Summary:

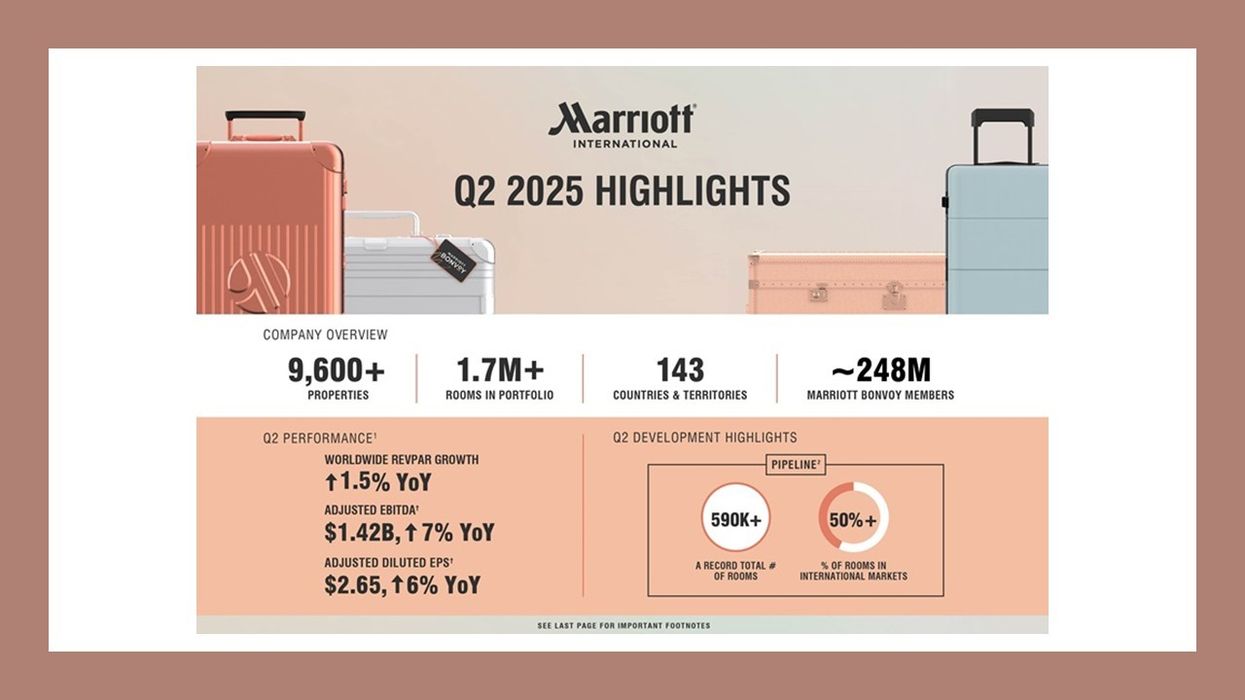

- Marriott International ended Q2 with a record pipeline of about 3,900 properties and more than 590,000 rooms.

- Global RevPAR rose 1.5 percent, including a 5.3 percent gain in international markets.

- Net income slipped 1 percent to $763 million; 17,300 net rooms were added.

MARRIOTT INTERNATIONAL’S GROWTH continued in the second quarter, according to the company’s recent earnings report. Along with its active pipeline, the company saw rising revenue and launched a new brand.

Marriott’s global development pipeline stood at approximately 3,900 properties with more than 590,000 rooms at the end of the second quarter. The company added about 17,300 net rooms, signed nearly 32,000 and reported more than 70 percent of signings and 8,500 of added rooms in international markets.

RevPAR in the U.S. and Canada was flat year over year, Marriott said in a statement.

“Marriott delivered another solid quarter, highlighted by strong financial results and robust net rooms growth despite heightened macro-economic uncertainty,” said Anthony Capuano, Marriott president and CEO. “Global RevPAR increased 1.5 percent in the second quarter, primarily driven by the leisure segment. International RevPAR rose more than 5 percent, with strong growth in APEC and EMEA. In the U.S. and Canada, RevPAR was flat year over year with continued strength in the luxury segment offset by a decline in select-service demand, largely reflecting reduced government travel and weaker business transient demand. Adjusting for the Easter holiday shift, U.S. and Canada RevPAR increased by nearly 1 percent.”

Base management and franchise fees rose nearly 5 percent to $1.2 billion, driven by RevPAR growth, room additions and co-branded credit card fees, the statement said. Reported operating income increased to $1.236 billion from $1.195 billion, while net income declined 1 percent to $763 million. Reported diluted earnings per share were $2.78, up from $2.69.

Adjusted operating income rose to $1.186 billion from $1.120 billion, Marriott said. Adjusted net income increased to $728 million from $716 million and adjusted diluted EPS rose to $2.65 from $2.50. Adjusted EBITDA grew 7 percent to $1.415 billion.

Pipeline and brands

Marriott added about 17,300 net rooms in the quarter, including over 8,500 internationally, bringing its global system to more than 9,600 properties and around 1.736 million rooms. It signed nearly 32,000 rooms, over 70 percent in international markets. Conversions made up about 30 percent of signings and openings in the first half. Full-year net rooms growth is expected to approach 5 percent.

Marriott Bonvoy membership also reached nearly 248 million by the end of June, the statement said.

“Development activity remained robust,” Capuano said. “We signed nearly 32,000 rooms, more than 70 percent of which were in international markets, and our quarter-end pipeline stood at a record of more than 590,000 rooms. Conversions continued to be a key driver of growth, representing approximately 30 percent of our room signings and openings in the first half of this year. We still expect full year net rooms growth to approach 5 percent this year.”

The development pipeline included 3,858 properties and more than 590,000 rooms, with 234 properties and over 37,000 rooms approved but not yet under contract, the statement said. The pipeline included 1,447 properties with more than 238,000 rooms under construction or conversion. Over half of the pipeline rooms were outside the U.S. and Canada.

The company launched Series by Marriott, a regional collection brand for midscale and upscale segments, and announced its first agreement to affiliate India’s Fern portfolio. Marriott also completed the acquisition of citizenM. However, the citizenM and Series by Marriott additions were not included in the pipeline total.

Capuano said both brands are expected to support international expansion.

2025 outlook

Marriott’s outlook assumes no major shifts in macroeconomic conditions. The company expects RevPAR to be flat to up 1 percent in the third quarter of 2025 and grow 1.5 to 2.5 percent for the full year. Net rooms growth is projected to approach 5 percent in 2025.

Gross fee revenues are expected to total $1.310 billion to $1.325 billion in the third quarter and $5.365 billion to $5.420 billion for the year. Adjusted EBITDA is forecast at $1.288 billion to $1.318 billion for the third quarter and $5.310 billion to $5.395 billion for the full year.