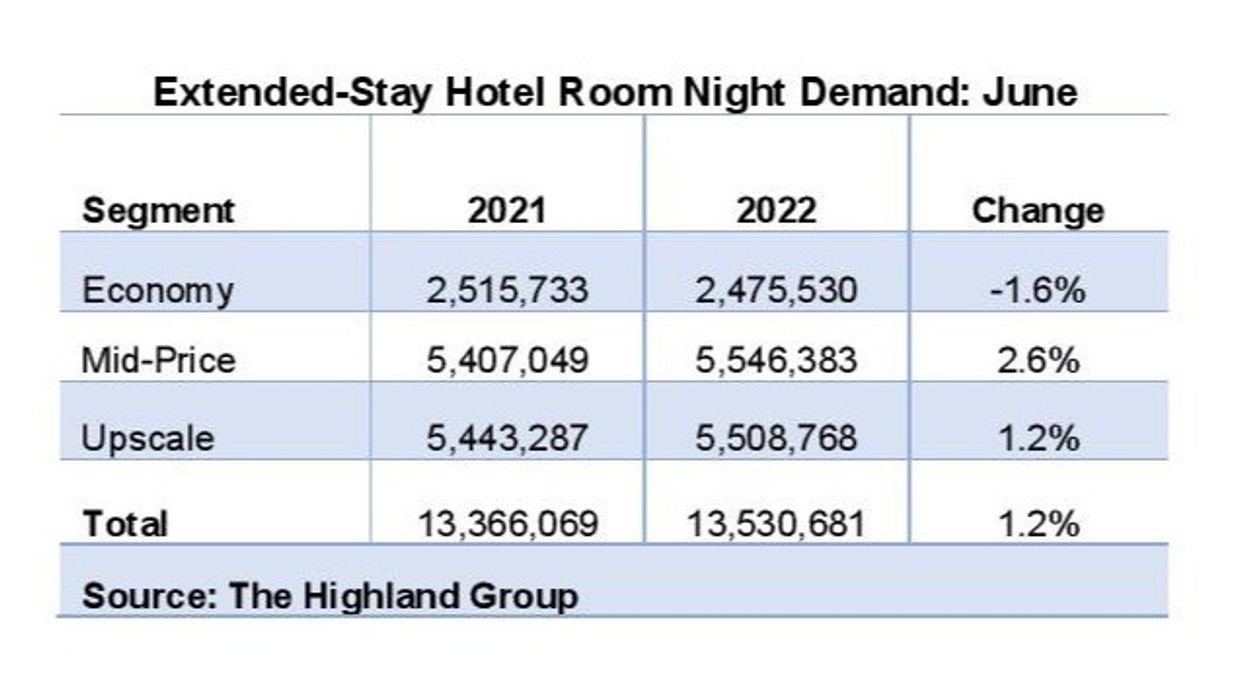

ALL RECOVERY INDICES of U.S. extended-stay hotels were up in June compared to 2019 than in May, according to hotel investment advisors The Highland Group. But demand for economy extended-stay hotels declined 1.6 percent for the third consecutive month in June compared to same period last year due to strong increase in ADR over several months, the report added.

The U.S. Extended-Stay Hotels Bulletin: June 2022 by The Highland Group said that ADR growth decelerated for the third consecutive month in June, but it remained considerably higher than any other period before 2021.

RevPAR recovery for upscale extended-stay hotels was up 5 percent in June compared to May due to the summer travel surge. According to the report, economy extended-stay hotels led the RevPAR recovery compared to 2019 despite the decline in demand and occupancy.

"The 1.4 percent increase in extended-stay room supply in June is the third successive month supply growth was below 2 percent since 2013, excluding some of 2020,” the report said. “It is also the ninth consecutive month of 4 percent or lower supply growth. The increase in supply for this segment will be well below pre-pandemic levels during the near term."

The report noted that the gap in recovering revenue is narrowing as the overall hotel industry’s recovery catches up with extended-stay hotels. STR reported that all hotel room revenue was up 29 percent in June compared to last year.

"In June, mid-price and upscale extended-stay segments reported their lowest monthly change in demand this year. The second quarter demand for economy extended-stay segment was lower than the same quarter one year ago for the third consecutive month. This was only the second time the economy reported a quarterly fall in demand since 2013, except in 2020," the report said. "Overall hotel occupancy gained more than extended-stay hotels in June compared to 2021, decreasing extended-stay hotel’s occupancy premium to 10 percentage points. However, the premium remains within its long-term average range."

The ADR recovery was led by mid-price and upscale extended-stay hotels. The mid-price segment’s ADR recovery steadied in June but the upscale segment gained about 2 percent compared to May. Upscale extended-stay hotels more than fully regained ADR back to its nominal 2019 value for the third successive month, according to the report.

"Mid-price and upscale segments continued posting the strongest RevPAR growth over last year during the period. After slipping back below 100 percent in May, upscale extended-stay hotels once again reported higher nominal monthly RevPAR compared to 2019. The RevPAR growth in June compared to last year was greater but the gap continues to narrow," the report said.