Sameer Nair is the new senior vice president of equity asset management at Peachtree Group. In this role, he will manage and implement asset oversight for Peachtree’s real estate portfolio and preferred equity investments. Previously, Nair held the position of senior vice president of acquisitions and development at Hospitality Ventures Management Group, focusing on sourcing equity, debt, and third-party management opportunities, Peachtree said in a statement.

Nair is an experienced asset manager with development and transactional expertise, Peachtree said.

“Over the past decade, Sameer has been instrumental in the growth of some of the most respected companies in the hospitality industry,” said Brian Waldman, Peachtree Group’s CIO. “He has led multiple acquisition, development and investment efforts throughout the country, which gives him a deeper perspective of the industry and market.”

Nair previously held the role of vice president of investments and capital markets at Kolter Hospitality. There, he managed over $600 million in transaction volume, overseeing hotel investments and debt restructuring. Additionally, in a similar capacity at Banyan Investment Group, Nair closed transactions exceeding $125 million in volume.

Nair earned his bachelor’s degree in hotel administration from Cornell University's Nolan Hotel School of Hotel Administration.

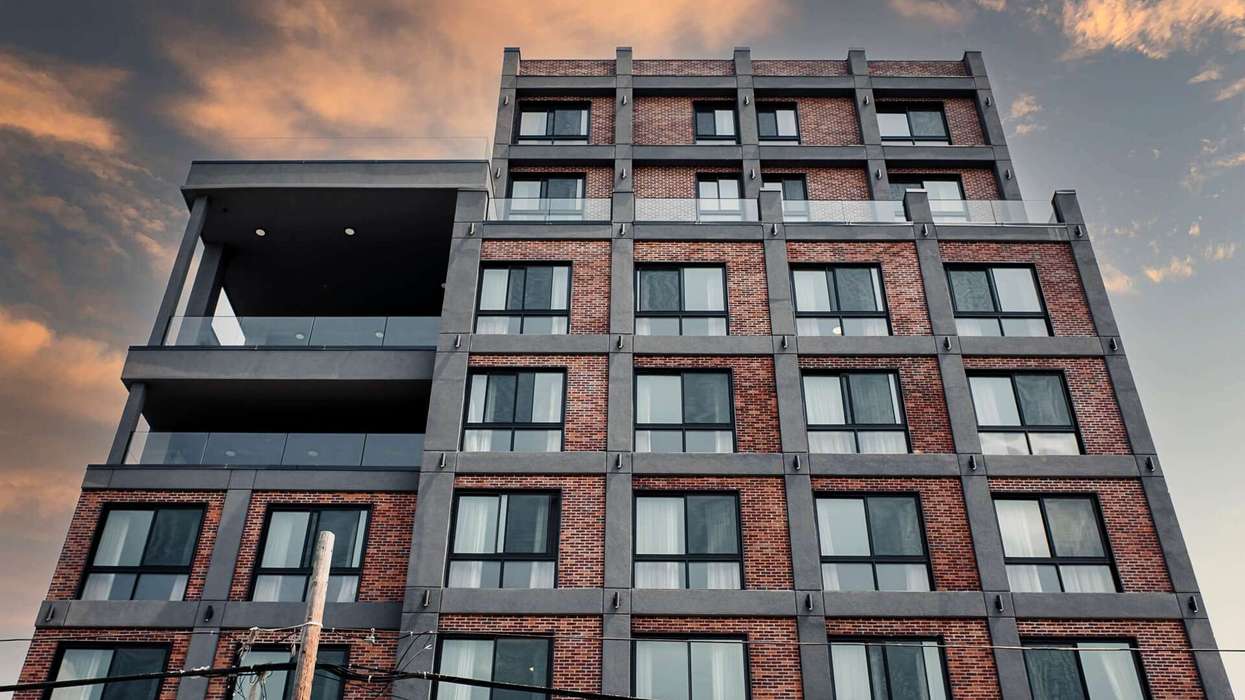

In November, DD Partners, Peachtree Group, and Woodbine Development announced a collaboration on Embassy Suites Gulf Shores, an 8-story resort with a Gulf of Mexico view in Alabama. DD Partners and Woodbine lead development, with Peachtree overseeing resort operations.