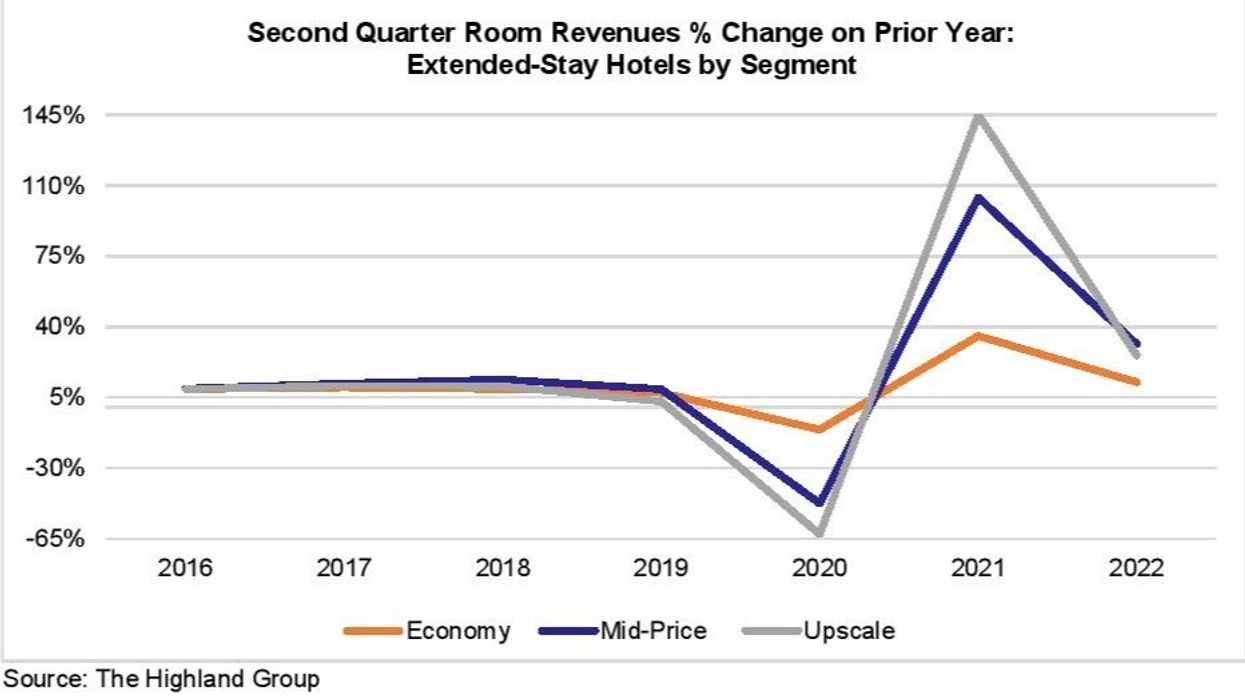

AS THE FIRST half of 2022 ended, U.S. hotels overall were catching up with extended-stay hotels in terms of recovery, according to a report from The Highland Group. RevPAR recovery, for example, was almost the same for hotels overall and extended-stay.

Also, the report found that new construction fell to an 8-year low over the first two quarters of the year, according to the report.

For the first time in 18 months, the overall hotel industry’s second quarter RevPAR recovery index surpassed 100 percent, matching the extended-stay hotel’s 109 percent index. Economy and mid-price extended-stay hotels are still ahead of the overall recovery as well as upscale extended-stay hotels. The gap between the segments is expected to narrow over the near term.

All extended-stay segments have recovered back to second quarter 2019 levels, the report said. Room revenues are 25 percent higher than in the same time period of 2019, and the mid-price extended-stay segment has seen record high occupancy. Extended-stay hotel’s occupancy premium compared to all hotels rose more than 11 percentage points.

“Upscale extended-stay hotels, which hindered the recovery pace for the entire extended-stay segment, posted their first full quarter with RevPAR above its corresponding nominal value in 2019. Full recovery of upscale extended-stay hotels is likely to occur during the near term,” the report said. “The bottom-up recovery of extended-stay hotels is reflected in rooms under construction. The economy segment, which is attracting increasing investor interest, saw no change in rooms under construction over the last year. The mid-price segment, which is one of the hotel industry’s strongest performers, is also experiencing growing investor interest.”

Upscale extended-stay hotels’ rooms under construction fell by more than half. The exiting of hotels from brands because the properties no longer met brand standards contributed to the net change in new rooms open being lower than rooms under construction as a ratio to existing supply, the report said. Some of the exited hotels will remain as extended-stay hotels but others are being converted to apartments or demolished.

“The foreseeable outlook for extended-stay hotels is very good because the last time extended-stay hotel supply growth declined below 3 percent it stayed there for four years and RevPAR grew 47 percent over the same period,” said Mark Skinner, a partner at The Highland Group.

The mid-year report comes shortly after the release of The Highland Group’s June report that found all recovery indices of U.S. extended-stay hotels were up compared to 2019. However, demand for economy extended-stay hotels declined 1.6 percent for the third consecutive month in June compared to same period last year due to strong increase in ADR over several months.