Occupancy Hits 68.6%, Still Down Year Over Year

U.S. HOTEL METRICS increased for the week ending June 14 but remained below year-ago levels, according to CoStar. Industry performance in May was also higher than the same month last year.

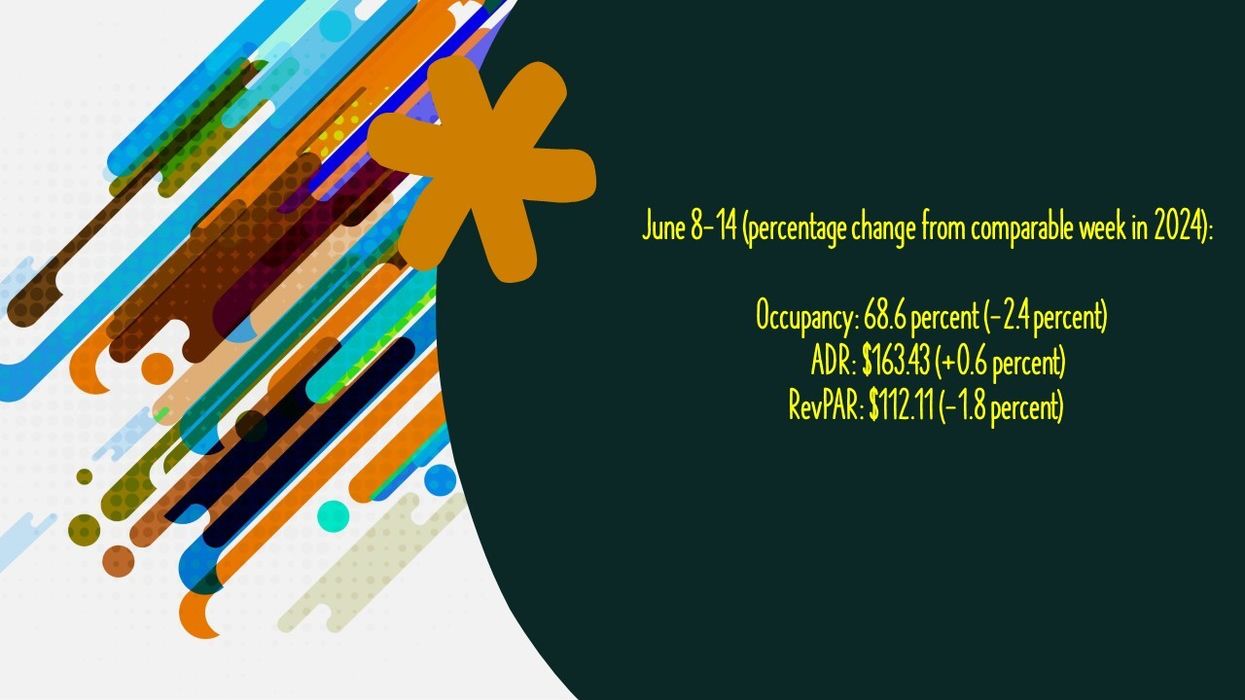

Occupancy rose to 68.6 percent for the week ending June 14, up from 67 percent the previous week but 2.4 percentage points lower year over year. ADR increased to $163.43 from $161.57, a 0.6 percent decline year over year. RevPAR rose to $112.11 from $108.23, down 1.8 percent year over year.

Among the top 25 markets, St. Louis had the highest YOY occupancy gain, up 7.1 percent to 73.2 percent. San Diego reported the largest ADR increase, up 10.4 percent to $244.60 and the largest RevPAR increase, up 13.1 percent to $205.12.

Las Vegas posted the largest declines across the three measures: occupancy down 20.6 percent to 66.2 percent, ADR down 9.1 percent to $180.40 and RevPAR down 27.8 percent to $119.51.

RevPAR fell by double digits in Houston, down 14.3 percent to $74.86; Phoenix, down 11.1 percent to $69.30 and Philadelphia, down 10.2 percent to $117.00.

May results

The top 25 markets posted higher occupancy and ADR than other markets in May, CoStar reported.

Occupancy rose to 65.3 percent in May, up from 63.9 percent in April but 0.7 percent lower than May 2024. ADR increased to $162.72 from $161.28, up 0.8 percent year over year. RevPAR reached $106.30, up from $103.11, a 0.1 percent increase from May 2024.

New York City recorded the highest occupancy among the top 25 markets, up to 87.9 percent compared to the previous year. New Orleans at 60.1 percent and Houston at 61.4 percent had the lowest occupancy for the month.