U.S. HOTEL OCCUPANCY has reached an all-time high in the fourth week of December though the numbers came in lower than the previous week, according to STR. Christmas Day occupancy was 47.2 percent, up from the previous high of 47 percent recorded in 2015.

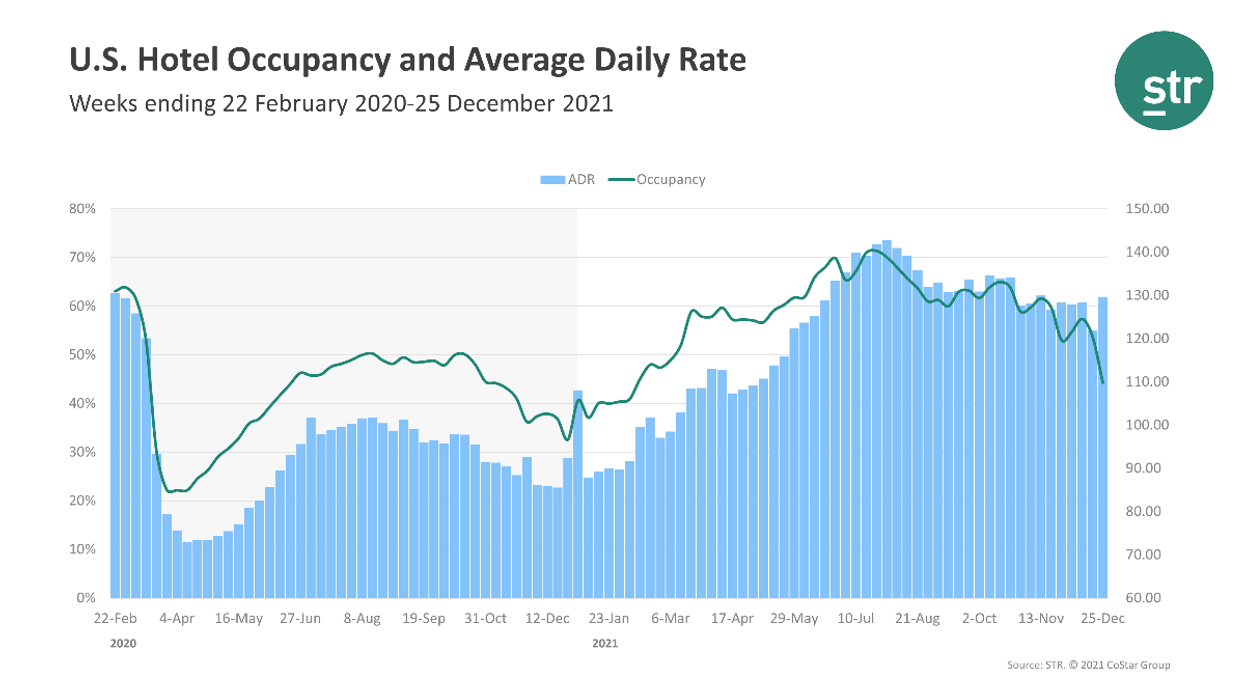

Occupancy was 44.3 percent for the week ended Dec. 25, down from 53.8 percent the week before, and down 8.7 percent when compared to 2019. ADR was $129.67 for the week, up from $121.87 the week before and an increase of 0.5 percent from 2019. RevPAR reached $57.46, down from $65.61 the week before, and dropped 8.3 percent from two years ago.

According to STR, a steeper decline during the week from 2019 levels was due to the fact that Christmas fell on a Wednesday two years ago and allowed for an earlier return to non-holiday weekend levels that year.

"While Omicron-related closures and service disruptions affected performance in New York City, overall U.S. occupancy was less impacted," STR said.

None of STR’s top 25 markets recorded an occupancy increase over 2019 in the fourth week of December. Dallas came closest to its 2019 levels as it was just down 2.8 percent to 43.6 percent. San Diego registered the largest ADR increase, up 12.5 percent to $147.05, when compared to two years ago.

The largest RevPAR deficits were in San Francisco/San Mateo, down 32 percent to $65.66, followed by New York City, which dropped 30 percent to $143.80, compared to 2019.