U.S. Extended-Stay Hotels See RevPAR Growth in Feb 2025

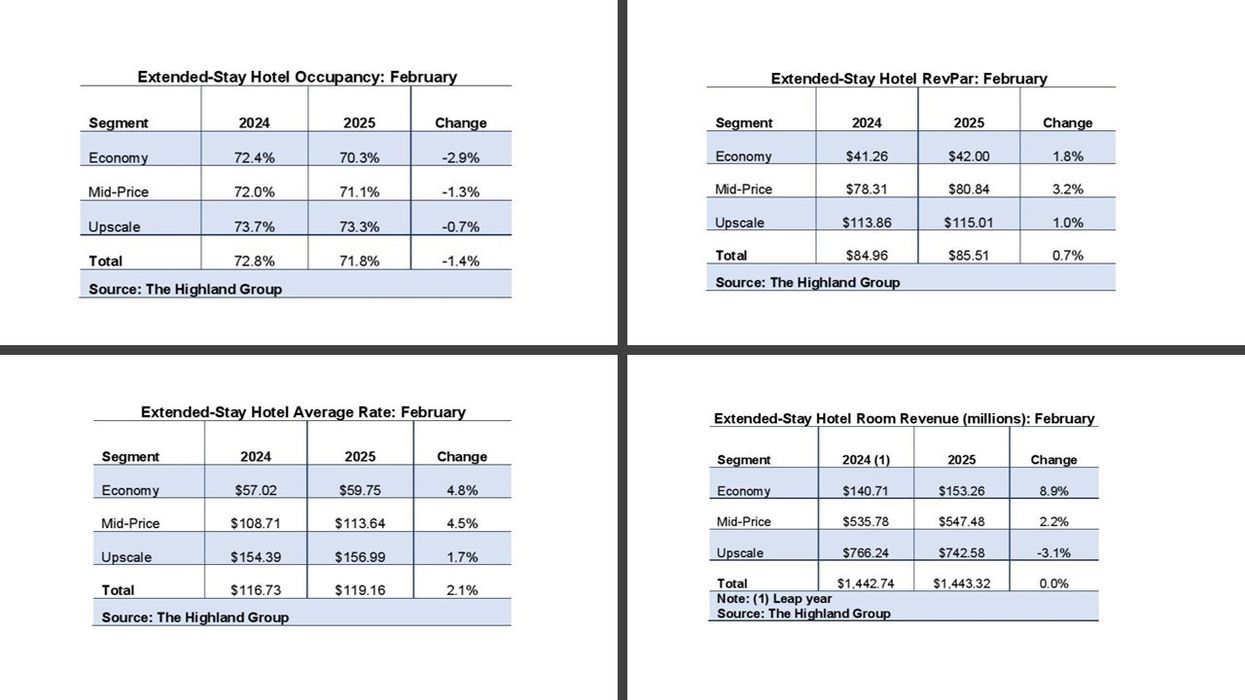

U.S. EXTENDED-STAY HOTELS outperformed the overall industry in revenue, occupancy, ADR and RevPAR compared to February, according to The Highland Group. RevPAR rose 0.7 percent in February, marking five consecutive months of growth.

The U.S. Extended-Stay Hotels Bulletin: February 2025 found that RevPAR growth across all extended-stay segments was driven solely by ADR increases, as occupancy declined.

“Extended-stay hotel occupancy declined in February, but ADR growth was high enough to drive a fifth consecutive month of RevPAR growth,” said Mark Skinner, The Highland Group’s partner.

Extended-stay room nights available fell 0.6 percent in February from a year earlier due to the leap year, the report said. However, the number of rooms open rose 3 percent, matching the 12-month average growth. The increase partly reflects the inclusion of WaterWalk by Wyndham and Executive Residency by Best Western in the database starting May and January, respectively.

Supply vs. demand

February marked 41 consecutive months of supply growth at 4 percent or less, with annual changes ranging from 1.8 percent to 3.1 percent over the past three years, The Highland Group said. These levels remain well below the long-term average. The 7 percent increase in economy extended-stay supply, alongside modest changes in mid-price and upscale segments, is largely driven by conversions, as new construction in the economy segment accounts for about 3 percent of rooms open year over year.

Supply comparisons were affected by rebranding, hotel de-flagging, and sales to multifamily firms and municipalities, the report said. Conversion activity is expected to decline, keeping 2025's total extended-stay supply growth well below the long-term average.

Unadjusted for the leap year, economy and mid-price extended-stay hotel revenues rose in February from a year earlier, while total extended-stay revenue remained flat, The Highland Group said. STR/CoStar reported a 0.9 percent decline in overall hotel industry revenue.

Unadjusted for the 2024 leap year, extended-stay hotel demand fell 2 percent. Accounting for the extra day, demand rose about 1.6 percent, marking growth in 26 of the past 27 months.

Key metrics overview

Extended-stay hotel occupancy fell 1.4 percent in February, the second consecutive monthly decline and third in 11 months, the report said. The drop was smaller than STR/CoStar’s 2.6 percent decline for all hotels. February occupancy remained 12.5 percentage points above the total industry, aligning with the long-term average premium.

After declines in February and March 2024—the first in three years—extended-stay hotel ADR rose for the 11th straight month, nearly doubling STR/CoStar’s 1.1 percent increase for all hotels, The Highland Group said. All extended-stay segments outpaced corresponding hotel classes in ADR growth.

Extended-stay RevPAR rose 0.7 percent in February, the tenth gain in 11 months. Though the smallest increase in five months, it outperformed the 1.5 percent decline reported by STR/CoStar for the overall industry. February’s total extended-stay RevPAR gain was lower than individual segment increases due to the economy segment’s larger share of supply compared to February 2024.

The U.S. Extended-Stay Hotels Bulletin: January 2025 reported stronger ADR and the highest RevPAR gains among extended-stay segments compared to corresponding hotel classes.