OCCUPANCY AND ADR in U.S. hotels will continue to grow in 2022, with a year-over-year rebound in RevPAR of 14.4 percent, around 93 percent of pre-pandemic levels, according to PwC. Meanwhile, ADR in the third and fourth quarter of 2022 is expected to surpass comparable 2019 levels.

The near-term outlook for the U.S. lodging sector by PwC, titled U.S. Hospitality Directions: November 2021 has said that the vast majority of temporarily-closed hotels will have reopened and demand growth, particularly from individual business travelers and groups, will improve if infection rates continue to drop in 2022.

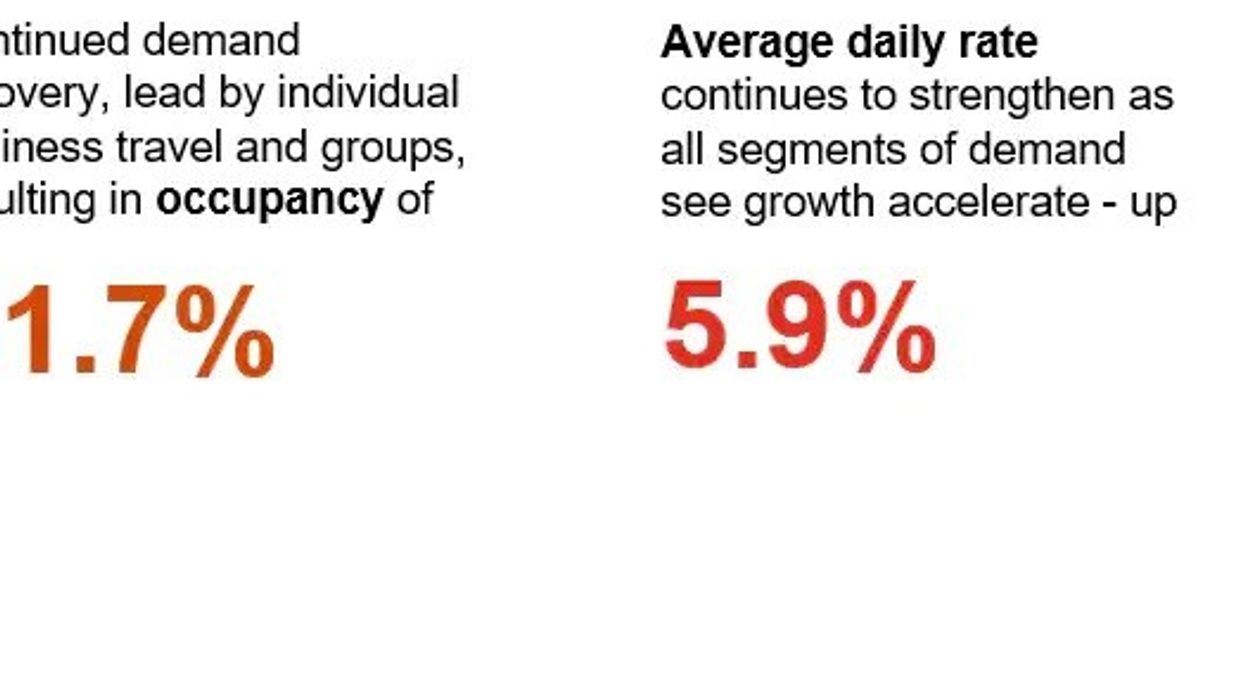

According to PwC report, continued demand recovery will result in an occupancy of 61.7 percent next year and ADR will see an increase of 5.9 percent. The consultancy firm anticipates RevPAR up by 14.4 percent in 2022.

"If vaccinations increase and infection rates continue to drop as we close out 2021 and start the new year, demand from individual business travelers and groups will improve, with average daily room rates in the third quarter and fourth quarter of 2022 expected to surpass comparable 2019 levels,” said Warren Marr, managing director, U.S. hospitality & leisure, PwC.

PwC hinted that lodging’s recovery is expected to remain uneven with slowing growth in vaccinations and waning consumer optimism during December. Just 59 percent of the U.S. population was fully vaccinated as of Nov. 16.

"Due to strong demand during the summer, we expect annual occupancy for U.S. hotels this year to remain consistent, increasing to 57.1 percent. We now expect ADR to increase 19.6 percent in 2021, with resultant RevPAR up 55.1 percent, approximately 82 percent of pre-pandemic levels," the report said.

According to the report, upper upscale hotels in the U.S. will show the most increase in RevPAR at 40.3 percent in 2022 followed by luxury segment at 23.7 percent. The upscale sector will also show an increase in RevPAR at 21.1 percent next year. Only the economy segment will be down 3.8 percent in 2022.

The latest report from STR has said that U.S. hotel performance moved closer to pre-pandemic levels during the third week of November.