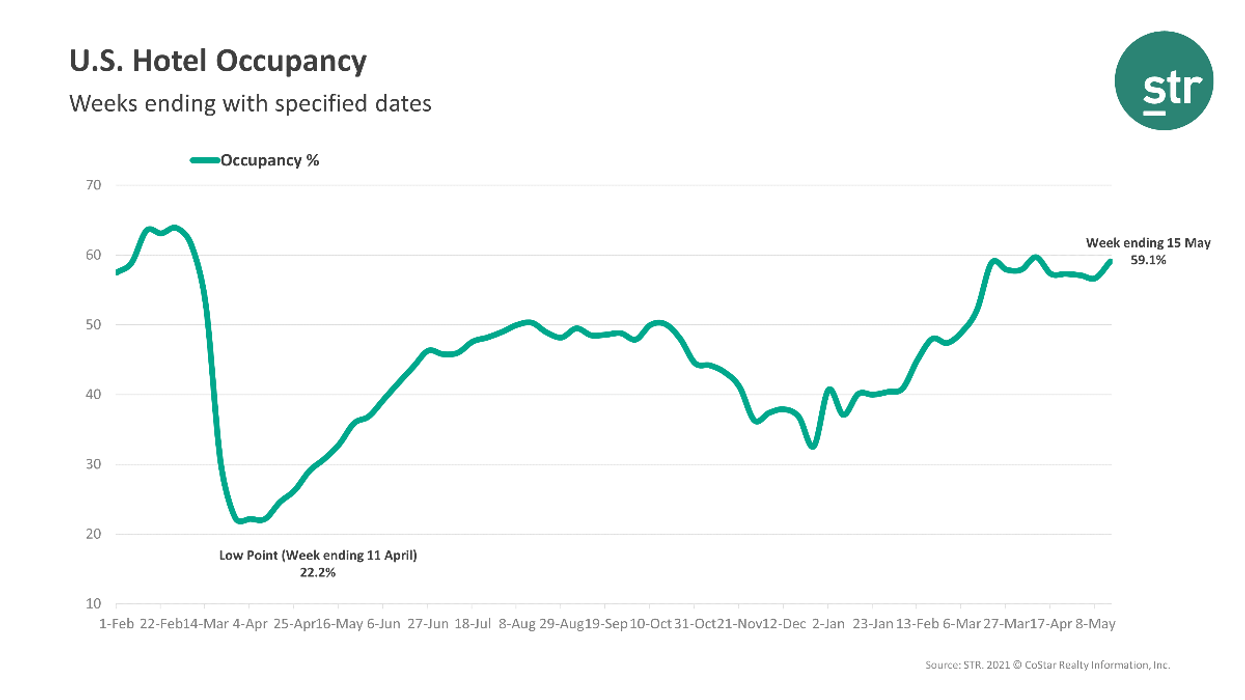

U.S. HOTELS REACHED a new high in the second week of May, according to STR. Occupancy reached its second-highest level since the start of the pandemic.

Occupancy was 59.1 percent for the week ending May 15, up from 56.7 percent the week before and down 16.4 percent from the comparable week in 2019. STR now compares performance to comparable weeks in 2019 because all comparable months from last year were impacted by the beginning of the pandemic and do not represent a return to normal.

ADR for the more recent week was $113.54, up from $110.19 the week before and down 15.4 percent from two years before. RevPAR was $67.05, up from $62.50 the previous week and down 29.2 percent from 2019.

“Friday/Saturday occupancy came in higher than any weekend since Valentine’s Day weekend in 2020. Additionally, ADR reached its highest point of the pandemic but was still $20 less than the corresponding week in 2019,” STR said.

Business travel volume improved during the week ending May 15, bringing STR’s top 25 markets up in week-over-week comparisons.

“Tampa, up 4.8 percent to 72.1 percent, was the only top 25 market to report an occupancy increase over 2019,” STR said. “San Francisco/San Mateo saw the steepest decline in occupancy when compared with 2019, negative 49.1 percent to 43.9 percent.”

Miami led in ADR increases among the top 25, up 34.8 percent to $233.81, followed by Tampa with a 10.3 percent rise to $138.47, and Norfolk/Virginia Beach, which rose 0.3 percent to $106.46, making them the only top 25 markets with levels higher than 2019.

Only two top 25 markets saw RevPAR levels higher than the 2019 comparable, Miami with a 32.5 percent rise to $174.55, and Tampa, which rose 15.6 percent to $99.90. The largest RevPAR deficits were in San Francisco/San Mateo, down 73.7 percent to $59.05, and Boston, down 73.2 percent to $57.31.