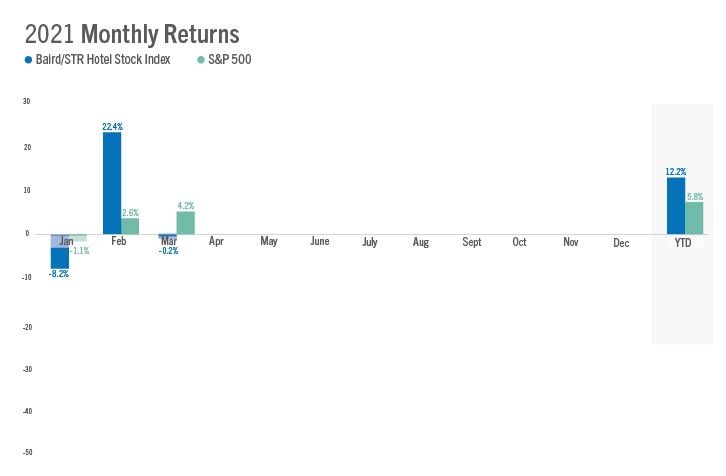

THE BAIRD/STR HOTEL Stock Index dropped 0.2 percent in March as investors sought a different, more long-term angle on the recovering travel market, according to STR and Baird. Experts expect the upward trends to continue in conjunction with COVID-19 vaccinations.

The index reached a level of 5,131 in March and was up 12.2 percent year to date, including a 22.4 percent rise in February. The Baird/STR index in March fell behind both the S&P 500, which rose 4.2 percent, and the MSCI US REIT Index with its 3.9 percent increase. The hotel brand sub-index decreased 0.3 percent from February to 8,811, while the hotel REIT sub-index came in flat at 1,304.

“Hotel stocks were relatively flat in March but underperformed their benchmarks as investors rotated into more defensive and value-oriented sectors,” said Michael Bellisario, senior hotel research analyst and director at Baird. “The pent-up demand expectation is becoming a reality, and broader travel trends continue to improve as vaccination rates improve; with leisure strength well understood at this point, we expect the focus to begin shifting to the business traveler and what the demand environment might look like later this year.”

Strong leisure and spring break demand made occupancy levels in March the best the U.S. has seen in a year, said Amanda Hite, STR president. Occupancy was flat in the first week of April, according to STR, but ADR and RevPAR reached their highest point since last March.

“U.S. room demand during the first quarter actually trended slightly ahead of our forecast, reflecting the acceleration in vaccine distribution and travel,” Hite said. “TSA checkpoints have now registered more than 1 million flyers since March 11, which combined with slowly rising Wednesday occupancy levels, can be seen as an indicator that corporate transient demand is also returning. Our forecast still calls for a return of group travelers in the later part of the year.”