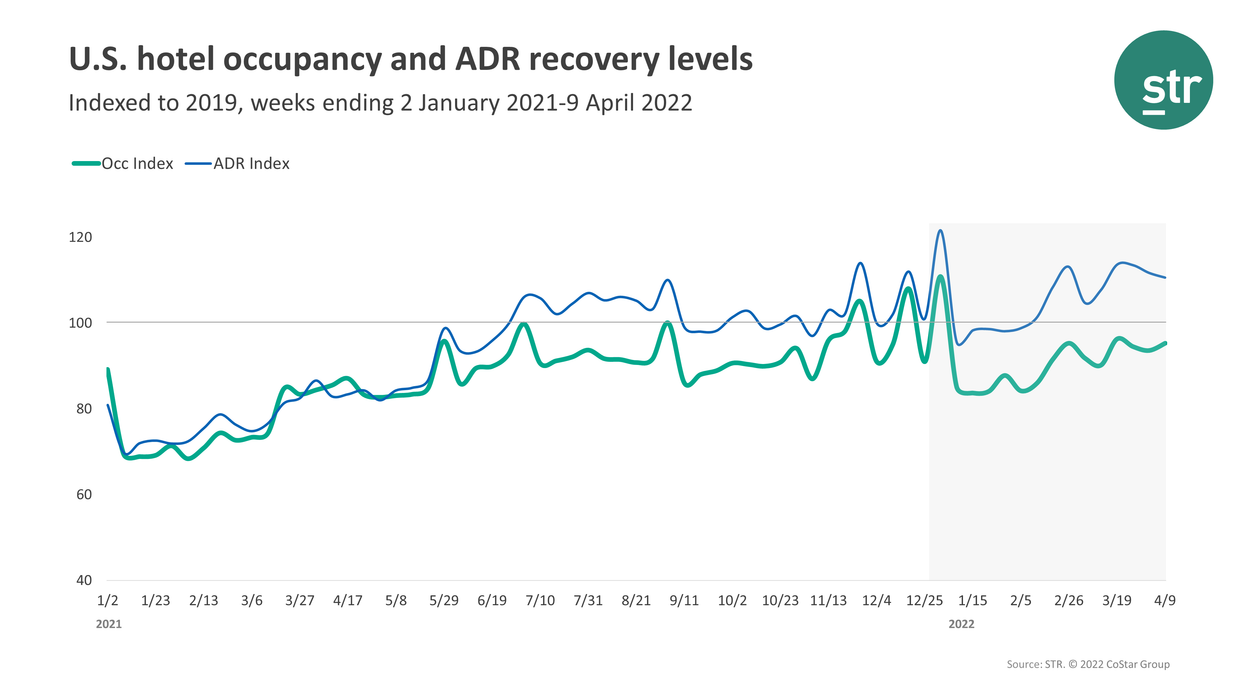

BUSINESS CONTINUED TO improve in the second week of April for U.S. hotels, according to STR. Occupancy, ADR and RevPAR all rose on a weekly basis, and the last two were up compared to the same time in 2019.

Occupancy was 66.4 percent for the week ending April 9, up from 64.1 percent the week before but down 4.7 percent from 2019. ADR was $150.45 for the week, up from $145.74 the previous week and up 10.6 percent from 2019. RevPAR reached $99.93, a rise from $93.48 weekly and up 5.4 percent from three years ago.

Among STR’s top 25 markets, Tampa saw the highest occupancy increase over 2019, up 6.2 percent to 84 percent. Minneapolis had the largest occupancy decrease from three years ago, down 29.5 percent to 51.4 percent.

Miami posted the largest ADR increase over 2019, up 49.6 percent to $328.35.

The steepest RevPAR deficits were in San Francisco/San Mateo, down 51.9 percent to $121.19, and Minneapolis, down 44.8 percent to $60.25.