U.S. HOTEL PERFORMANCE decreased slightly in the first week of February from the previous week, while year-over-year comparisons remained mixed, according to CoStar. Key metrics, including occupancy, ADR, and RevPAR, all declined in the first week of February compared to the previous week.

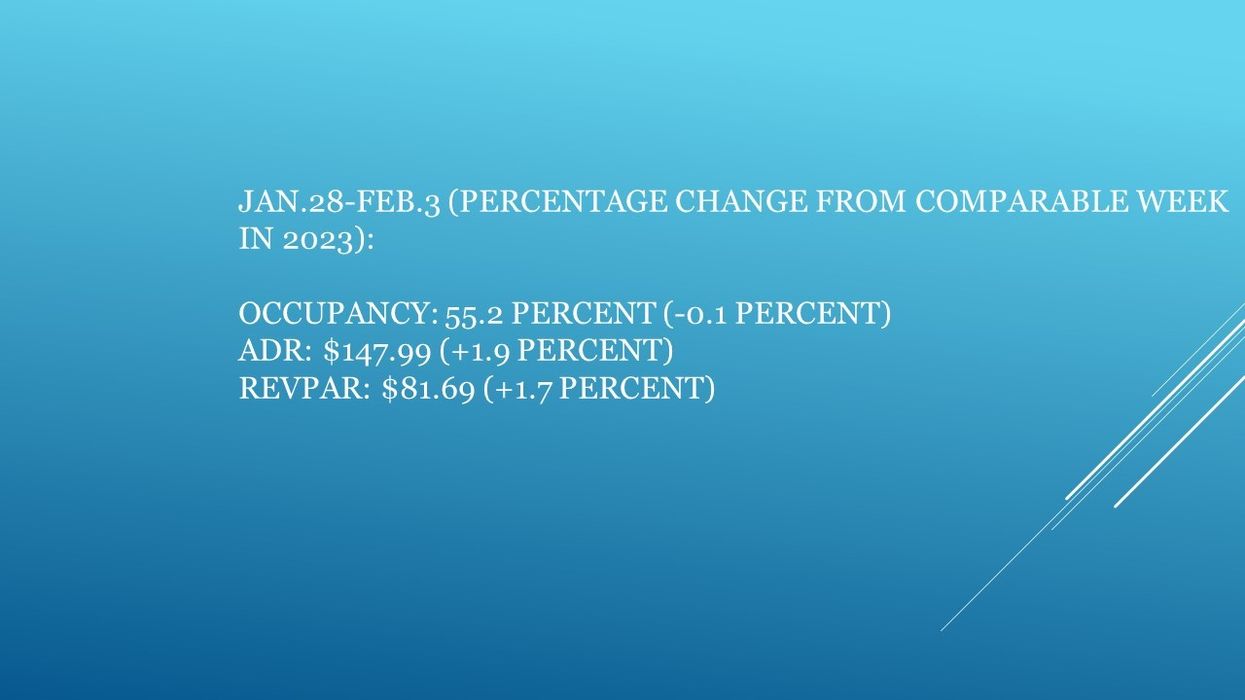

Occupancy dipped slightly to 55.2 percent for the week ending Feb. 3, from the previous week's 56.2 percent, reflecting a 0.1 percent decrease year-over-year. ADR decreased to $147.99 from the prior week's $149.76, marking a 1.9 percent increase compared to the previous year. RevPAR declined to $81.69 from the prior week's $84.13, reflecting a 1.7 percent increase compared to the corresponding period in 2023.

Among the top 25 markets, Seattle saw the largest year-over-year increases, with occupancy rising 19.3 percent to 60.1 percent and RevPAR increasing by 27.5 percent to $89.11.

Atlanta led in ADR growth, surging by 7.6 percent to $132.07. Meanwhile, St. Louis saw the most significant RevPAR decline, dropping 14.5 percent to $48.16, followed by Las Vegas, down 9.3 percent to $166.43.