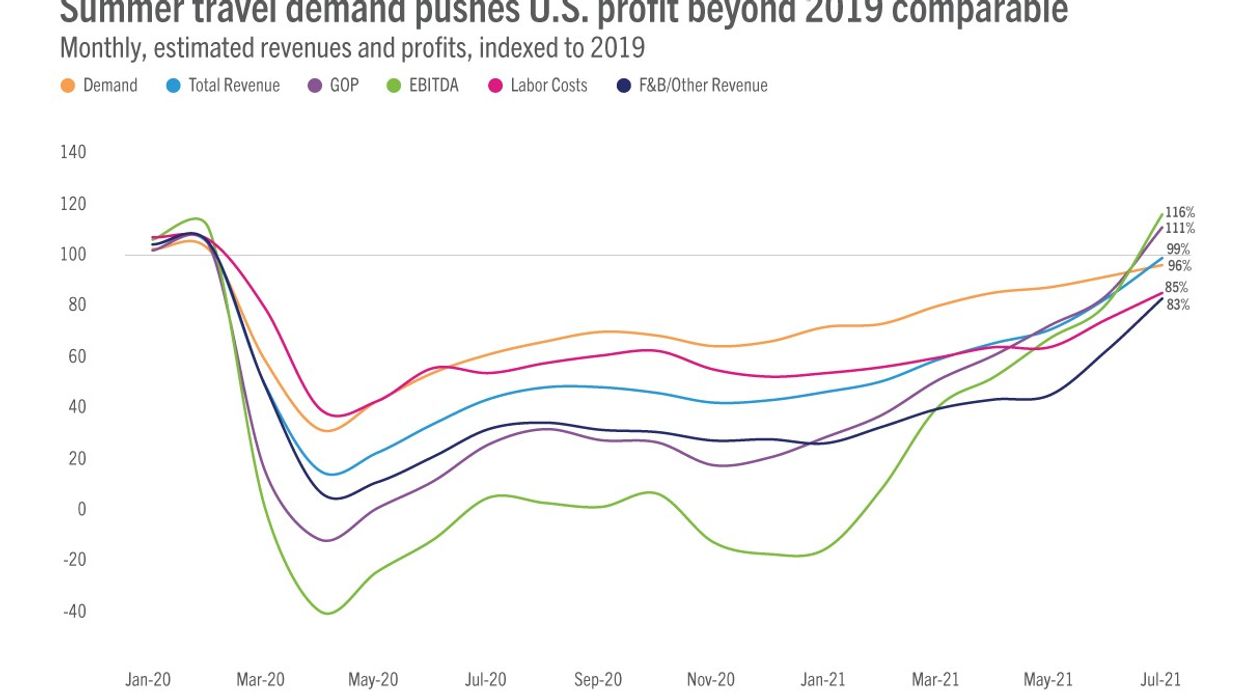

PROFIT FOR U.S. hotels exceeded 2019 levels in July, according to STR. However, experts with the research firm say the recovery is not yet complete.

GOPPAR for July was $62.33, 111 percent of the 2019 comparable, according to STR‘s latest monthly P&L data release. EBITDA PAR was $41.81, another high at 116 percent of the pre-pandemic comparable time period. TRevPAR for the month was $156.58 and labor costs per available room were $46.24, and all metrics other than labor came in higher than any month since February 2020.

Nevertheless, July’s results should not be taken as a sign that the industry is out of the COVID-19 pandemic downturn yet, said Raquel Ortiz, STR’s assistant director of financial performance.

“It is first important to note that one, or even a few months, with higher GOP than 2019 does not mean the industry has recovered,” Ortiz said. “As we’ve noted recently in the top-line metrics, the industry is heading into the lower season as summer wraps up, but looking back, we see just how high the surge in leisure demand pushed U.S. profitability in recent months. There was also the inflation impact on room rates to consider.”

Similar results are expected for April, she said, with a drop-off in September.

“The July numbers were less impressive when focusing in on just the major markets, which are mostly below 50 percent of 2019 revenue,” Ortiz said. “However, like the rest of the country, those key metro areas are showing margins in line with 2019 because of leaner operations.”

STR’s P&L report for June also showed higher profitability than any month since February 2020. GOPPAR reached 84 percent of 2019 levels during that month. Also, in July, hotels saw new monthly highs in ADR and RevPAR. ADR was $143.30, up from $129 in June and up 6 percent from 2019, and RevPAR was $99.71 compared to $85.31 in June and up 0.2 percent from 2019.

Performance has been consistently dropping on a week-to-week basis in August.