Wyndham net income growth Q2 2024

WYNDHAM HOTELS & RESORTS is quietly bouncing back after Choice Hotels International's failed takeover bid. The company reported a net income of $86 million for the second quarter ending June 30, a 22.8 percent increase from $70 million the previous year.

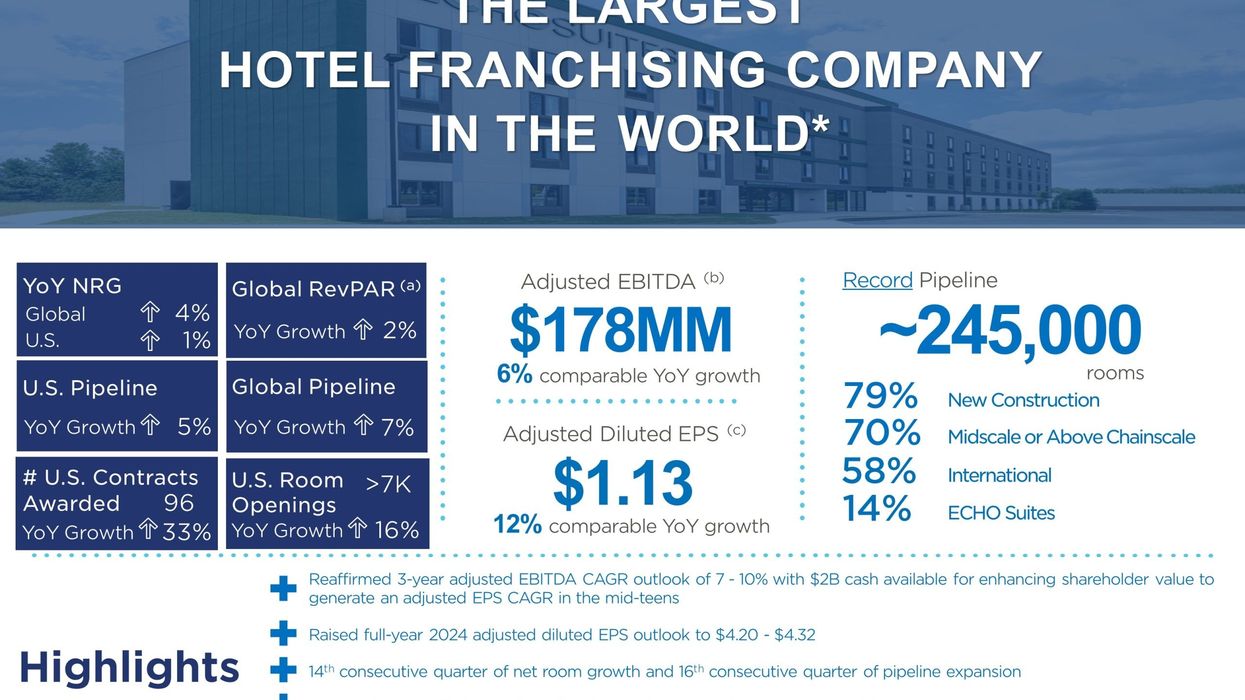

Wyndham’s global pipeline grew 7 percent year-over-year, with a 5 percent increase in the U.S. alone. Its net income increase was driven by higher adjusted EBITDA, a benefit from the reversal of a spin-off matter and a lower effective tax rate, Wyndham said in a statement.

"The resilience and highly cash generative nature of our business model was once again on full display this quarter," said Geoff Ballotti, Wyndham’s president and chief executive officer. "Amid a normalizing domestic RevPAR environment, we delivered strong adjusted EBITDA driven by net room and ancillary fee growth. We awarded 33 percent more hotel contracts domestically which grew our development pipeline to a record 245,000 rooms, and drove significant increases in our U.S, international and global royalty rates. Year-to-date, we've returned over $250 million to shareholders, representing 4 percent of our beginning market capitalization this year."

In March, Choice Hotels ended its bid to acquire Wyndham, and both companies announced they would now focus on their standalone strategies.

Revenue streams

Wyndham’s adjusted net income for the quarter was $91 million, up 14 percent from the second quarter of 2023, the statement said. Adjusted EBITDA grew 13 percent to $178 million, including a $10 million favorable impact from marketing fund variability. Excluding this impact, adjusted EBITDA increased by 6 percent, driven by higher fee-related and other revenues, disciplined cost management and insurance recoveries.

The company's franchise fee-related and other revenues reached $366 million, up from $358 million in the second quarter of 2023. This increase was supported by 4 percent global net room growth and a 6 percent rise in ancillary revenue streams, despite a $3 million decrease in management fees due to the company's exit from the U.S. management business.

Expansions on track

Wyndham’s system-wide rooms grew by 4 percent year-over-year, with over 18,000 rooms opened globally, including more than 7,000 in the U.S. The company awarded 180 new development contracts worldwide, with 96 in the U.S., representing a 33 percent increase from the previous year. The second quarter also saw the launch of the first ECHO Suites Extended Stay by Wyndham in the U.S.

The company’s global system growth resulted from a 3 percent increase in the higher RevPAR midscale and above segments in the U.S., along with strong growth in its two highest international RevPAR regions: EMEA and Latin America, which grew 12 percent and 11 percent, respectively.

Wyndham’s development pipeline expanded by 1 percent sequentially and 7 percent year-over-year to a record 245,000 rooms. Additionally, the company continued to improve its retention rate and remains solidly on track to achieve its net room growth outlook of 3 to 4 percent for the full year 2024.

RevPAR trends

Wyndham’s RevPAR increased by 2 percent globally in constant currency during the second quarter, with stagnant growth in the U.S. and a 7 percent increase internationally, the statement said. The midscale and above segments grew U.S. RevPAR by 2 percent year-over-year, while RevPAR for the economy segment declined by 2 percent. Overall U.S. RevPAR results were driven by a 90-basis point increase in occupancy, partially offset by a 50 basis point decline in ADR.

RevPAR growth in the U.S. accelerated during the second quarter, improving 520 basis points sequentially, with a 560-basis point improvement for its U.S. economy brands, Wyndham said.

The company grew RevPAR for its economy and midscale brands by 9 percent and 8 percent, respectively, compared to 2019, which neutralizes the impact of COVID recovery timing. However, RevPAR for its upscale and above brands lagged 2 percent behind 2019 levels.

Meanwhile, RevPAR for the company’s global operations, including Latin America, EMEA, and Canada, increased 15 percent, driven by continued pricing power with ADR up 13 percent and a 2 percent growth in occupancy.

2024 outlook

Wyndham reported a net income of $102 million for the first half of 2024, down from $137 million in the same period of FY 2023. Net revenue for the first six months of this year was $671 million, slightly down from $674 million in the previous year’s first half.

Diluted EPS for the first half of 2024 was $1.26, down from $1.59 in the same period last year, while operating income decreased to $195 million from $236 million in the first half of 2023, Wyndham said.

However, the company now expects adjusted net income to be between $338 million and $348 million, revised from the previous outlook of $341 million to $351 million. Adjusted diluted EPS is expected to be between $4.20 and $4.32, up from the earlier range of $4.18 to $4.30.

Wyndham’s first-quarter net income fell to $16 million from $67 million in the same period of 2023. However, its global development pipeline surged 8 percent, reaching a record 243,000 rooms and nearly 2,000 hotels. The company opened 13,000 rooms, marking a 27 percent year-over-year increase.