How U.S. Extended-Stay Hotels Performed in January 2025?

U.S. EXTENDED-STAY HOTELS started 2025 with strong January growth, particularly at lower price points, according to The Highland Group. Supply and demand grew much faster than the overall industry, but other performance metrics lagged.

The U.S. Extended-Stay Hotels Bulletin: January 2025 reported stronger ADR and the most RevPAR gains for extended-stay hotels compared to corresponding classes.

“January was another very good month for extended-stay hotels with positive change in RevPAR in nine of the last ten months and the economy segment continuing to lead RevPAR growth,” said Mark Skinner, The Highland Group’s partner.

Meanwhile, the report attributed this to economy extended-stay hotels making up a larger share of rooms and luxury hotels boosting industry metrics. STR/CoStar cited special events like Inauguration Day and the college football playoffs, along with severe disasters such as the Los Angeles wildfires and hurricanes, though the impact on extended-stay hotels was minimal.

Supply, revenue and demand growth

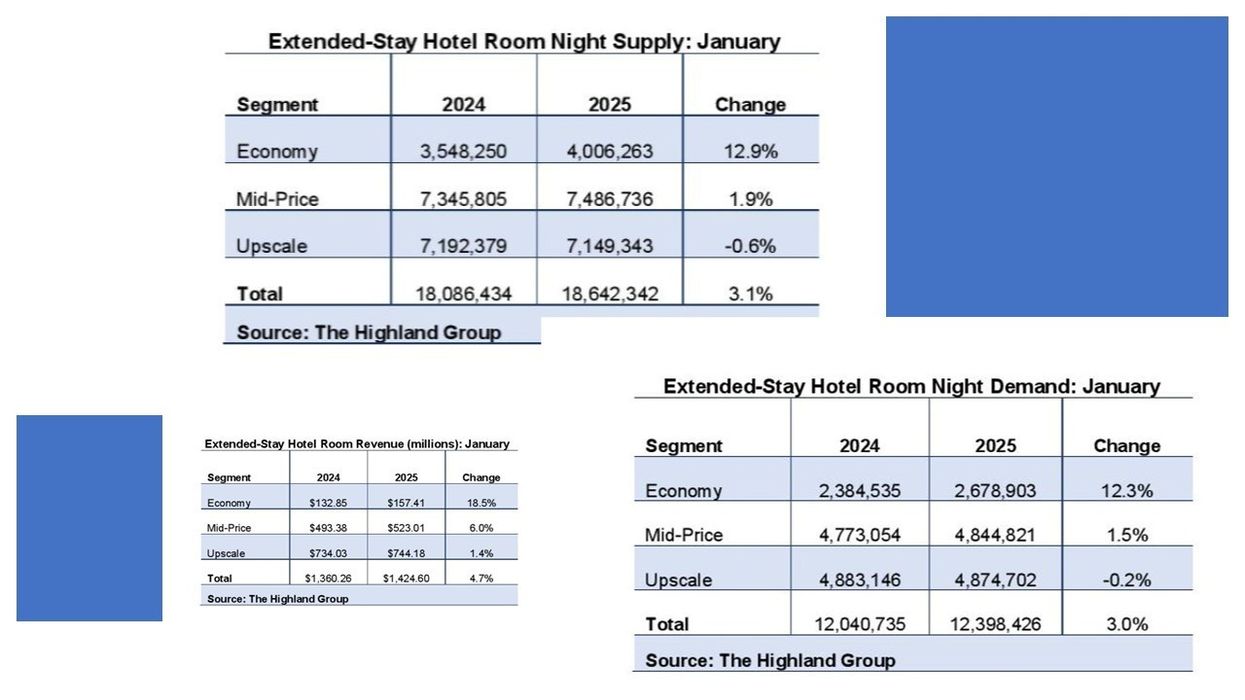

January marked 40 straight months of supply growth at 4 percent or less, with annual increases ranging from 1.8 percent to 3.1 percent over the past three years—well below the long-term average, The Highland Group said. Extended-stay room supply rose 3.1 percent in January, matching the 2024 monthly average. The increase partly reflects the inclusion of Water Walk by Wyndham in May and Executive Residency by Best Western in January in the database.

Economy extended-stay supply rose 12.9 percent, driven mainly by conversions, as new construction added just 3 percent of existing rooms year over year. However, mid-price and upscale segment changes were minimal.

Supply changes have been affected by rebranding, de-flagging, and hotel sales to multifamily operators and municipalities. Conversion activity should slow, keeping 2025's extended-stay supply growth well below the long-term average.

Room revenue rose 4.7 percent in January, marking ten consecutive months of growth but trailing the overall industry's 5.2 percent gain, the report said, citing STR/CoStar. Demand also increased 3 percent in January, marking growth in 25 of the last 26 months. By comparison, STR/CoStar reported a 1.7 percent increase in overall hotel demand.

Key metrics overview

Extended-stay occupancy dipped 0.1 percent in January, only the second decline in ten months, compared to a 1.1 percent gain for all hotels, according to STR/CoStar. However, extended-stay occupancy remained 13.8 points above the industry average, aligning with historical trends.

After declines in February and March 2024—the first in three years—extended-stay ADR rose for the tenth straight month in January but lagged the overall industry's 3.5 percent gain, STR/CoStar reported. However, all extended-stay segments outpaced their corresponding hotel classes in ADR growth.

RevPAR rose 1.6 percent in January, the ninth increase in ten months, but lagged the overall industry's 4.6 percent growth, per STR/CoStar. The total gain was lower than individual segment increases due to the economy segment’s larger share of extended-stay supply compared to January 2024.

The Highland Group recently reported that U.S. extended-stay hotels ended 2024 strong after a slow start. Supply, demand, and room revenue grew faster than the overall industry, while ADR and RevPAR remained positive, gaining momentum later in the year.