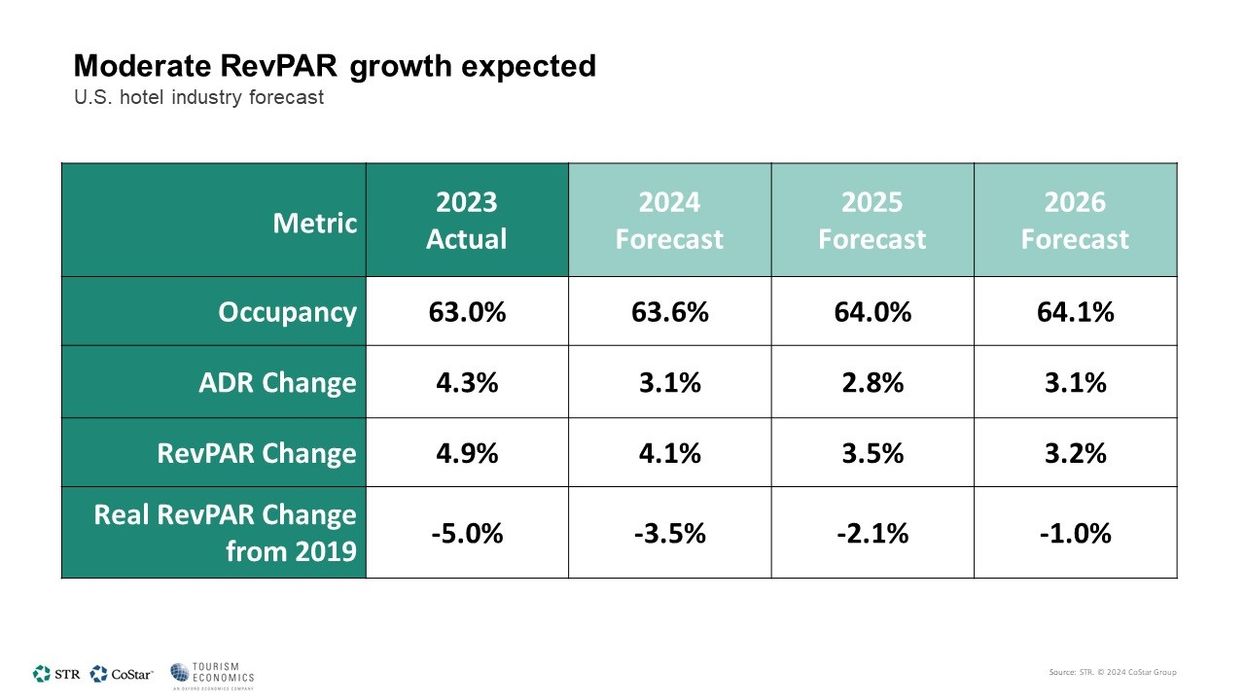

ADR is projected to rise by 0.1 percentage points in 2024, with occupancy and RevPAR remaining unchanged from the previous forecast, according to STR and Tourism Economics' initial U.S. hotel forecast for 2024 at the Americas Lodging Investment Summit. Yet, 2025 projections for key performance metrics were revised downward due to stabilized long-term average trends: occupancy down 0.1 percentage points, ADR down 0.3 points and RevPAR down 0.5 ppts.

“U.S. ADR and RevPAR reached record highs in 2023 with solid travel fundamentals and a big year for group business underpinning performance,” said Amanda Hite, STR president. “We expect to see continued growth as fundamentals remain more favorable for the travel economy. The indicator that is especially important is the low unemployment rate among college-educated individuals, those most likely to travel for business and leisure.”

The STR and Tourism Economics forecast a rise in GOPPAR growth due to increased TRevPAR levels and stable labor costs. Among chain scales, luxury and upper upscale hotels are expected to see substantial cost increases, driven by growing group demand.

“The economic outlook has improved, but we still expect a deceleration in economic growth, characterized by softer labor markets and business sector caution,” said Aran Ryan, director of industry studies at Tourism Economics, “Modest lodging demand growth will be supported by household prioritization of travel, a continued rebuilding of business travel and group events, and a rebound in international visitation.”

In August, U.S. hotel REVPAR projections were reduced by 0.5 points, attributed to a 0.6-point decline in occupancy growth. However, RevPAR was anticipated to exceed the long-term average, with a significant portion of the growth concentrated in the early months of 2023.