THE U.S. HOTEL industry is on track to full recovery from the COVID-19 pandemic, according to STR latest industry forecast. Progress may be uneven, however, as some obstacles, such as labor costs, still remain.

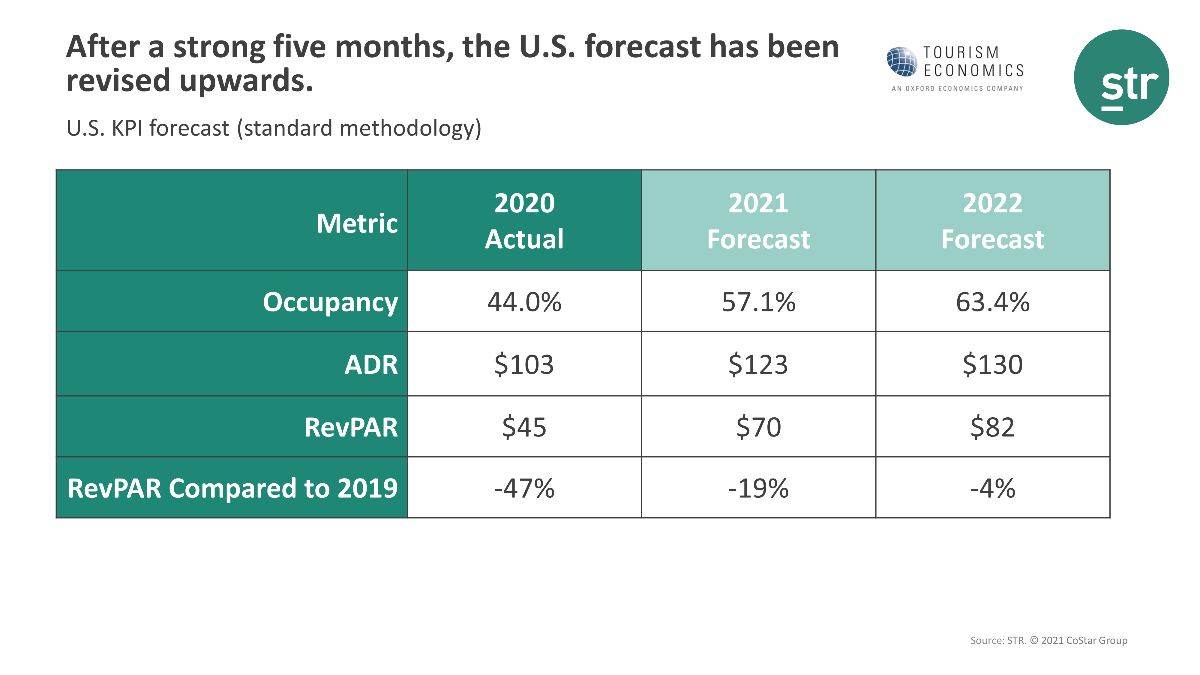

ADR will near full recovery in 2022, averaging $130 while occupancy for the year is predicted to reach 63.4 percent. RevPAR’s average for the year is set to be $82, down 4 percent compared to 2019, but it is expected to be fully recovered in 2023, according to the forecast given at the 43rd Annual NYU International Hospitality Industry Investment Conference.

STR and Tourism Economics said changes in the nation’s economy warranted the new forecast.

“We have essentially moved up the top-line recovery timeline by one year, with the caveat that improved RevPAR projections are largely due to ADR,” said Amanda Hite, STR’s president. “ADR has risen more rapidly than we expected—in some cases, that rise was due to strong demand confronting capacity constraints, which enabled solid revenue management, while in other cases, the rise was more influenced by inflation. When adjusted for inflation, RevPAR is further off the pace and will likely remain below 2019 levels until at least 2025. Other than the first quarter of 2021, demand has mostly adhered to the forecast with strong leisure travel, slowly improving group business and an expected progressive increase in international arrivals next year. Of course, these are all national projections of top-line performance. Recovery is not playing out the same across the marketplace, and as noted in our latest monthly P&L release, the cost of labor is adding pressure on the bottom line, which is a contributing factor to many hotels driving rate. Recovery is progressing at a solid rate no doubt, but there will still be plenty of ups and downs along the way.”

In early October, CBRE Hotels Research revised its forecast for the year’s fourth and final quarter down on the basis that concerns over the Delta variant of the virus that causes COVID-19 could slow the return of business travel. However, Aran Ryan, Tourism Economics director said the public health situation has improved.

“Travel activity entered the fall with strong momentum. With improving public health conditions and sustained economic recovery, additional business and group travelers are expected to join leisure travelers, supporting further gains next year,” Ryan said. “The demand recovery, coupled with successful revenue management, has supported resilient hotel pricing, helping shorten the time it will take to recover 2019 revenue levels.”