IHG Hotels Drives RevPAR Growth and Expansion in USA for Q1 2025

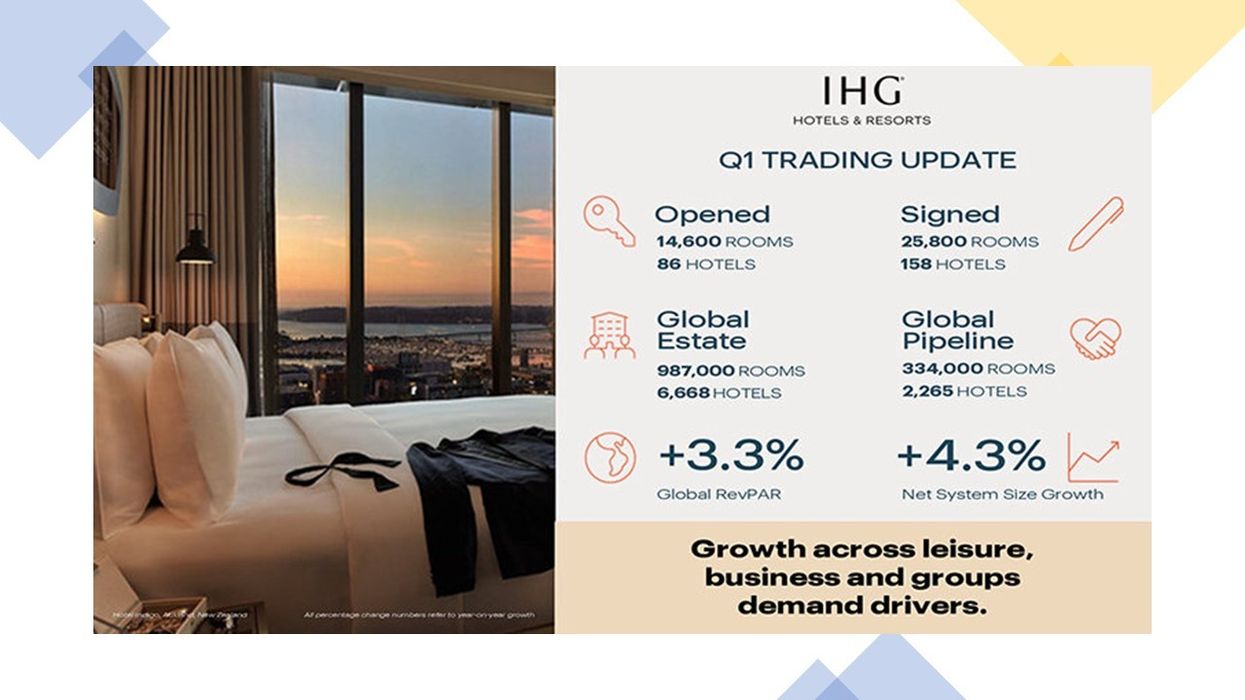

IHG HOTELS & RESORTS posted a 3.3 percent increase in global RevPAR for the first quarter of 2025, led by 3.5 percent growth in the Americas. The company continued to grow with more than 25,000 rooms signed.

The Europe, Middle East, Asia & Africa region saw a 5 percent RevPAR gain, while Greater China saw a 3.5 percent decline, IHG said in a statement. Business travel revenue rose 3 percent, leisure 2 percent, and group bookings 5 percent, with global ADR increasing 2.2 percent and occupancy rising 0.6 percentage points.

“We had strong trading performance and development activity in the first quarter, despite increased macro volatility,” said Elie Maalouf, IHG's CEO. “Global RevPAR grew 3.3 percent, reflecting the strength of our diverse footprint and growth across business, leisure and groups.”

IHG’s system size expanded, with gross growth up 7.1 percent year-over-year and 1.5 percent year-to-date. The company opened 86 hotels with 14,600 rooms, more than double the same period in 2024. Net system size grew 4.3 percent year-over-year and held flat year-to-date.

Excluding the removal of rooms formerly affiliated with The Venetian Resort Las Vegas, net growth reached 5 percent year-over-year and 0.7 percent year-to-date, bringing IHG’s total to 987,000 rooms across 6,668 hotels, IHG said.

“A strong signings performance of 25,800 rooms across 158 properties was also well ahead of 2024, leading to a 9.4 percent year-on-year increase in our pipeline,” Maalouf said. “This included 5,700 rooms across 30 hotels from our February acquisition of the Ruby brand. Since then, two additional Ruby signings have been added. Demand for quick-to-market conversions remains high, representing about 60 percent of openings and 40 percent of organic signings this quarter.”

Excluding Ruby, signings totaled 20,200 rooms, up from 17,700 a year ago, the statement said. IHG’s global pipeline now stands at 334,000 rooms across 2,265 hotels, up 9.4 percent year-over-year.

“Looking ahead, while some forward economic indicators have softened, our on-the-books global revenue for the second quarter continues to show growth versus the same time last year,” Maalouf said. “Our ability to capture demand across geographies and chain scales, and our focus on domestic stay occasions, are core strengths. While still early, we remain on track to meet full-year consensus profit expectations.”

IHG has completed $324 million of its planned $900 million share buyback for 2025, reducing its share count by 1.9 percent. Maalouf said that long-term structural growth drivers for travel demand and supply remain intact for both the industry and IHG.

“The power of our growth algorithm comes from the compounding effect of increasing fee revenues through RevPAR, system expansion, and ancillary fees, which help grow margins,” Maalouf said. “Strong cash generation enables us to reinvest and return surplus capital to shareholders. Despite short-term macroeconomic uncertainty, we remain confident in the strength of our platform and our ability to build on our scale and market positions.”

IHG reported global RevPAR growth of 3 percent for 2024 and 4.6 percent in the fourth quarter, with the Americas up 2.5 percent for the year and 4.6 percent for the quarter. In February, the company acquired Germany-based Ruby for about $116 million, targeting global expansion, including in the Americas.