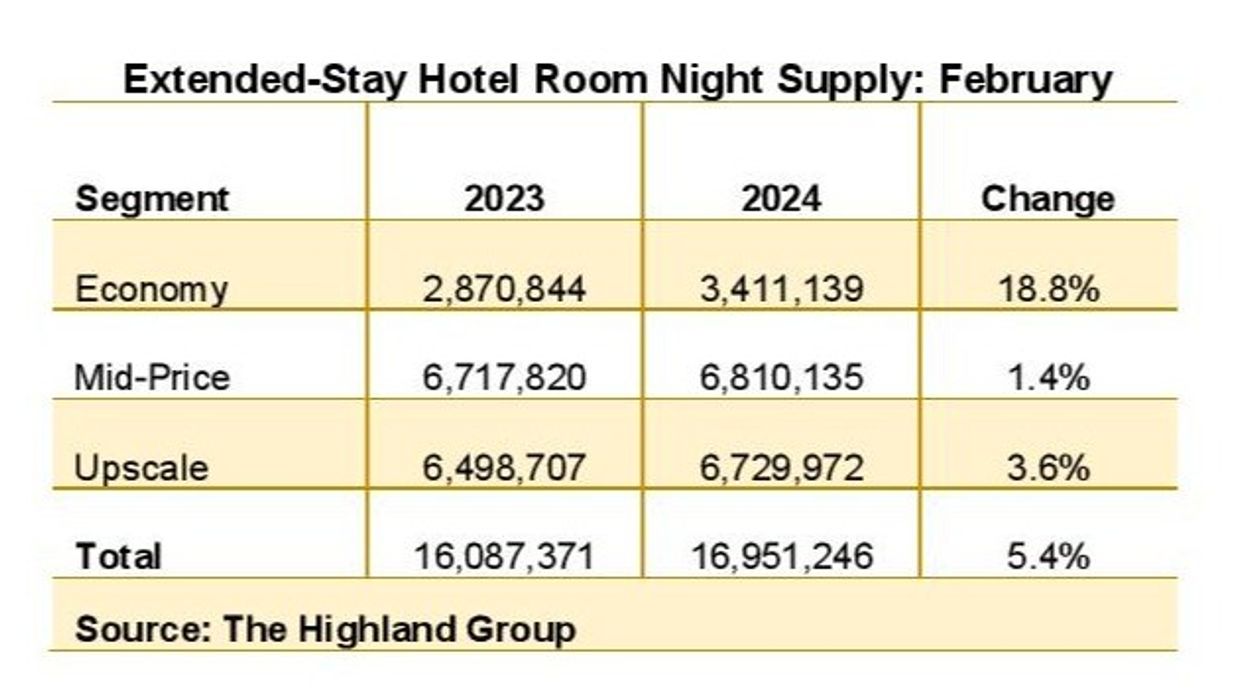

EXTENDED-STAY ROOM SUPPLY increased by 1.8 percent in February due to it being a leap year, consistent with the average monthly increase observed over the last two years, according to The Highland Group. February marked 29 consecutive months of 4 percent or less supply growth. Additionally, the change in supply has remained below 2 percent for more than two years, with both metrics significantly falling below the long-term average.

The 18.8 percent surge in economy extended-stay supply, along with a modest increase in mid-price segment rooms, is largely attributed to conversions, The Highland Group said. Meanwhile, new construction in the economy segment is estimated at around 3 percent of open rooms compared to a year ago.

2024 first half supply trends

Supply change comparisons have been affected by rebranding, segment realignment in The Highland Group’s database, and the de-flagging of hotels failing to meet brand standards, along with sales to multi-family apartment companies and municipalities, the report said. This trend is expected to persist into the first half of 2024, particularly with older extended-stay hotels still available on the market.

However, the year-over-year increase in total extended-stay supply compared to 2023 is expected to remain significantly below the long-term average.

Decline in mid-price segment revenues

Adjusted for the leap year, mid-price extended-stay hotels recorded their third consecutive monthly revenue decline in three years, while the economy segment continued to show double-digit gains, The Highland Group said.

The mid-price segment experienced a contraction in supply due to rebranding, which notably affected segment demand, the report added. Adjusted for the leap year, the segment saw a decline of about 2 percent in demand. Even adjusted for the additional day in 2024, February’s extended-stay demand increase was the highest monthly gain over the last year.

Occupancy grows, ADR and RevPAR decrease

February saw the extended-stay hotel occupancy grow slightly, marking the first monthly increase in 11 months, the report further said. Extended-stay hotel occupancy in February was 12.2 percentage points higher than the total hotel industry, aligning with the historical long-term average occupancy premium.

In February, total extended-stay hotel ADR experienced a monthly decline for the first time since March 2021, The Highland Group said. While economy extended-stay was the only segment reporting a decrease in ADR, both mid-price and upscale segments saw the smallest monthly increases since rates began rising in April 2021, which was insufficient to elevate the total extended-stay ADR.

Extended-stay hotel RevPAR mirrored the ADR trend, the report said. While the economy segment experienced a decline, the increases in mid-price and upscale segments were insufficient to boost the total extended-stay hotel RevPAR, resulting in a third consecutive month of decline.

In January, extended-stay hotels experienced lower performance compared to the overall industry, attributed to weather factors, according to The Highland Group. Room supply, revenues, ADR, and RevPAR across segments were impacted.