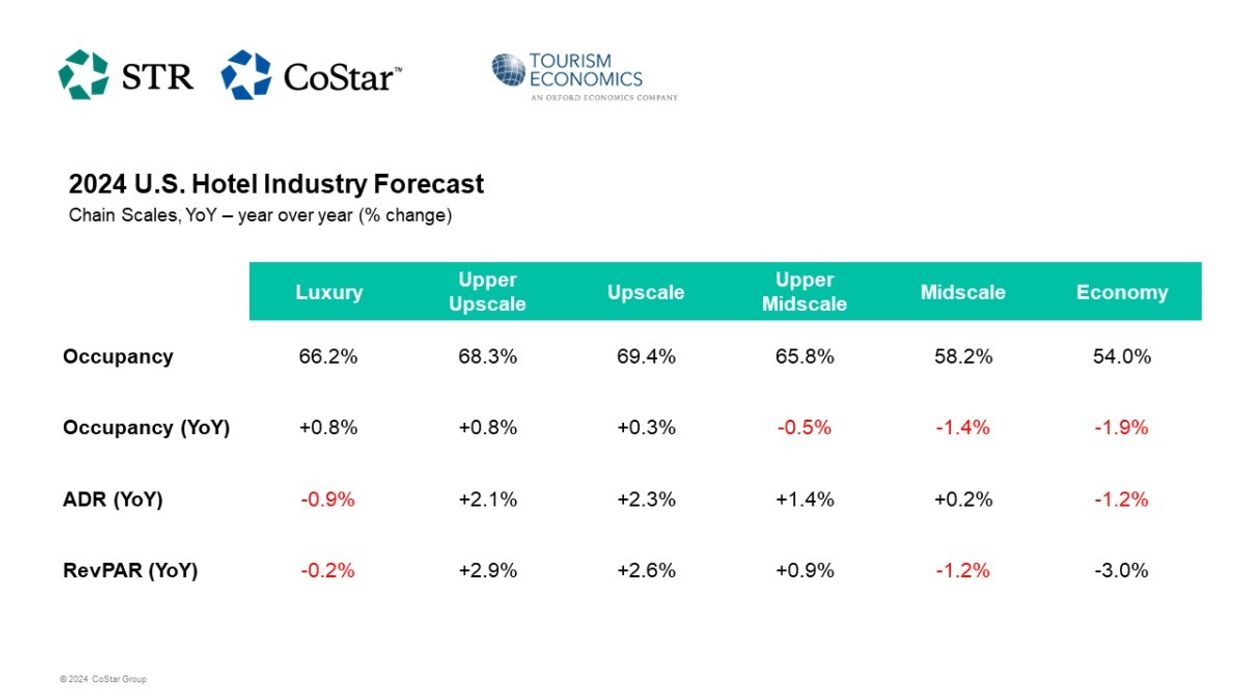

STR AND TOURISM Economics made significant downward adjustments to the 2024-25 U.S. hotel forecast, reflecting lower-than-expected performance and reduced growth projections for the remainder of the year. Projected gains in ADR and RevPAR were downgraded by 1 and 2.1 percentage points, respectively. Occupancy is also expected to decline, contrasting with the previous forecast's projection of year-over-year growth in this metric.

While an occupancy growth projection was maintained for 2025, ADR and RevPAR were adjusted downward by 0.8 and 0.9 percentage points, respectively, STR and TE said in a joint statement.

“We have seen a bifurcation in hotel performance over the first four months of the year, which we don’t believe will abate soon,” said Amanda Hite, STR’s president. “The increased cost of living is affecting lower-to-middle income households and their ability to travel, thus lessening demand for hotels in the lower price tier. The upscale through luxury tier is seeing healthy demand, but pricing power has waned given changes in mix and travel patterns and to a lesser extent, economic conditions. Travel remains a priority for most Americans, but the volume has lessened as prices on goods and services continue to rise.”

"Still-elevated interest rates and easing wage growth have contributed to cautious business investment and pinched spending by many middle- and lower-income consumers," said Aran Ryan, TE’s director of industry studies. "Looking beyond this near-term pull-back in demand at lower-tier properties, we expect moderate travel growth to resume, supported by a tempered economic expansion and the continued rebound of group, business, and international travel."

“Higher operating expenses have led us to forecast lower GOP margins,” said Hite. “Labor costs are projected to be nearly 33 percent of total revenues through the remainer of 2024 and will have the greatest impact on GOP margins. Upper midscale chains are expected to maintain the lowest labor costs, and thus the most competitive GOP margins for most of 2024, which follows pre-pandemic trends.”

CBRE Hotels recently forecasted steady growth in U.S. hotel RevPAR for 2024, driven by improvements in group business, inbound international travel, and transient business demand. RevPAR is projected to grow by 3 percent, with occupancy rising by 45 bps and ADR increasing by 2.3 percent.