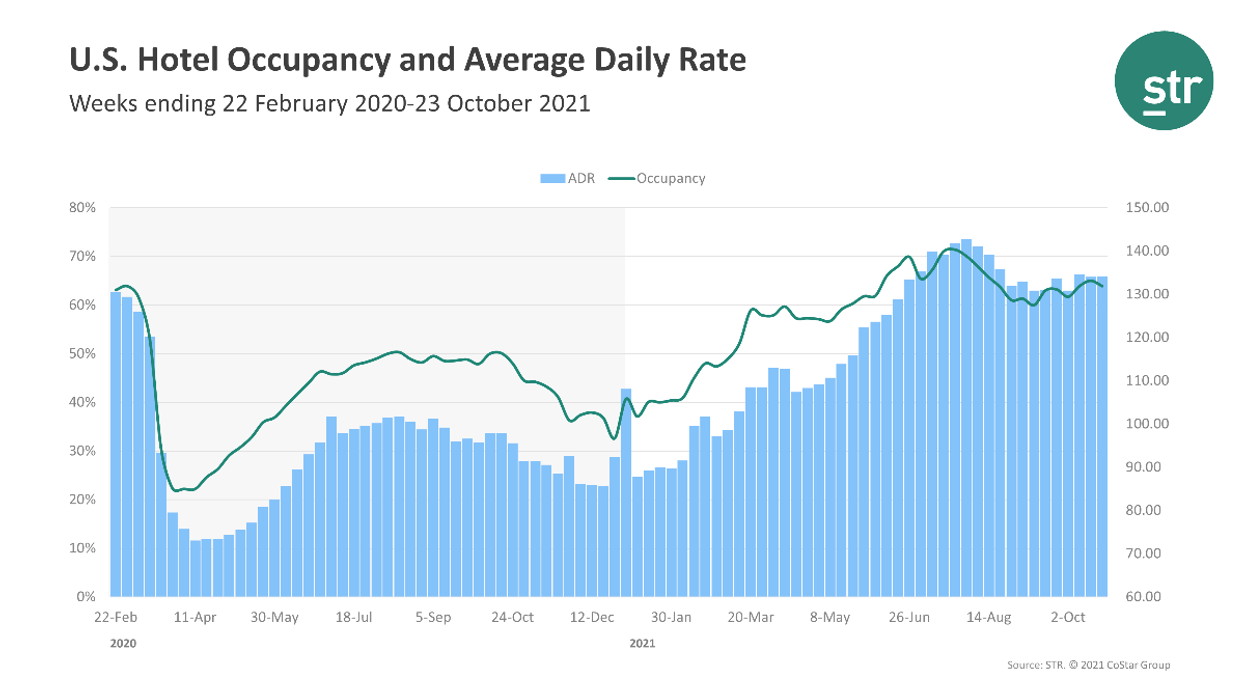

ONE WEEK AFTER reaching its highest point since mid-August, US hotel occupancy dipped a percentage point in the third week of October, according to STR. At the same time, room rates rose slightly.

Occupancy was 63.9 percent for the week ending Oct. 23, down from 65 percent the week before and a 9.1 drop from the same period in 2019. ADR for the third week of the month was $134.14, almost the same rates as the prior week’s $134.03 and just 0.6 percent down from its value in 2019. RevPAR decreased to $85.74 during the week from $87.15 the week before. However, it was reduced by 9.6 percent when compared to the same period two years ago.

None of STR’s top 25 markets recorded an occupancy increase over 2019. Tampa came closest to its 2019 comparable at 68.5 percent, a 3.1 percent dip. The market also reported the largest increases in ADR, up 16.1 percent to $138.33 and RevPAR also shot up 12.6 percent to $94.71 when compared to 2019.

The steepest occupancy decline was reported by Oahu Island, reducing 39.7 percent to 49.6 percent and San Francisco/San Mateo, dropped 39.7 percent to 53.0 percent, from the levels witnessed two years ago.

According to STR, San Francisco/San Mateo experienced the largest RevPAR deficits, down 58.9 percent to $92.26, followed by Washington, which was down 49.9 percent to $81.21 during the week under review.