RevPAR Up 3.3% in the U.S. and Canada

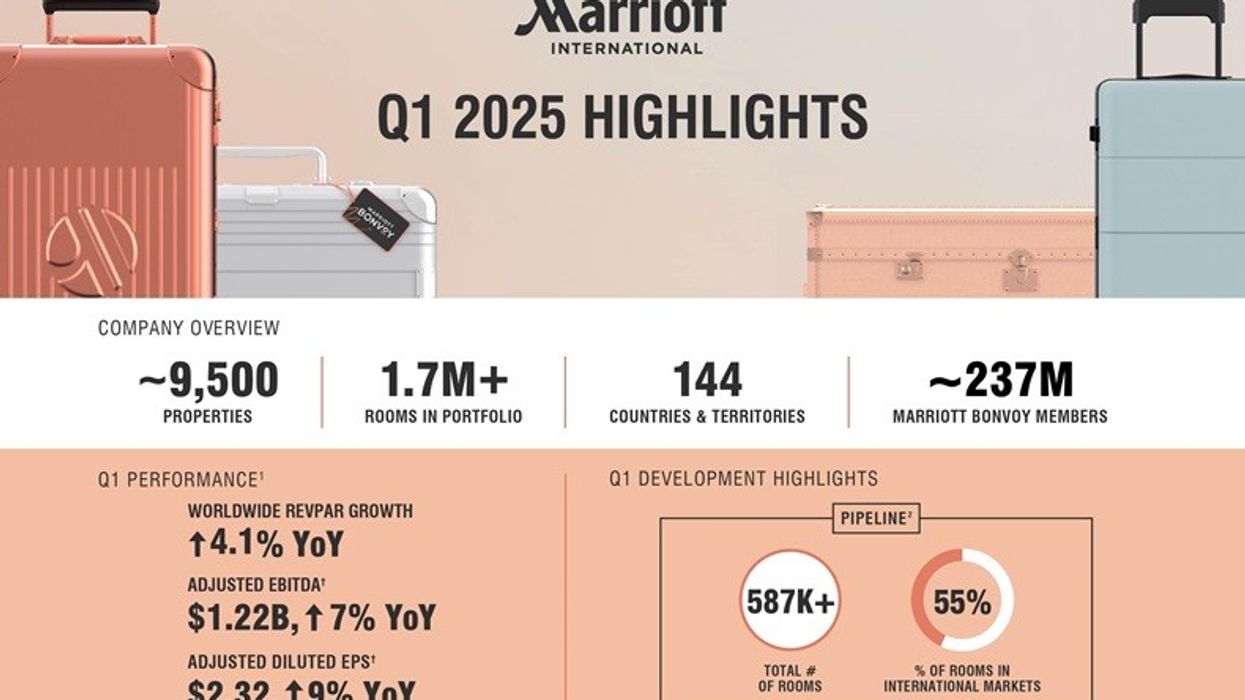

MARRIOTT INTERNATIONAL INC. reported a 4.1 percent year-over-year increase in RevPAR globally, with 3.3 percent growth in the U.S. and Canada and 5.9 percent in international markets. The company’s net income rose 18 percent to $665 million in the first quarter of 2025, up from $564 million in the first quarter of 2024.

The company added about 12,200 net rooms in the quarter, including more than 7,300 internationally, bringing its global system to nearly 9,500 properties and approximately 1.72 million rooms, Marriott said in a statement.

“The combination of continued travel demand, the strength of our brands, and our fee-driven business model drove strong financial results in the first quarter,” said Anthony Capuano, Marriott’s president and CEO. “Despite macroeconomic uncertainty, global RevPAR rose over 4 percent, mainly driven by higher ADR, and our development momentum remained positive. International markets saw robust growth, with RevPAR up nearly 6 percent, led by double-digit gains in APEC. RevPAR in the U.S. and Canada rose over 3 percent, although March growth slowed.”

Capuano also noted record first-quarter signings of over 34,000 rooms, two-thirds of which were in international markets. Conversions were a key driver, representing about a third of the signings and openings.

Mixed revenue streams

Base management and franchise fees grew 7 percent to $1.071 billion, driven by RevPAR gains, unit growth, and higher residential and cobranded credit card fees. Incentive management fees totaled $204 million, down slightly from $209 million a year ago, with nearly two-thirds from international markets.

Owned, leased, and other revenue, net of expenses, declined to $65 million from $71 million due to lower termination fees. General and administrative expenses fell to $245 million from $261 million, reflecting lower compensation costs from efficiency initiatives. Net interest expense rose to $183 million from $153 million, while the income tax provision dropped to $99 million from $163 million, due to an $86 million tax reserve release.

Operating income rose to $948 million from $876 million, and net income increased 18 percent to $665 million. Adjusted operating income reached $1.016 billion, adjusted net income was $645 million, and adjusted EBITDA grew 7 percent to $1.217 billion.

Pipeline and outlook

At the end of the first quarter, Marriott’s global pipeline included 3,808 properties and over 587,000 rooms, including 171 projects with 27,000 rooms approved but not yet under contract. The pipeline also featured 1,447 properties with nearly 244,000 rooms under construction, including conversions to the Marriott system. More than half of the rooms in the quarter-end pipeline are in international markets.

Marriott expects additional properties from its planned acquisition of citizenM, a Netherlands-based select-service brand. The acquisition, valued at $355 million, adds citizenM’s 36 open hotels with 8,544 rooms across more than 20 cities, including New York, London, Paris, and Rome, plus three pipeline hotels with over 600 rooms.

Capuano emphasized the company’s commitment to growing its global portfolio and enhancing offerings for guests, Marriott Bonvoy members, and hotel owners.

“We’re excited about citizenM’s global growth prospects, given its unique offering and our successful track record with acquired brands like AC Hotels,” he said. “Our net rooms growth outlook remains strong, with full-year 2025 net rooms growth expected to approach 5 percent, assuming the acquisition closes before year-end.”

Marriott’s updated outlook assumes continued booking trends, with somewhat softer expectations in the U.S. and Canada. The company expects worldwide RevPAR growth of 1.5 to 2.5 percent for the second quarter and 1.5 to 3.5 percent for full-year 2025. Net rooms growth is projected to approach 5 percent for full-year 2025, with adjusted EBITDA ranging from $1.370 billion to $1.390 billion for the second quarter and $5.285 billion to $5.425 billion for full-year 2025.

“Despite macroeconomic uncertainty, we are confident that the strength of our global portfolio, the Marriott Bonvoy platform, our associates, and our asset-light business model position us for sustainable, long-term growth,” said Capuano.