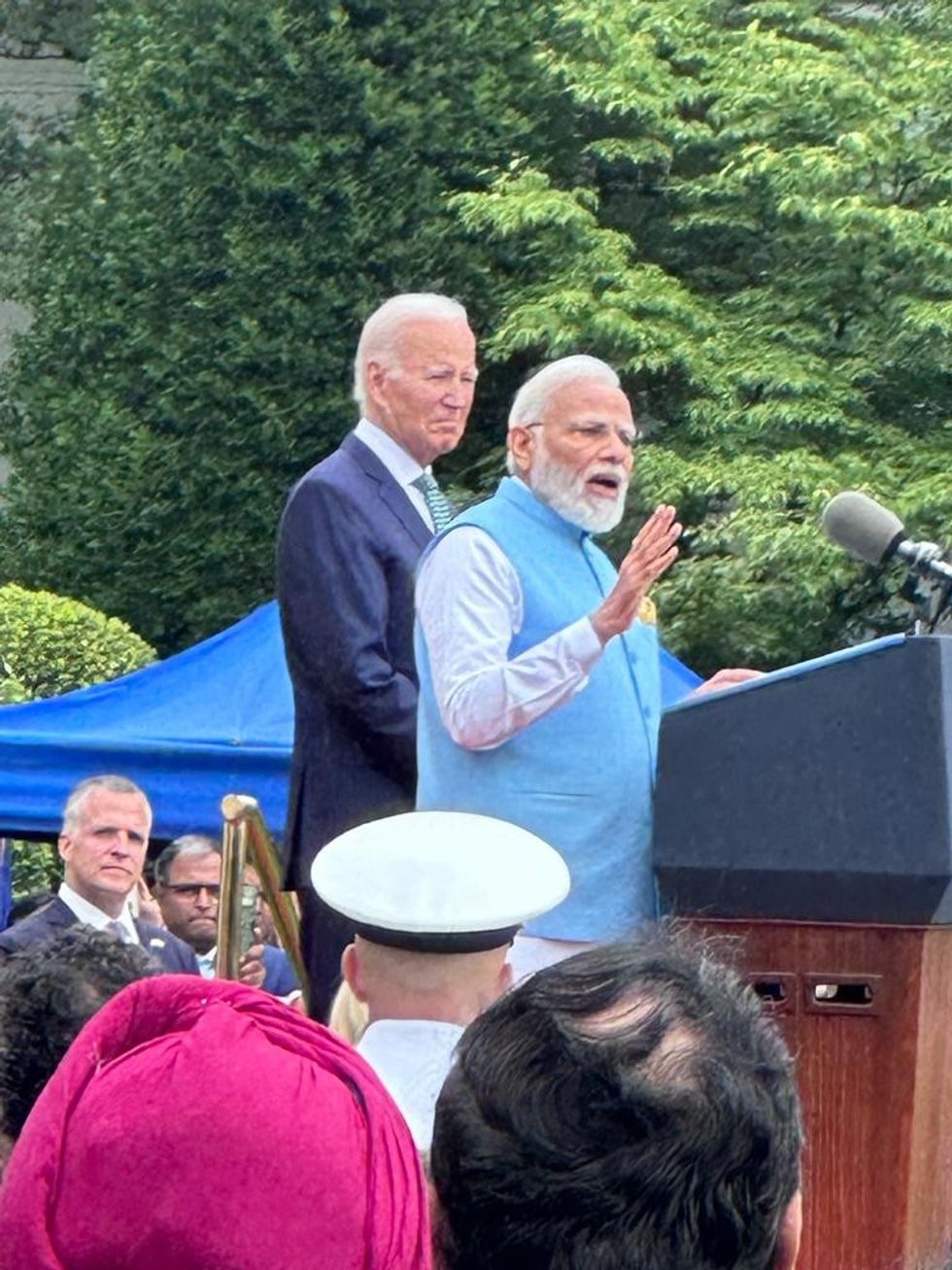

INDIAN PRIME MINISTER Narendra Modi’s steadfast dedication to economic reform, environmental concerns, technological advancements and foreign policy has cemented his position as a respected and esteemed leader, said Bharat Patel, AAHOA chairman. Patel and other AAHOA officers attended Modi’s recent visit to the White House and his address to Congress, and he said plans were laid to increase AAHOA’s connections to India with programs supporting more trade with Indian companies and a worker training program.

