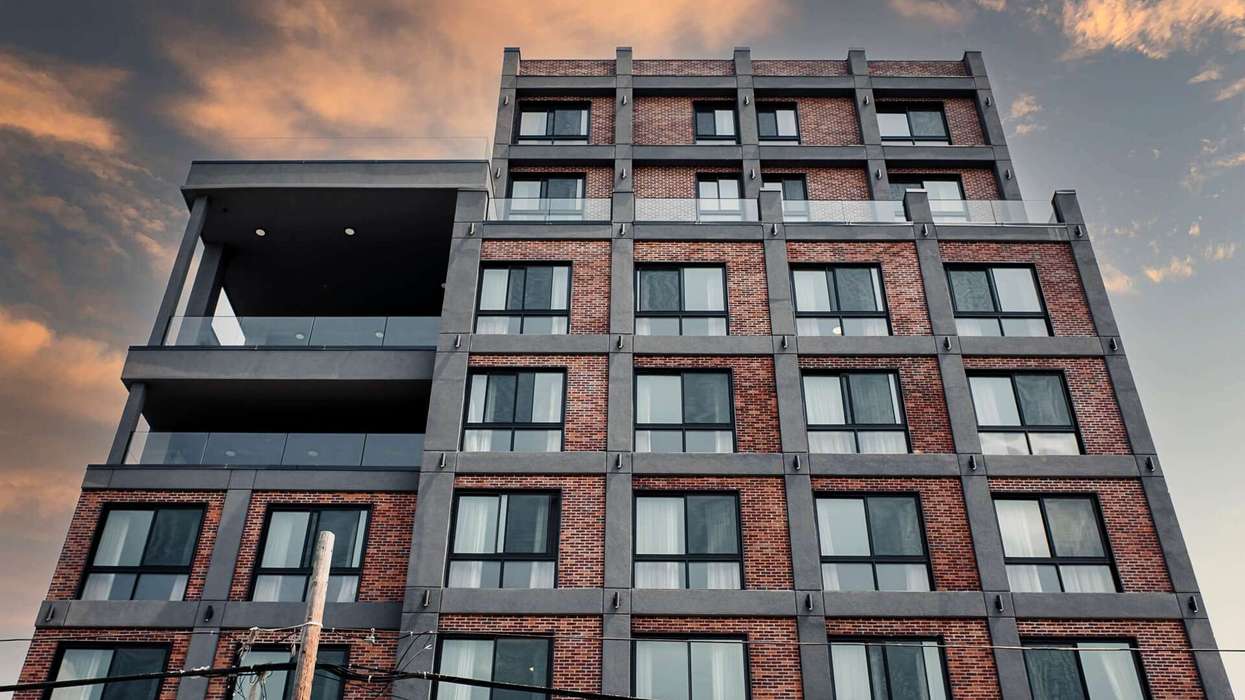

PEACHTREE GROUP SECURED a $73 million construction loan and C-PACE financing to fund the development of a 263-key dual-brand Home2 Suites and Tru by Hilton Hotel in San Diego, California, on behalf of the locally based Baxter Hotel Group. Baxter is set to commence construction on its 16-story, dual-branded hotel this month, with a projected 22-month construction timeline, Peachtree said in a statement.

Peachtree facilitated a $50.4-million floating-rate construction loan with a three-year term and secured $22.6 million in fixed-rate C-PACE financing, amortized over 25 years. Collectively, these funds covered 64 percent of the total development cost, the statement said.

“We were able to execute an innovative capital stack with the addition of C-PACE in an otherwise challenging financing market, providing ample capital for the construction to begin while saving the sponsor 200 basis points in interest rate spread,” said Jared Schlosser, Peachtree’s senior vice president, head of hotel origination and C-PACE.

The budget includes C-PACE-eligible items like seismic improvements, lighting, building envelope, HVAC, plumbing, and qualifying soft costs, Peachtree added. The hotel targets both transient and extended-stay guests, addressing an historically underserved market.

The proposed amenities in this limited-service hotel depart from the norm and include sustainable designs for LEED certification, a ground-floor restaurant, and a rooftop pool with a fully equipped restaurant and bar offering panoramic views of Downtown San Diego, the company said.

In October, Peachtree Group's credit division concluded $556 million in loan originations, comprising half of the company's total deployment of $1.1 billion for the year. The remaining $526 million was allocated for the acquisition of five hotels and the initiation of three new hotel development projects. Sameer Nair was recently appointed as the senior vice president of equity asset management at Peachtree Group, responsible for overseeing asset management for Peachtree’s real estate portfolio and preferred equity investments.