Summary:

- U.S. extended-stay hotels outperformed peers in Q3, The Highland Group reported.

- Demand for extended-stay hotels rose 2.8 percent in the third quarter.

- Economy extended-stay hotels outperformed in RevPar despite three years of declines.

U.S. EXTENDED-STAY HOTELS outperformed comparable hotel classes in the third quarter versus the same period in 2024, according to The Highland Group. Occupancy remained 11.4 points above comparable hotels and ADR declines were smaller.

The report, “US Extended-Stay Hotels: Third Quarter 2025”, found the largest gap in the economy segment, where RevPAR fell about one fifth as much as for all economy hotels. Extended-stay ADR declined 1.4 percent, marking the second consecutive quarterly decline not seen in 15 years outside the pandemic. RevPAR fell 3.1 percent, reflecting the higher share of economy rooms. Excluding luxury and upper-upscale segments, all-hotel RevPAR dropped 3.2 percent in the third quarter.

“With further declines in extended-stay hotel RevPAR expected, national supply growth could plateau or even decline over the near term,” said Mark Skinner, partner at The Highland Group.

Economy extended-stay hotels saw a 1.7 percent decline in RevPAR, compared with a 7.6 percent drop for all economy hotels, while room revenues rose 6.6 percent. Mid-price extended-stay hotels contracted slightly but remained above all mid-price hotels. Upscale extended-stay hotels posted a small RevPAR gain, influenced by urban market concentrations.

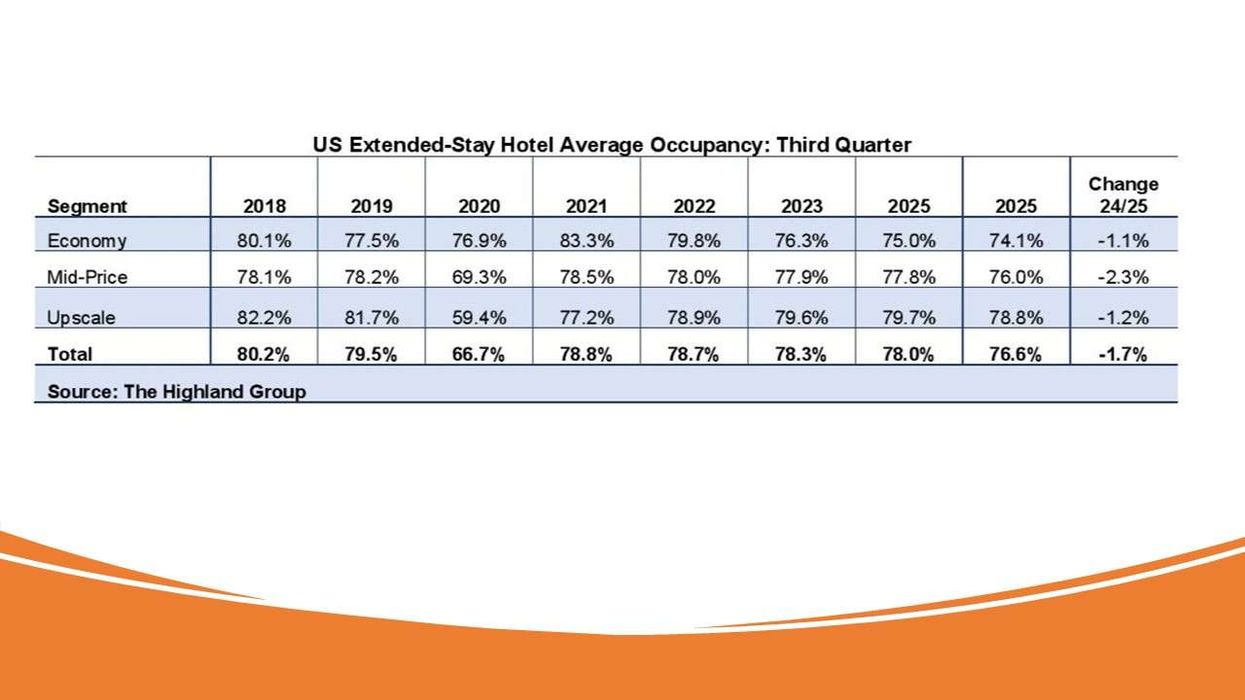

Overall demand for extended-stay hotels rose 2.8 percent in the third quarter, the largest growth in four years, with record demand across all segments. Total room revenues increased 1.3 percent, the smallest third-quarter gain in four years. Occupancy fell 1.7 percent, the largest third-quarter decline since 2019, but remained highest among all hotel classes.

Supply grew by 26,835 rooms, a 48 percent increase over 2024, bringing the total extended-stay room count to 619,029. Economy supply increased 8.4 percent, largely through conversions, while mid-price and upscale segments saw smaller gains. Supply growth is expected to plateau nationally as conversions slow and new construction remains limited.

The Highland Group reported that U.S. extended-stay occupancy fell 2.1 percent in August, its eighth consecutive monthly decline, while ADR dropped 1.8 percent and RevPAR fell 3.9 percent for the fifth month. Total room revenue rose 0.4 percent year over year.