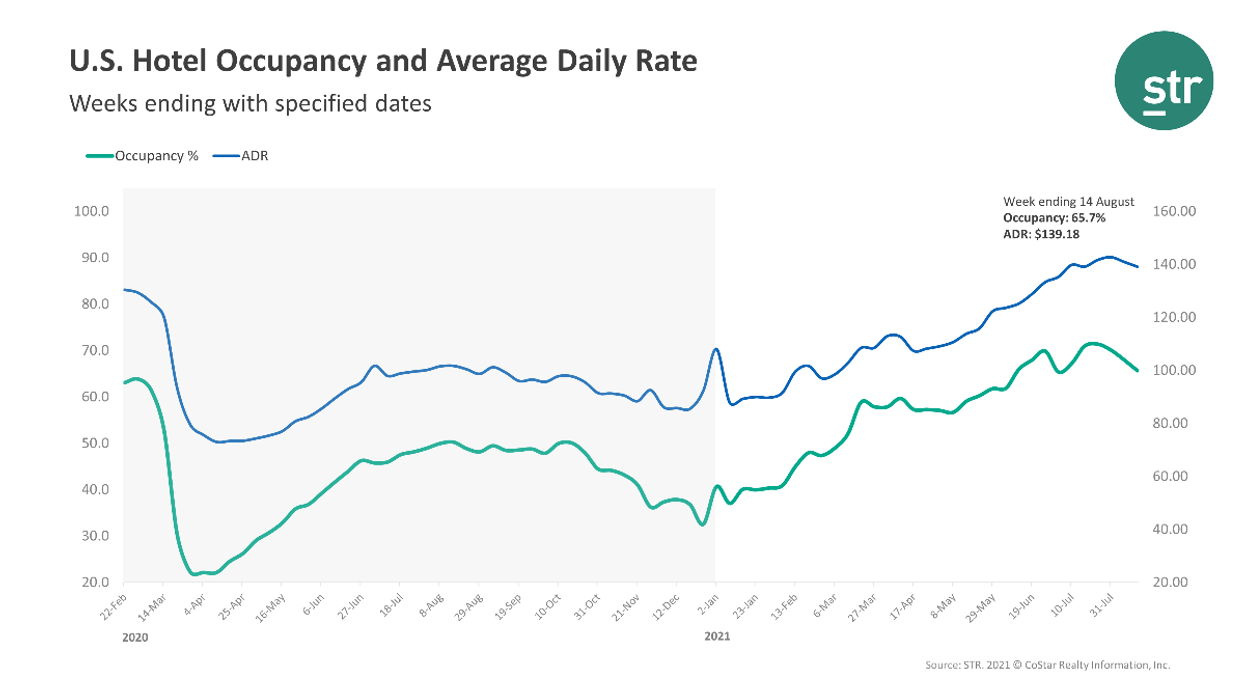

U.S. HOTELS SET new monthly highs in ADR and RevPAR during July, according to STR. That performance was dipping a little by the second week of August.

Occupancy reached 69.6 percent for July, up from 66.1 percent in June and down 5.5 percent from the comparable time period in 2019. ADR was $143.30, up from $129 in June and up 6 percent from 2019, and RevPAR was $99.71 compared to $85.31 in June and up 0.2 percent from 2019.

“When adjusted for inflation, the ADR and RevPAR levels were lower than the all-time highs recorded in 2019,” STR said. “On an absolute basis, occupancy was the highest for any month since August 2019.”

Oahu Island, Hawaii, was the top 25 market with the highest occupancy level for the month, 82 percent, which was still down 6.9 percent from the market’s 2019 benchmark. Oahu also recorded the highest ADR, $258.65, and RevPAR at $212.

Tampa saw the highest occupancy increase over 2019 for a top 25 market, up 3.7 percent to 76.1 percent. Washington, D.C., and Minneapolis saw the lowest occupancy with 55.9 percent and 57.1 percent respectively. San Francisco/San Mateo, California, reported the steepest decline in occupancy when compared with 2019, down 31.7 percent to 57.5 percent.

For the week ending Aug. 14, occupancy was 65.7 percent, down from 68 percent the week before and down 8.4 percent from comparable 2019 levels. ADR was $139.18, also down from $140.97 week-over-week and up 5.9 percent from two years ago. RevPAR was $91.45, down from $95.89 the week before and down 3 percent from 2019.

“While the metrics were down week over week, comparisons with 2019 remained consistent, which is further evidence of seasonality in the data as more schools return to class and leisure demand wanes,” STR said. “Concern around COVID-19 cases also persists.”

Among STR’s top 25 markets, Norfolk/Virginia Beach saw the only occupancy increase over 2019 during the week, up 0.4 percent to 80 percent, and the highest RevPAR increase when compared with 2019, rising 24.3 percent to $131.07.

San Francisco/San Mateo experienced the steepest decline in occupancy when compared with 2019, down 36.8 percent to 56.9 percent. Miami reported the largest ADR increase over 2019, up 24.1 percent to $185.00. The largest RevPAR drops were in San Francisco/San Mateo, down 55.2 percent to $96.42, and New York City, down 39.9 percent to $122.06.