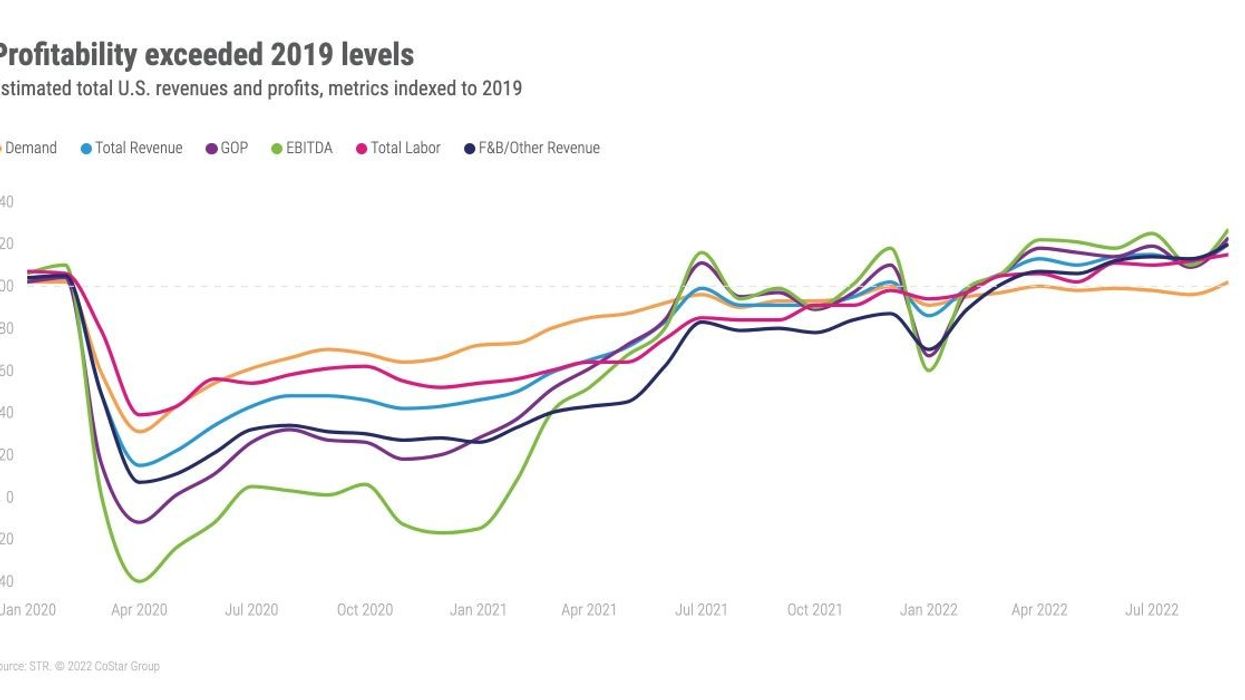

GOPPAR FOR U.S. hotels improved in September compared to the month before and it exceeded the pre-pandemic levels, according to STR. Meanwhile, the cost of labor per available room came in higher than the pre-pandemic comparable for the first time.

GOPPAR was $84.03 for the month, up from $64.26 reported in August. It was $78.30 for July and $91.23 in June. The performance index was $88.63 in May and stood at $90.96 in April. EBITDA PAR was $60.71 for September, TRevPAR was $222.97 and labor costs per room were $71.52.

“Labor costs moved ahead the 2019 comparable due to continued high levels of hospitality unemployment and more spending on contract labor,” said Raquel Ortiz, STR’s director of financial performance. “Total labor costs were up 5 percent year to date, with all departments reporting higher expenses, except F&B, due to less group demand earlier this year. GOPPAR was the strongest since June 2022, and profit margins came in higher than September 2019. Profit margins have been strong for some time caused by lower employment levels and reduced services.”

According to STR, 13 of major markets realized both GOPPAR and TrevPAR levels higher than 2019.

“Miami still remains the front-runner when it comes to both GOPPAR and TrevPAR recovery. Just three of the top 25 markets – Minneapolis, New Orleans, and San Francisco – remained below 80 percent of 2019 GOPPAR levels. While San Francisco is showing some improvement, other business-centric markets, such as Chicago and New York City, saw GOPPAR that was higher than the pre-pandemic comparable,” Ortiz said.