PROFITS FOR U.S. hotels continued to see some small improvements in March, one year after the beginning of the pandemic, according to HotStats. Year-over-year comparisons finally began to favor the more recent time period.

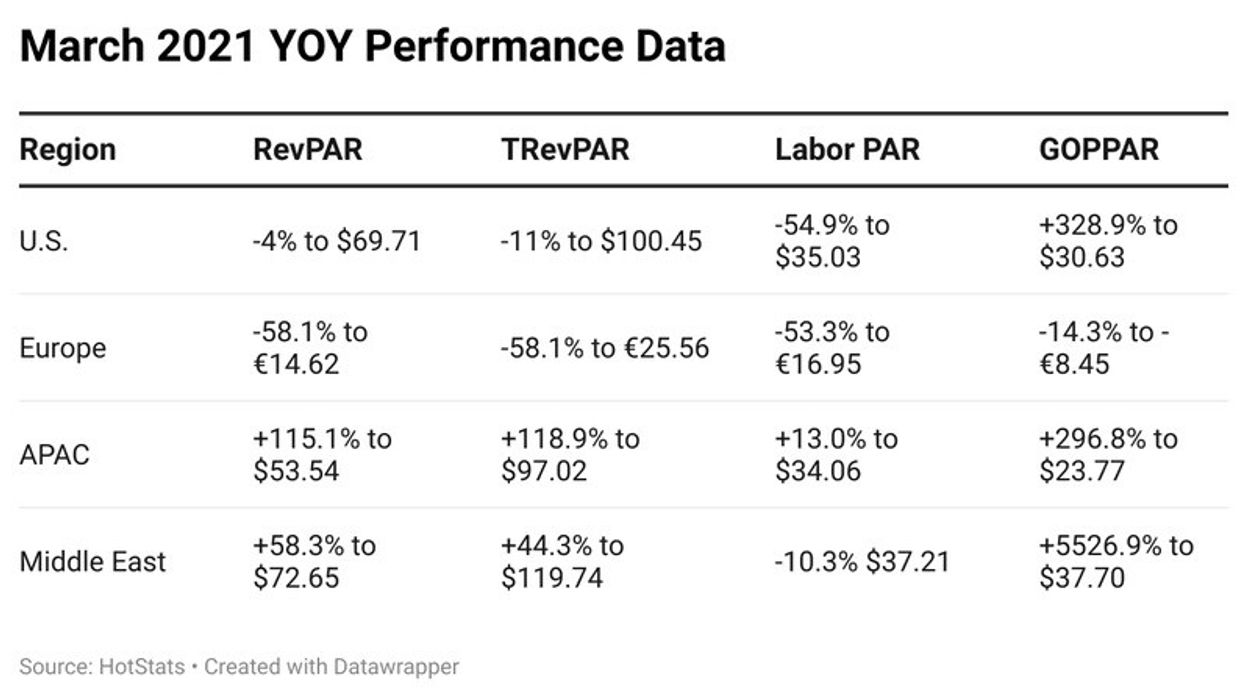

GOPPAR for the U.S. was up 328.9 percent over the same time last year to $30.63 compared to negative $13.38 in March 2020, according to HotStats.

“GOPPAR in March 2020 checked in at, one of eight months in 2020 when profit was negative. Still, March 2021 GOPPAR was the highest it’s been since February of last year and $20 higher than last month,” David Eisen, HotStats’ director of hotel intelligence for the Americas, wrote in a blog on the company’s website. “Just over a year after the World Health Organization declared COVID-19 a pandemic, the global hotel industry is, slowly, stirring from hibernation and seeing at least modest gains in traveler demand. The wait has been long, and it remains a work in progress.”

The advances made in March “only shined a light on the decrepitude that was 2020,” Eisen wrote. “March was also the first time in a year that year-over-year RevPAR was up, by 4 percent. It was also $20 higher than last month. Both occupancy and rate were at their highest levels since last March, with the former up 5.8 percentage points over the same time a year ago to 36.8 percent.”

TREVPAR rose to $100.45, aided by the overall increase in rooms revenue, despite still muted ancillary revenue. Total labor costs were down 55 percent from the same month the previous year.

Profit margin was up 42.4 percentage points to 30.5 percent, the highest mark since February 2020 and a number more in line with historical levels.

U.S. hotels have been seeing similar improvements since the beginning of 2021.