Summary:

- Occupancy, ADR and RevPAR fell week over week and year over year for the week ending July 5, according to CoStar.

- St. Louis led in occupancy and RevPAR gains, while San Diego had the only double-digit ADR increase.

- Las Vegas saw the steepest drops in occupancy, ADR and RevPAR.

U.S. HOTEL METRICS declined for the week ending July 5, hitting weekly and annual lows, according to CoStar. St. Louis led the top 25 markets in year-over-year occupancy and RevPAR growth.

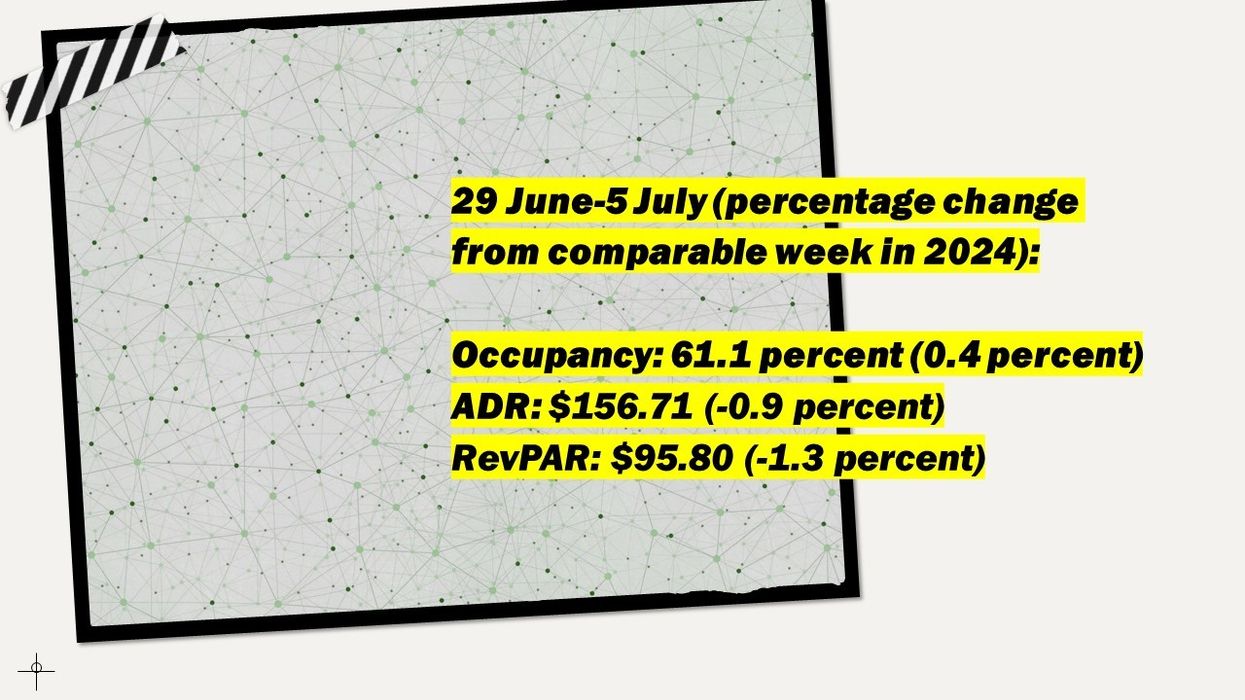

Occupancy fell to 61.1 percent for the week ending July 5, down from 71.9 percent the previous week and 0.4 percentage points lower year over year. ADR declined to $156.71 from $163.30, a 0.9 percent drop from the same week in 2024. RevPAR decreased to $95.80 from $117.45, down 1.3 percent year over year.

Among the top 25 markets, St. Louis posted the largest occupancy gain, up 27.1 percent to 64 percent and a RevPAR increase of 38.4 percent to $81.19. San Diego posted the only double-digit ADR increase, up 10.9 percent to $271.96.

Las Vegas reported the largest declines in occupancy, ADR and RevPAR. Its occupancy fell 16.8 percent to 66.7 percent, ADR dropped 14.3 percent to $154.16 and RevPAR declined 28.7 percent to $102.75.