U.S. HOTEL PERFORMANCE advanced to its highest levels since December during the second week of February, according to STR. The top 25 markets stayed below 2019 levels, however.

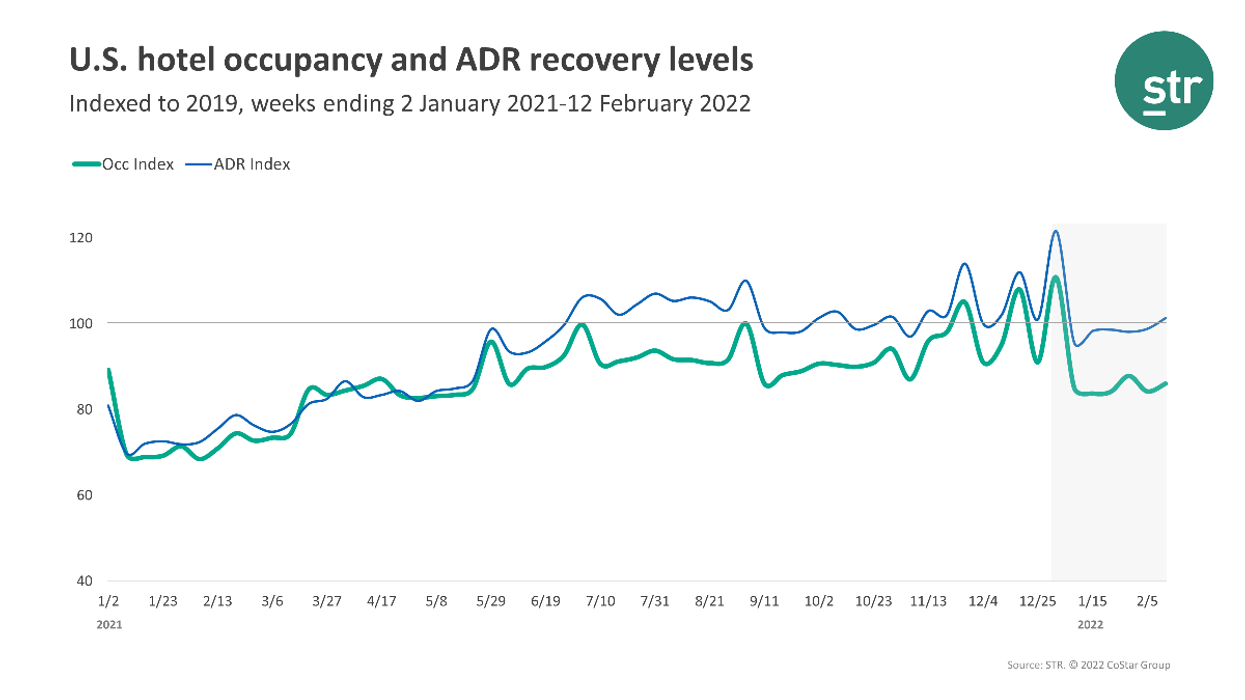

Occupancy was 54.6 percent for the week ending Feb. 12, up from 50.4 percent the week before and down 14 percent for the same period in 2019. ADR was $133.72 for the week, up from $125.06 the week before and up 1.3 percent from two years ago.

RevPAR was $73 for the week, up from $63.05 the week before and down 12.9 percent from the same period two years ago.

None of STR's top 25 markets recorded an occupancy increase over 2019 during the week ending Feb.12, Phoenix came closest to its pre-pandemic comparable, down 3.2 percent to 80.5 percent.

Los Angeles reported the highest ADR, up 50.1 percent to $277.30 and RevPAR, increased 25 percent to $191.60, over 2019, mainly due to Super LVI weekend.

According to the report, San Francisco/San Mateo experienced the largest occupancy decrease, down 50.5 percent to 42.4 percent.

San Francisco/San Mateo posted the steepest RevPAR deficits, down 74.8 percent to $66.89, followed by Seattle, dropped 43.1 percent to $59.11.