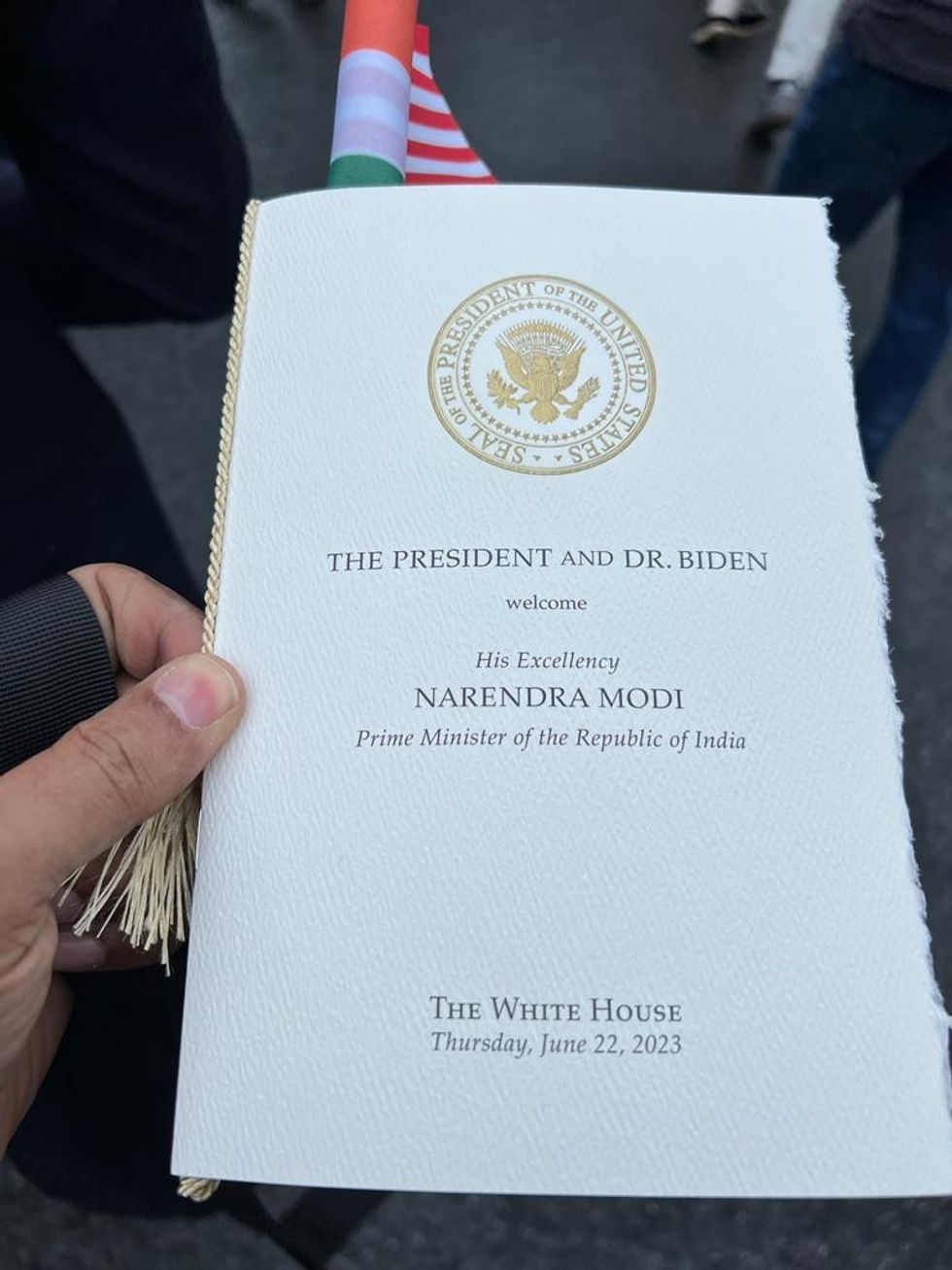

Modi's state visit June 21 to 23 significantly strengthened bilateral relations between India and the U.S., Patel said. The Indian prime minister received a warm welcome from the American diaspora community.

"Americans wholeheartedly recognize him as a crucial ally and genuine friend to the U.S.,” Patel said.

“While the nature of each visit may differ, Modi's visit to the U.S. is universally acknowledged as carrying immense significance for both democracies, representing a strong and evolving relationship between the U.S. and India.”

AAHOA is the largest hotel owners’ association in the U.S., with 20,000 members who own 60 percent of the nation's hotels. The association’s leaders actively lobbied Congress for PM Modi’s address to the House and Senate during his state visit. It also cosponsored “We the People: Celebrating the U.S.-India Partnership,” a special appearance by Modi and other officials and business leaders at the John F. Kennedy Center for the Performing Arts.

Their delegation included Bharat; Miraj Patel, vice chairman; Kamalesh “KP” Patel, treasurer; Rahul Patel, secretary; and Nishant “Neal” Patel, immediate past chair. They participated in the White House welcome ceremony and Modi's address to Congress, underscoring AAHOA’s dedication to robust Indian-U.S. relations.

