Summary:

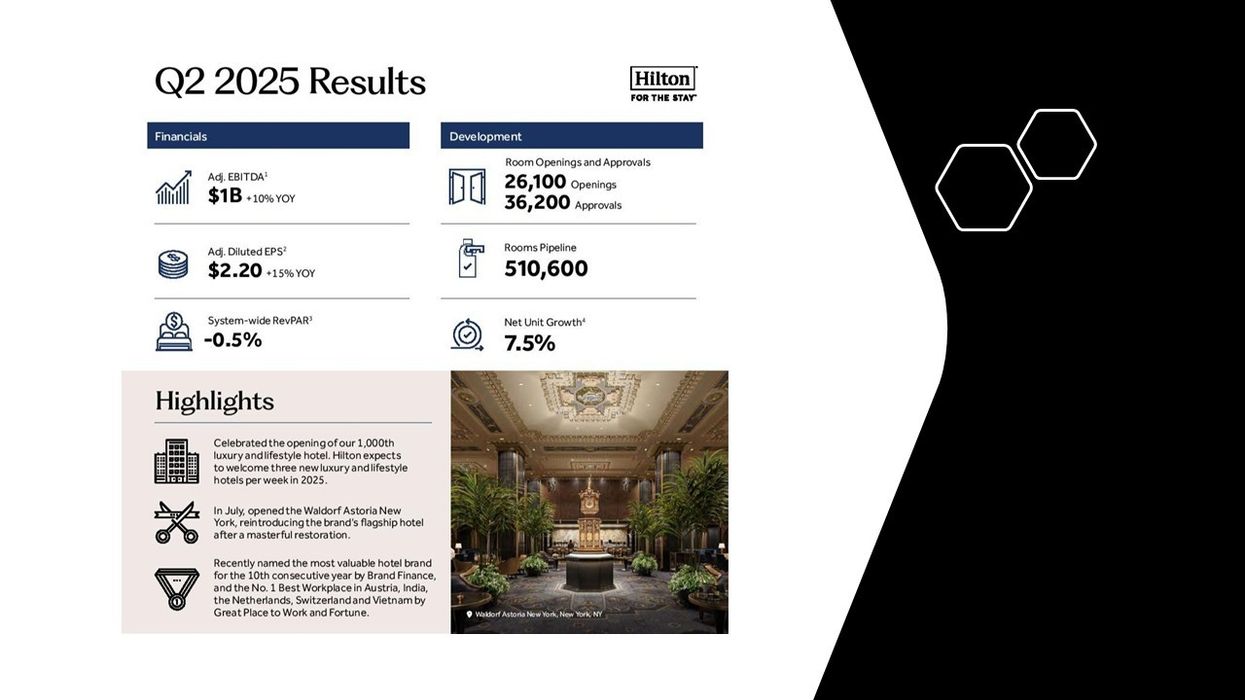

- Hilton reported 7.5 percent net unit growth in the second quarter while systemwide RevPAR declined 0.5 percent year-over-year.

- Net income and adjusted EBITDA for the first half of 2025 were $742 million and $1.8 billion, up from $690 million and $1.67 billion YoY.

- For the third quarter of 2025, Hilton expects systemwide RevPAR to be flat to slightly down.

HILTON WORDLWIDE HOLDINGS reported 7.5 percent net unit growth in the second quarter of 2025, however systemwide RevPAR declined 0.5 percent year-over-year. The company said economic fluctuations are being felt but not hindering performance.

The company approved 36,200 rooms for development, bringing its pipeline to a record 510,600 rooms, up 4 percent year-over-year excluding acquisitions and strategic partner hotels. It added 26,100 rooms in the quarter, resulting in 22,600 net additions and 7.5 percent net unit growth over the year, Hilton said in a statement.

“We continued to demonstrate the power of our resilient business model as we delivered strong bottom line results in the quarter, even with modestly negative top line performance given holiday and calendar shifts, reduced government spending, softer international inbound business and broader economic uncertainty,” said Christopher Nassetta, Hilton’s president and CEO. “With that being said, we believe the economy in our largest market is set up for better growth over the intermediate term, which should accelerate travel demand and, when paired with low industry supply growth, unlock stronger RevPAR growth.”

Meanwhile, on the development side, Nassetta said growth was strong.

“We achieved the largest pipeline in our history, and we remain confident in our ability to deliver net unit growth between 6 percent and 7 percent for the next several years,” he said.

Systemwide comparable RevPAR declined 0.5 percent for the three months ended June 30, 2025, compared to the same period in 2024, due to lower occupancy partially offset by ADR gains, the statement said. For the six-month period, RevPAR rose 1 percent year-over-year, driven by higher ADR. Management and franchise fee revenue rose 7.9 percent year-over-year.

Net income and adjusted EBITDA were $742 million and $1.8 billion, respectively, for the six months ended June 30, compared to $690 million and $1.67 billion for the same period in 2024.

Pipeline and outlook

Hilton opened 221 hotels totaling 26,100 rooms in the second quarter of 2025, resulting in 22,600 net room additions. Its luxury and lifestyle portfolio grew to more than 1,000 hotels globally.

Hilton added 36,200 rooms to its development pipeline in the second quarter. As of June 30, the pipeline totaled 3,636 hotels with 510,600 rooms across 128 countries and territories, including 29 where it had no existing hotels.

Nearly half of the rooms were under construction with more than half outside the U.S.

Hilton projects systemwide comparable RevPAR to range from flat to up 2 percent in 2025 compared to the prior year. Net unit growth is expected between 6 percent and 7 percent. The company anticipates adjusted EBITDA between $3.65 billion and $3.71 billion, with general and administrative expenses projected between $420 million and $430 million. Net income is expected to range from $1.64 billion to $1.68 billion.

For the third quarter of 2025, Hilton expects systemwide comparable RevPAR to be flat to slightly down from the same period in 2024. Adjusted EBITDA is projected to range between $935 million and $955 million, while net income is expected to be between $453 million and $467 million.