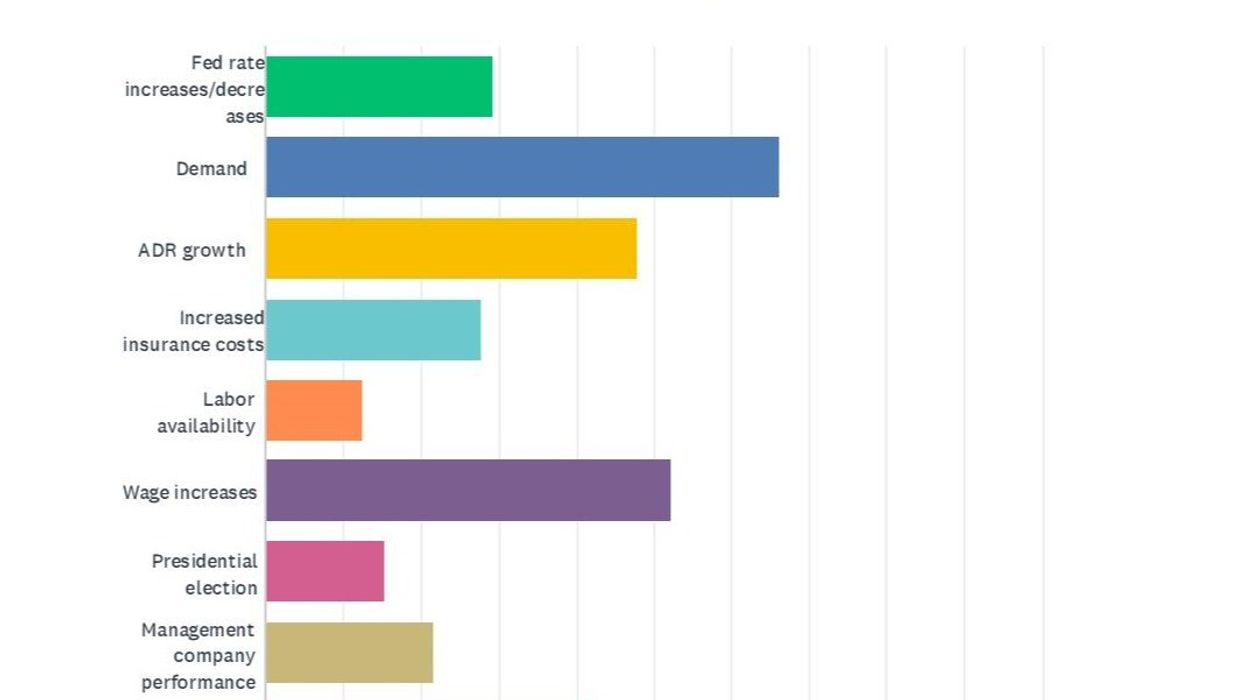

DEMAND, WAGE GROWTH and ADR increase remain the top concerns in hospitality industry, according to the Hospitality Asset Managers Association’s Fall 2024 Industry Outlook Survey. However, about 82 percent of respondents do not expect a recession in 2025.

Furthermore, approximately 58 percent have made or plan to make changes to brand or management as part of their strategy.

“The overall hospitality industry outlook remains positive from the hotel asset management point of view,” said Sarah Gulla, HAMA’s president. “For the most part, our member hotels continue to exceed budgeted forecasts, and there seems to be little fear of a recession on the immediate horizon. While demand and wage increases remain persistent concerns, this is a solid time to be in the hospitality industry.”

The semi-annual report, released during HAMA’s 2024 Fall Meeting in La Jolla, reflects insights from nearly 70 hotel asset managers on topics including budget forecasts and management company outlooks. HAMA said that 65 asset managers, representing about one-third of its membership, participated in the survey.

In April, 83.83 percent of respondents to HAMA’s “Spring 2024 Industry Outlook” survey said they believed that RevPAR will return to U.S. hotels as a whole no later than 2025.