"As two of the world's leading democracies, the U.S. and India share a remarkable number of similarities," said Bharat. "Amidst the intense scrutiny that world leaders endure on the global stage, Prime Minister Modi has garnered substantial support in the U.S. Many Americans appreciate his focus on economic development, initiatives such as 'Made in India,' and efforts to enhance India's global standing.”

Meanwhile, the prime minister also praised Indian Americans for their significant contributions to the host nation and the India-U.S. relationship during the state dinner. He highlighted their pride in values, democratic traditions, vibrant culture, and notable achievements in sectors like hospitality, healthcare, education, research, and logistics.

“Be it hospitals or hotels, universities or research labs, gas stations or logistics management, they are making their mark everywhere,” Modi said.

Enhanced bilateral relations

Modi’s visit acted as a catalyst for enhancing bilateral relations, offering a platform to discuss and advance cooperation in key areas such as trade, defense, security, technology, artificial intelligence, and cultural exchanges.

Bharat emphasized that Modi's visit signifies the strengthening ties between the two nations as they collaborate to address global challenges like climate change, AI advancements, defense and security, and shifting geopolitical dynamics.

He highlighted that the opportunity to attend a state dinner at the White House is universally recognized as an extraordinary honor.

“It serves as a prominent platform for diplomatic exchanges, bolstering bilateral relations, and celebrating international cooperation in a remarkable manner,” Bharat said.

AAHOA's properties make a substantial contribution to the U.S. economy, representing 1.7 percent of the U.S. GDP. Bharat said the association plans to step up its participation in the “Buy Indian” program.

“So many people of Indian origin do business in America, but they're not able to buy textiles for different reasons,” Bharat said. “We want to work with brands and hotel operators just to buy more textiles from India. I think that's a win-win for everybody.”

Past Chairman Neal Patel gave details on the need for cooperation with India.

“After COVID the cost of our expenses when it comes to FF&E and even soft goods, they've doubled and for some hotels, it's even tripled,” he said. “The idea was, how can you increase competition to drive the cost down or increase the quality of the products that we’re receiving in our hotels? And when you look at the hotel industry, mainly, their supplies are coming from either Pakistan or Bangladesh. Our goal is, how can we give India and the companies that are based there a platform to increase competition, lower the costs and hence increase our ROI on our assets.”

Neal said AAHOA previously sent a delegation to India to discuss plans for how the association can increase trade between its membership and Indian companies.

“The idea was very simple, to promote AAHOA and the hospitality industry by partnering with the Indian government,” Neal said. “The challenge that we saw that was happening is that the companies in India do not know the specs that are needed in our industry. So, what AAHOA’s role will be is to provide those specs, be the person in the middle, and provide the specs to the new companies and increase competition.”

Neal said the goal is to have 50 percent of AAHOA members buying products for their hotels from India in the next five years.

The AAHOA delegation to India also met with India’s minister of education to discuss a program that would help address U.S. hotels’ ongoing labor shortage.

“The idea would be for the Indian government to train hospitality students in AAHOA certification. Once they're trained, they'll provide us up to 50,000 students part time to work in our members’ hotels, and the cost will be very, very low compared to what we would pay here,” Neal said. “This helps us because right now, we can barely survive when it comes to labor and building a team. This will help us building a global team.”

U.S. tribute to PM

Bharat Patel described the atmosphere as Indian-Americans, influential figures, and dignitaries gathered for the momentous occasion.

“The White House paid a fitting tribute to Modi's visit by offering a delectable selection of vegetarian Indian cuisine, a splendid display that not only celebrated India's vibrant culture but also highlighted its global influences,” he said.

According to Bharat, the relationship between the U.S. and India encompasses a wide array of dimensions, ranging from strategic and economic to diplomatic and cultural ties.

“With the U.S. recognizing India as a major global power, the acknowledgement extends beyond Asia, considering India's growing influence as the world's most populous country, even surpassing China.”

Patel emphasized that the U.S. and India share fundamental values, rooted in a steadfast commitment to democracy and individual freedoms.

"These shared values strengthen the enduring bond between our nations," he said.

Neal Patel said the AAHOA officers did have a brief meeting with Modi himself.

“It wasn't an official meeting, it was just in passing ‘Hello,’” Neal said. “Unfortunately, we weren't able to take our phones there, but it was a very good experience for us. AAHOA is now recognized on with the India-America partnership and we were invited to be part of the delegation.”

Prior to Modi's visit, Indian Ambassador Taranjit Singh Sandhu attended a reception hosted by Marriott International in Washington. In April, leading American hotel brands such as Marriott, Hilton Worldwide, and Radisson Hotel Group further strengthened their presence in India.