THE HOTEL PROPERTY types most associated with business travel, upper upscale hotels, are well represented in the U.S. hotel construction pipeline. The volume of projects in the segment points to confidence in the future of business travel, according to STR.

“Upper upscale saw the slowest recovery, but a steady climb in performance and the business travel indicators have supported developer confidence in the segment,” said Isaac Collazo, STR’s vice president for analytics. “The more than 23,000 upper upscale rooms in construction right now represent 3.4 percent of the segment’s existing supply. That is well above the long-term growth average, up 2 percent in the U.S.”

According to STR, a total 154,284 rooms were under construction in March, down 0.5 percent compared to the same period last year. As many as 239,995 rooms are in the final planning state, an increase of 34.6 percent over last year. STR pipeline data showed that 232,517 rooms are under planning, a decline of 21.6 percent compared to March 2022.

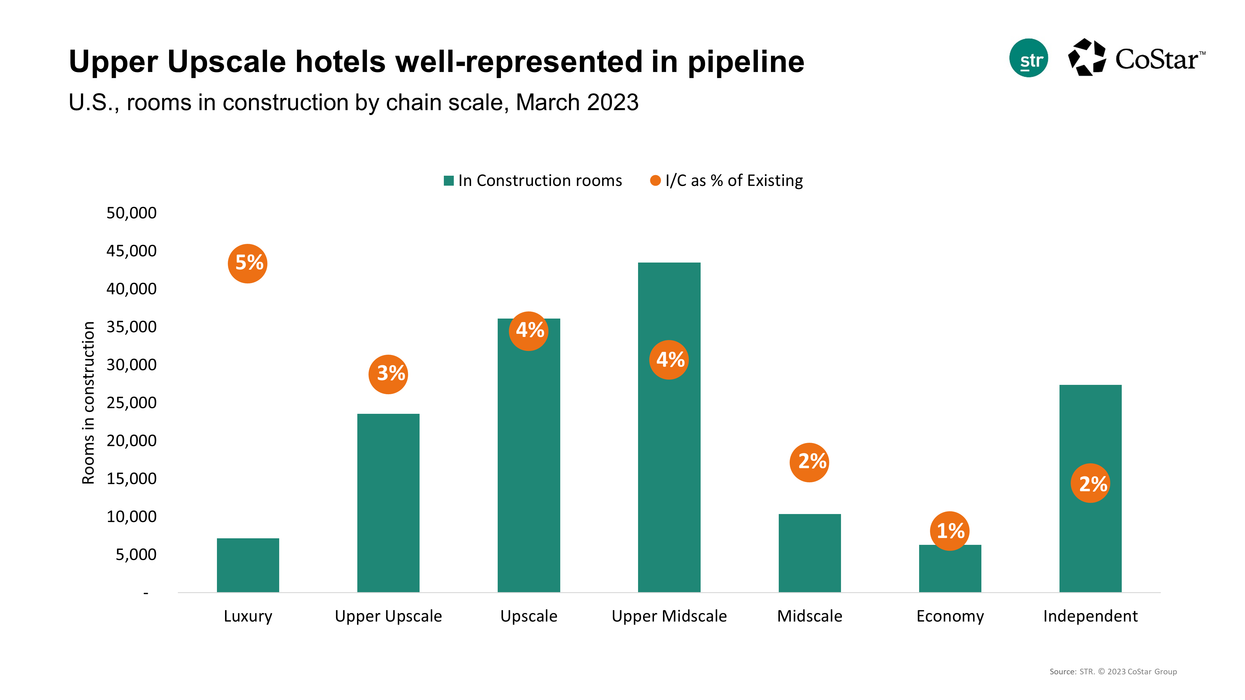

After three consecutive month-over-month increases, the overall number of U.S. rooms in construction fell slightly in March, which aligns with patterns in previous years. Among the chain scale segments, luxury shows the highest number of rooms as a percentage of existing supply.

Luxury segment reports the highest increase in hotel construction in March, up 5.2 percent containing 7,136 rooms, followed by upscale, up 4.1 percent with 36,089 rooms and upper midscale, increased 3.7 percent containing 43,470 rooms.

Upper upscale, up 3.4 percent with 23,564 rooms, midscale, increased 2.1 percent containing 10,363 rooms and economy, up 1 percent with 6,302 rooms are also showing increased activity.

“Luxury, though the smallest in terms of room count, shows the highest projected growth against existing supply, matching the rate gains experienced in the segment over the last few years,” Collazo said. “Select-service (upper midscale + upscale) continues to grow as well, which is no surprise given how well the segment of the market has regained demand. The upper tier of select-service also caters to the business traveler.”