HOTELS IN THE Americas performed above 2019 levels, although RevPAR is stabilizing amidst decreasing consumer travel spending, according to real estate firm JLL. This has affected resort markets heavily dependent on leisure travel. In contrast, urban travel demand is on the rise, driven by group, corporate, and inbound international travel.

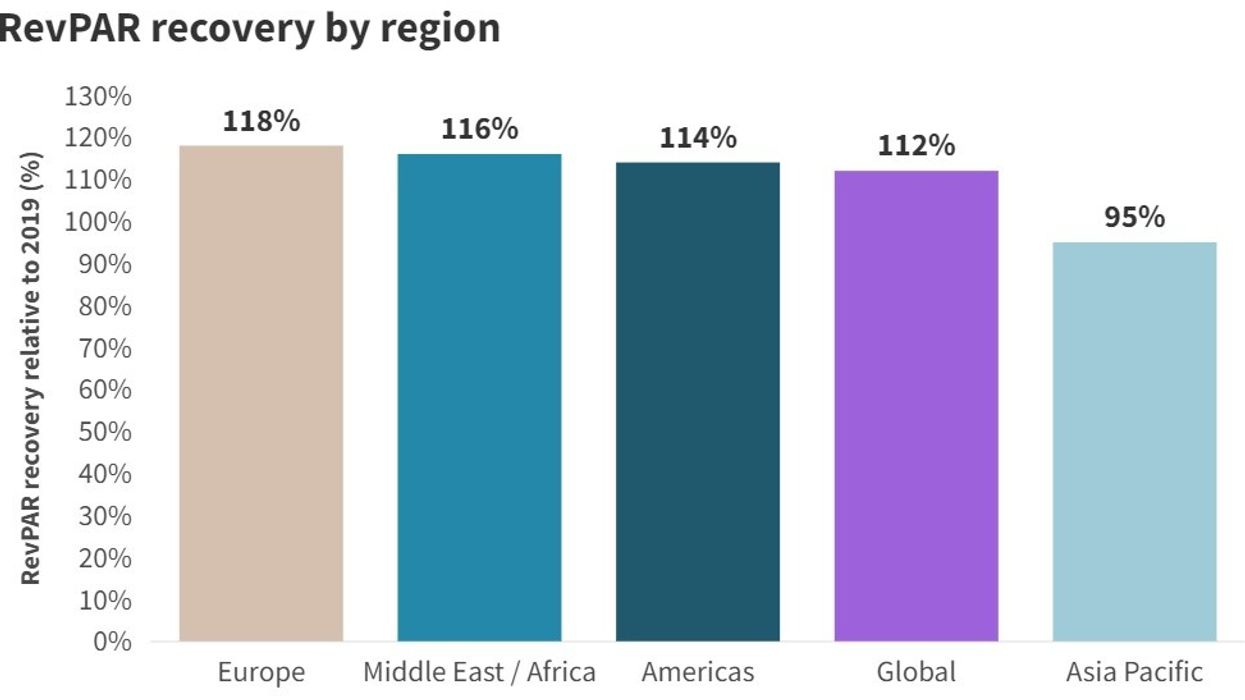

According to JLL’s Global Real Estate Perspective for February 2024, global hotel RevPAR surpassed 2019 levels by 11.7 percent in the first 11 months of 2023. The global urban market strengthened with increased international travel and the return of business and group demand. London, New York, and Tokyo are expected to lead global RevPAR performance in 2024 as urban travel rebounds.

Stabilization has weighed heaviest in resort markets, particularly in the Americas and EMEA, while Asia-Pacific continues to accelerate as intraregional travel grows following border reopenings, the report added. Foreign capital, absent since the onset of COVID, is expected to become more active over the next 12 months. Middle Eastern and Asian investors are likely to lead, with urban markets in Europe and select U.S. cities as primary recipients of capital.

EMEA leads RevPAR growth

EMEA leads all regions in RevPAR growth relative to 2019, propelled by strong international and intraregional travel, JLL said. While demand is starting to normalize in certain resort-heavy markets, urban performance has surged, particularly in many cities across Western Europe and the Middle East, resulting in historically high RevPAR.

Intraregional tourism within Asia-Pacific surged in 2023, driving RevPAR to a 94 percent recovery relative to 2019. The lifting of China’s group travel ban is further boosting this trend, notably benefiting Australia and Japan.

Positive outlook for 2024

Following the removal of all post-pandemic restrictions, international travel surged in 2023, reaching 87 percent of 2019 levels, the report said. The impact on urban hotel demand is notable, given the historically strong correlation of 90 percent between inbound foreign arrivals and urban hotel occupancy, particularly evident in gateway markets such as London, New York, and Tokyo.

Meanwhile, JLL expects international travel to accelerate further, with Europe likely to benefit most, especially with the Summer Olympics in Paris and Taylor Swift's Eras Tour heading to the U.K. and Western Europe. This increase in travel should also boost global hotel liquidity.

Investor confidence returns

With 1,350 global hotel brands to choose from, investors must be increasingly discerning in the brand they acquire, the report said. Investors are now buying into an entire ecosystem as traditional hotel brands expand into adjacent verticals with the goal of capturing the entire travel journey and solidifying loyalty.

Branded residences, private membership clubs, and even yachts are becoming more integrated into traditional hotel brands’ portfolios, offering new investment opportunities, JLL said. With global hotel development slowing due to rising construction costs, acquisitions of brand platforms are expected to enhance shareholder value and become a significant focus for investors in the long term.

According to the report, luxury and lifestyle brands are anticipated to draw significant investor interest, exemplified by PIF's recent $1.2 billion investment in Rocco Forte hotels.

The fourth quarter 2023 Global Hotel Construction Pipeline Trend Report by Lodging Econometrics underscored the U.S. and China's dominance, making up 64 percent of global projects, with the U.S. leading at 39 percent. Among the top five cities with the largest construction pipelines, three are in the U.S.: Dallas, Atlanta, and Nashville.