U.S. HOTEL PERFORMANCE increased in the third week of February compared to the previous week, with mixed year-over-year comparisons, according to CoStar. Key metrics like occupancy, ADR, and RevPAR maintained upward trends during this period compared to the preceding week.

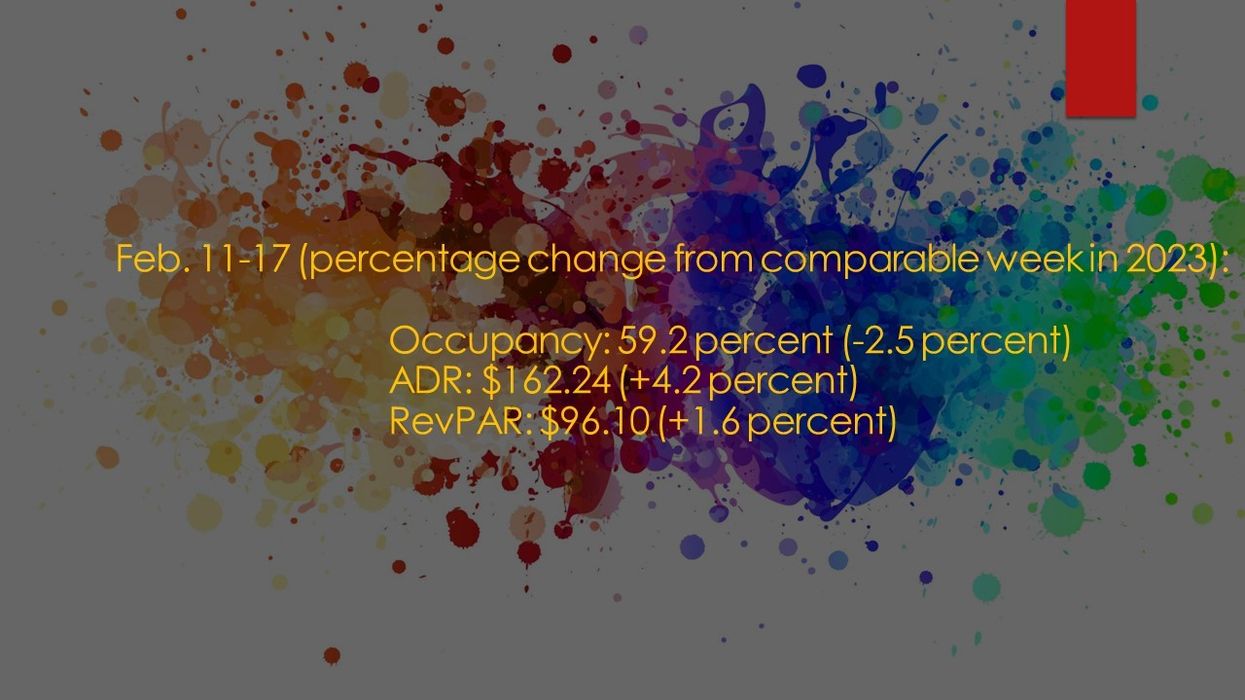

Occupancy climbed to 59.2 percent for the week ending Feb. 17, up from the previous week's 56.2 percent, representing a 2.5 percent year-over-year decline. ADR rose to $162.24 from $160.96 the prior week, signifying a 4.2 percent increase compared to the previous year. RevPAR similarly increased to $96.1 from $90.4 the prior week, reflecting a 1.6 percent rise compared to the corresponding period in 2023.

Among the top 25 markets, Boston and New Orleans saw substantial year-over-year increases in occupancy. Boston's occupancy rose by 14.6 percent to 64.7 percent, while New Orleans experienced a similar increase to 75.7 percent, driven by Mardi Gras.

Due to Super Bowl LVIII, Las Vegas reported significant increases. ADR rose by 76.7 percent to $318.88, while RevPAR jumped by 81.4 percent to $257.72. Weekly occupancy increased by 2.7 percent to 80.8 percent. On Sunday night, Las Vegas' occupancy surpassed 80 percent, with ADR exceeding $800.

Phoenix reported the sharpest decline in RevPAR, dropping by 21.6 percent to $173.63, attributed to comparisons with its Super Bowl hosting period last year.