PERFORMANCE OF U.S. hotels improved in the third week of September compared to the week before and also when compared to 2019, according to STR.

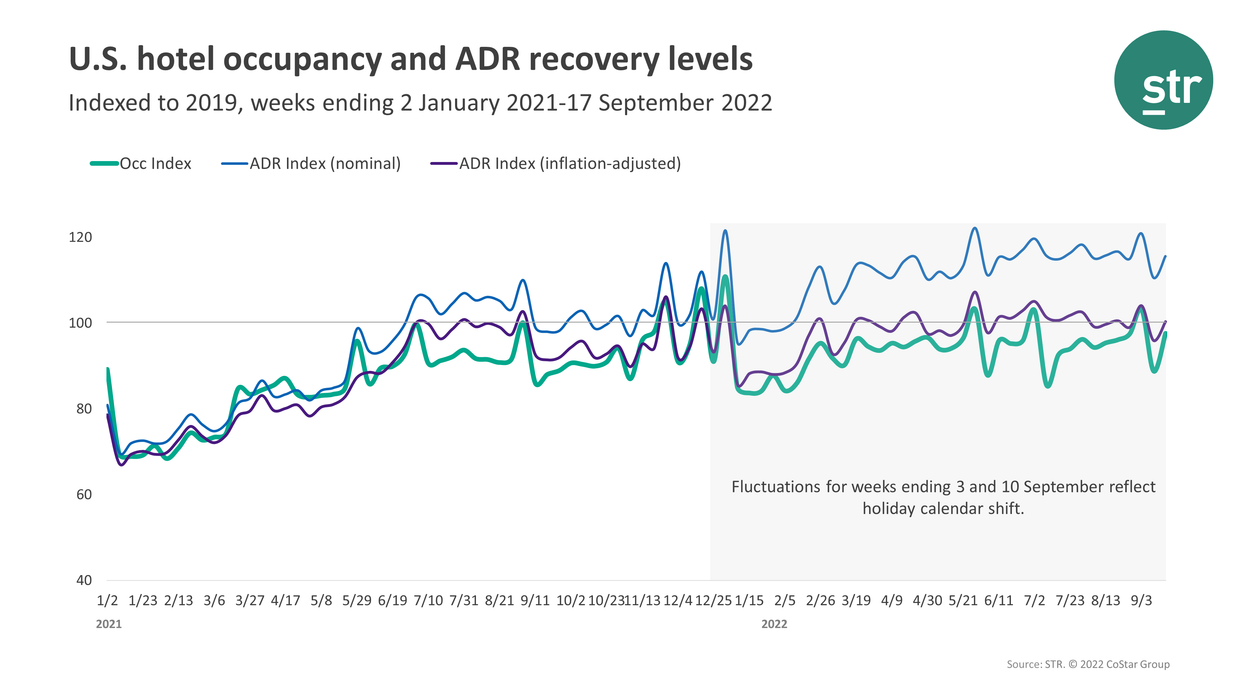

Occupancy was 69.6 percent for the week ending Sept. 17, up from 61.7 percent the week before and decreased 2.4 percent from 2019. ADR was $155.58 for the week, increased from $146.80 the week before and increased 15.6 percent from three years ago. RevPAR reached $108.25 during the week, up from $90.50 the week before and improved 12.9 percent from 2019.

Among STR’s top 25 markets, Norfolk/Virginia Beach reported the highest occupancy increase during the week, up 6.6 percent to 70.9 percent, over 2019. Miami reported the largest ADR gain, increased 30.7 percent to $177.10, over 2019.

The steepest RevPAR declines were in San Francisco, down 23.1 percent to $203.27, followed by Houston, dipped 13 percent to $63.58.