THE FIRST MONTH of 2021 saw consistent profits performance by U.S. hotels, according to HotStats. Unfortunately, it remained consistently low.

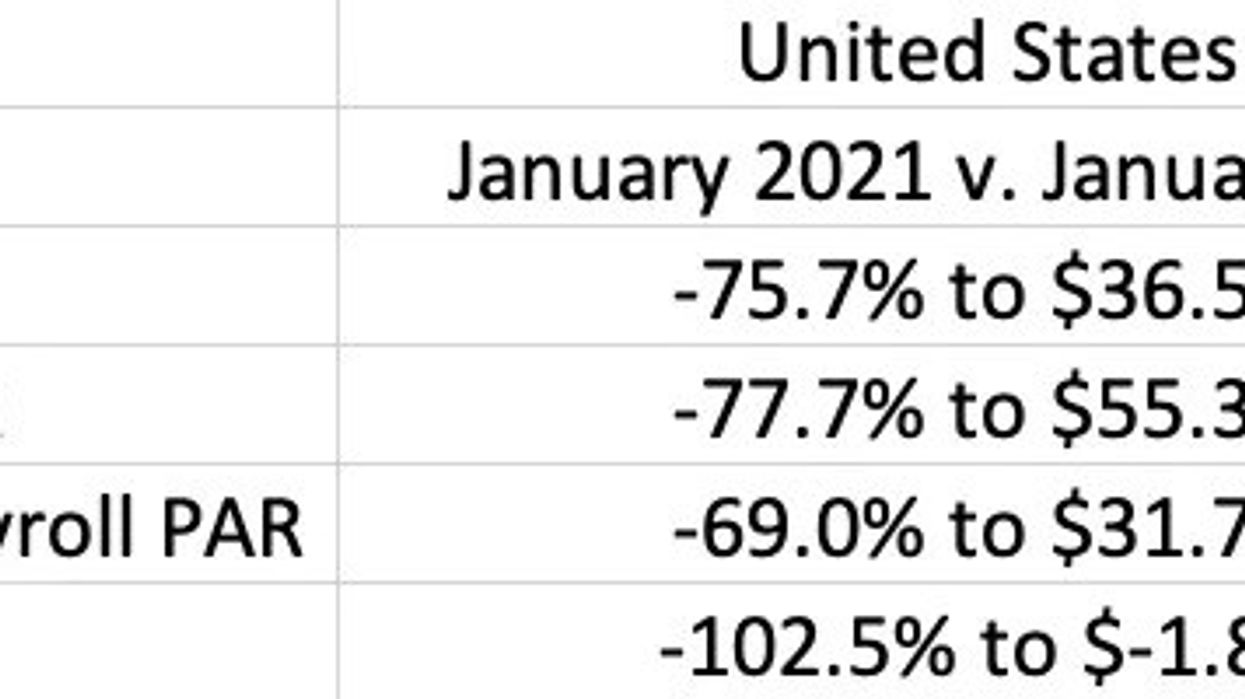

GOPPAR for the month was negative $1.81, a 102.5 percent year-over-year decrease. It was the 10th month of negative GOPPAR since March, except for a high mark of $4.98 in October.

“Occupancy continues to hang around the 20 percent -plus range, which, despite relative rate progression, is keeping RevPAR at around the same level it’s been since August,” HotStats said in its report. “Like RevPAR, TRevPAR remains stuck in neutral, not varying much from August. At $55.30 in January, it was down 77.7 percent year-over-year, the result of stunted ancillary revenue from the likes of food and beverage.”

Labor expenses have held relatively steady since dropping in April with the onset of the COVID-19 pandemic. After holding steady since October they dropped 69 percent in January from last year to $31.76 per available room. Operated and undistributed expenses were down from last January 28.1 percent, following a trend set by other months. The profit margin for U.S. hotels was negative 3.3 percent, a 32.8-percentage-point decrease over the same time a year ago.

While 2020 proved to be a bad year that ended on a historically sour note, the new year is not quite living up to expectations on a global scale, according to HotStats.

“Turning the page doesn’t always assure a better result. After the worst performing year on record, the hotel industry was ready for 2021, but resigned to the fact that a new year doesn’t mean things automatically get better. The harsh reality is a global pandemic that has ceased to fully recede,” the firm said. “Still, there is cause for optimism. Though travel remains stunted across the world, some regions are showing signs of sustained performance positivity.”