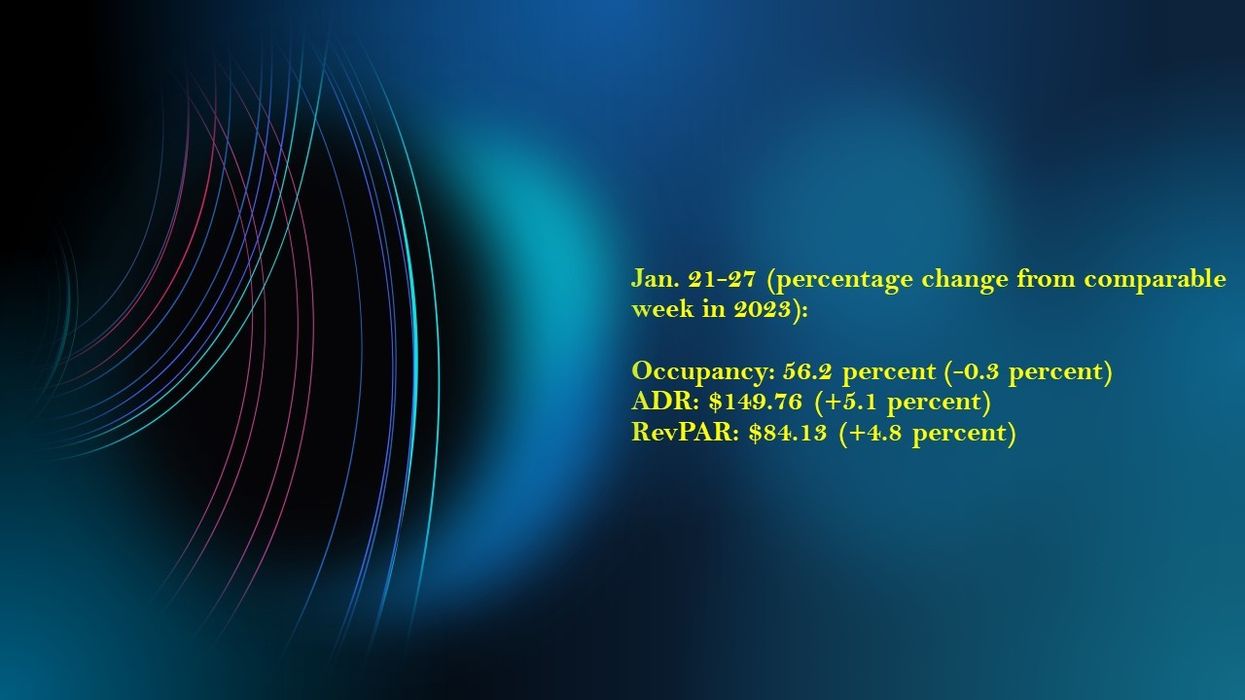

U.S. HOTEL PERFORMANCE improved in the fourth week of January compared to the previous week, according to CoStar. However, year-over-year comparisons remained mixed, with key metrics like occupancy, ADR, and RevPAR experiencing an increase compared to the preceding period.

Occupancy came in at 56.2 percent for the week ending Jan. 27, up from the previous week's 52.2 percent but down 0.3 percent year-over-year. ADR increased to $149.76 from the prior week's $142.27, a 5.1 percent rise from the previous year. RevPAR rose to $84.13 from the prior week's $74.31, reflecting a 4.8percent increase compared to the corresponding period in 2023.

Among the top 25 markets, Las Vegas exhibited the highest year-over-year growth across all key performance metrics: a 28.9 percent increase in occupancy to 83.4 percent, a 46.3 percent rise in ADR to $228.37, and an 88.5 percent growth in RevPAR to $190.42. This performance surge was attributed to the SHOT Show and World of Concrete events.

Boosted by the AHR Expo, Chicago saw significant increases in occupancy, rising 25.5 percent to 56.8 percent, ADR growing by 21.2 percent to $140.49 and RevPAR increasing by 52.1 percent to $79.74.

The steepest RevPAR declines were observed in Atlanta, which dropped by 17.6 percent to $75.46, and Tampa, experiencing a decrease of 13.4 percent to $84.06.