EXTENDED-STAY HOTELS reported mixed results in November compared to the broader hotel industry, as supply and demand showed gains and occupancy declined less than the total hotel industry, according to The Highland Group. However, the 2.2 percent net increase in extended-stay room supply for the month, consistent with September and October figures, represents a slight uptick compared to the average over the last 17 months.

Also, relatively low ADR growth led to a modest increase in extended-stay hotel RevPAR.

Supply growth stayed below 4 percent for the 26th consecutive month in November, well under the long-term average, The Highland Group said. The 13 percent increase in economy extended-stay supply and decline in mid-price segment rooms mainly result from conversions, as new construction in the economy segment is estimated at about 3 percent of rooms open compared to one year ago.

Meanwhile, supply change comparisons are influenced by factors such as re-branding, room relocations between segments in The Highland Group's database, de-flagging of hotels not meeting brand standards, and sales to multi-family apartment companies and municipalities, the report said. This trend is expected to persist in 2023, particularly with older extended-stay hotels still on the market. Despite this, the full-year increase in total extended-stay supply compared to 2022 will remain significantly below the long-term average.

Total extended-stay hotel revenue growth in November fell below the previous two monthly increases and slightly trailed the 3.3 percent gain reported by STR/CoStar for all hotels during the same period, it added. Moreover, November marked the third consecutive month economy extended-stay hotels reported a room revenue increase exceeding 10 percent.

The economy segment saw a 10.5 percent demand growth in November, the highest in three months, and the third consecutive month with a demand increase exceeding 9 percent, The Highland Group said. This rise was mainly due to a significant supply gain from conversions, which negatively impacted the change in demand in the mid-price segment. However, total extended-stay demand grew, in contrast to STR/CoStar's estimated 0.2 percent decline for the overall hotel industry compared to November 2022.

Key performance metrics

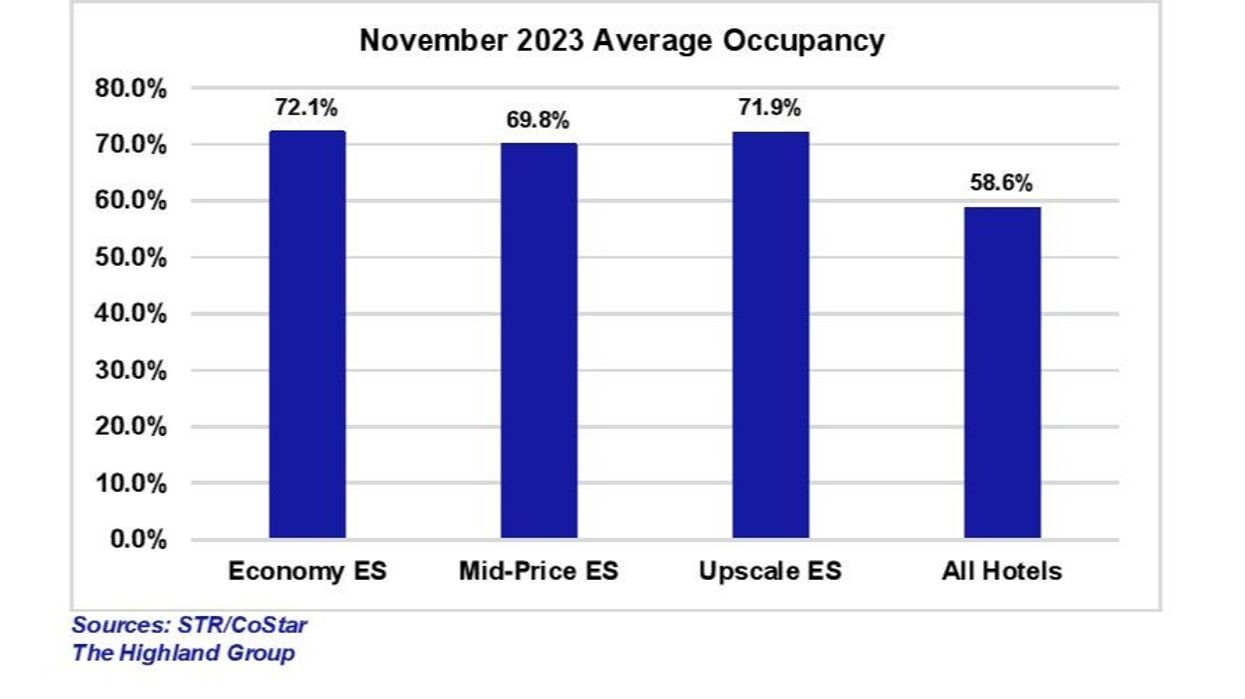

Extended-stay hotel occupancy declined less than the total hotel industry in November, maintaining a 12.5 percentage points lead, consistent with the historical long-term average occupancy, the report said.

November's extended-stay ADR gain, the lowest since July, was approximately half of the increase reported by STR/CoStar for the overall hotel industry, The Highland Group further said. This marked over two years of monthly total extended-stay ADR surpassing its nominal value in 2019.

Due to low ADR growth, extended-stay hotel RevPAR increased less than half the 2.4 percent gain estimated by STR/CoStar for the total hotel industry, the report said. RevPAR in the economy segment has fallen over the last eight months. However, the rate of RevPAR decline has generally decelerated since July, with November's 1.4 percent fall markedly less than the 4.2 percent contraction reported by STR/CoStar for all economy segment hotels.

In October, Extended-stay hotels outperformed the broader hotel industry across all performance metrics. Despite a dip in occupancy resulting from supply outpacing demand, extended-stay hotels exhibited superior growth in ADR, RevPAR, and revenues compared to the overall hotel industry.