U.S. EXTENDED-STAY HOTEL occupancy declined across 59 MSAs in 2023 compared to 2019, primarily due to significant ADR growth over the past three years, according to The Highland Group. Additionally, extended-stay hotel RevPAR surged in more than 80 percent of MSAs, with ten of them, including four major hotel markets, experiencing gains exceeding 10 percent.

Despite an 8 percent increase in the number of extended-stay hotel rooms under construction in the 100 largest MSAs over the past year, the figures remain below pre-pandemic levels, the report said.

The resurgence in occupancy was notably led by smaller markets, where strong ADR increases and supply expansion played pivotal roles in driving the lowest occupancy recovery indices for MSAs in 2023.

ADR, RevPAR growth strongholds

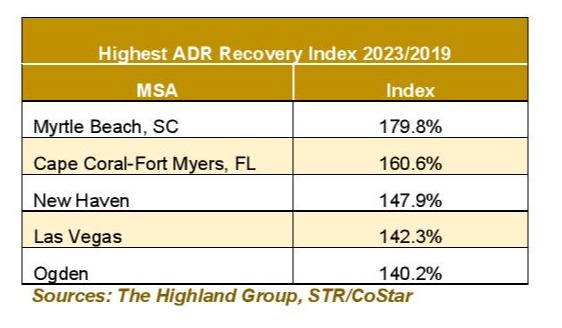

Apart from Las Vegas, Phoenix, and Tampa-St. Petersburg, few of the 25 largest hotel markets ranked among those with the highest ADR recovery indices, The Highland Group said. Myrtle Beach maintained its top position for the third consecutive year, with ADR surging nearly 80 percent higher in 2023 compared to 2019.

In 2023, eight MSAs saw a decline in ADR compared to 2022, with two of them still below their 2019 levels. San Jose and San Francisco continued for the third consecutive year with the lowest ADR recovery indices compared to 2019. While experiencing a robust recovery similar to some smaller extended-stay hotel markets, the introduction of new higher-rated extended-stay supply also significantly contributed to the ADR surge.

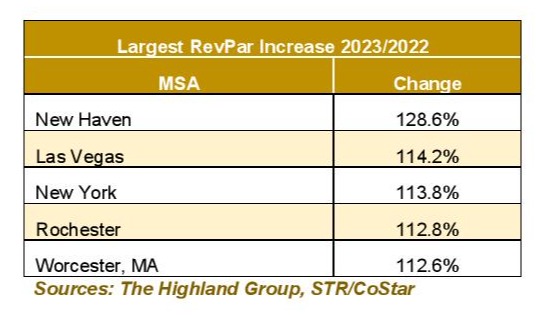

The report indicated that extended-stay hotel RevPAR surged in over 80 percent of MSAs in 2023. Notably, ten MSAs, including four major hotel markets, witnessed gains exceeding 10 percent. Despite being significantly impacted by the pandemic, markets such as New York, Boston, and Washington DC continued to register substantial RevPAR growth in 2023, mirroring trends from the previous year. However, San Jose experienced a slight decline in RevPAR, while San Francisco remained below its 2019 levels, standing out as exceptions.

The report indicated that extended-stay hotel RevPAR surged in over 80 percent of MSAs in 2023. Notably, ten MSAs, including four major hotel markets, witnessed gains exceeding 10 percent. Despite being significantly impacted by the pandemic, markets such as New York, Boston, and Washington DC continued to register substantial RevPAR growth in 2023, mirroring trends from the previous year. However, San Jose experienced a slight decline in RevPAR, while San Francisco remained below its 2019 levels, standing out as exceptions.

The report forecasted a promising outlook for extended-stay hotels in the 100 largest markets in the near term. In 2023, RevPAR growth surpassed 5 percent in over one-third of MSAs, with 40 markets outperforming the national average of 4.2 percent for all extended-stay hotels.

Looking ahead, supply growth across the 100 MSAs in 2024 is projected to be among the lowest in recent years. Nearly one-third of MSAs anticipate growth of 5 percent or less, with over 40 MSAs expecting no supply growth in the near term.

MSA room supply trends

Just under 12,800 extended-stay rooms were introduced to the 100 largest MSAs in 2023, marking a 3 percent increase, The Highland Group said. By year-end, extended-stay hotel companies reported 19,631 rooms under construction in these MSAs, reflecting an 8 percent rise compared to the previous year.

The report revealed that despite over 18,000 extended-stay rooms being under construction by the end of 2022, the net change in rooms open by the end of 2023 was less than 13,000. This trend reflects a lengthening hotel development timeline, along with instances of hotels no longer meeting brand standards, conversions to apartments, and municipalities acquiring extended-stay hotels for housing purposes.

With over three-quarters of extended-stay rooms concentrated in the 100 largest MSAs, these rooms represent over 10 percent of total room supply in 79 MSAs, with 33 MSAs having extended-stay rooms comprising 15 percent or more of all hotel rooms. Charleston, SC, Raleigh-Durham-Chapel Hill, and Salt Lake City boast the largest share of extended-stay rooms, while Myrtle Beach, Deltona-Daytona Beach, and Santa Rosa are among the most underrepresented MSAs.

According to the report, assuming all rooms under construction open by year-end and no existing rooms close, the absolute supply increase in 2024 would reach 4.4 percent. However, the actual increase is anticipated to be considerably lower.

Extended-stay room supply is projected to surge by 10 percent or more in 19 MSAs in 2024, with the most significant increases observed in smaller markets. Detroit stands out as the sole large hotel market expecting a greater than 10 percent rise in extended-stay supply in 2024, assuming all rooms under construction open by year-end.

The Highland Group recently reported a $1.1 billion surge in U.S. extended-stay hotel room revenues in 2023, closely matching figures from 2018 and 2019. Despite a slow pandemic recovery, all three extended-stay segments achieved record-high room revenues, with the upscale segment leading the trend.