THE U.S. HOTEL industry experienced improved performance in February compared to the previous year, according to CoStar. Despite a slight decrease in occupancy, both ADR and RevPAR showed notable increases compared to the same period last year. The top 25 markets exhibited higher occupancy and ADR compared to all other markets.

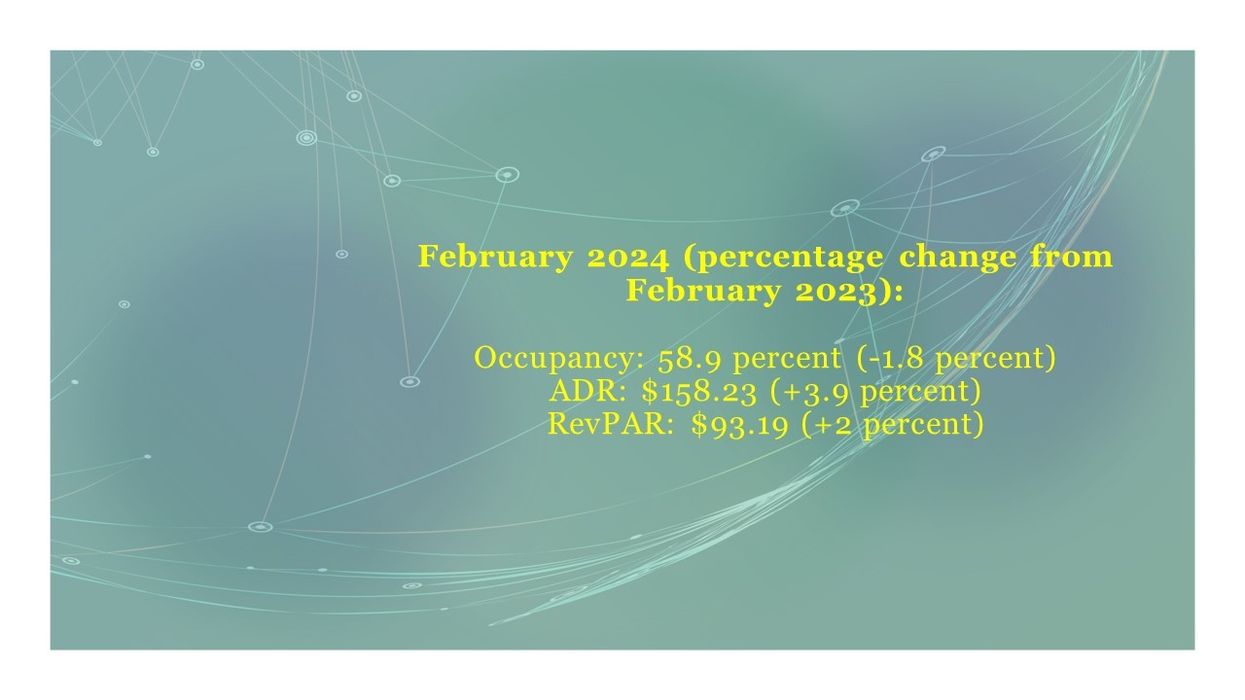

Occupancy rose to 58.9 percent in February from 51.9 percent in January, but declined by 1.8 percent compared to February 2023. ADR increased to $158.23 from $146.33 in the previous month, showing a 3.9 percent rise from 2023. RevPAR reached $93.19, compared to $75.99 in the preceding month, reflecting a 2 percent rise from February of the preceding year.

Among the top 25 markets, Oahu Island saw the highest occupancy level, up 84 percent and a 6.6 percent increase year over year. Boosted by Super Bowl LVIII, Las Vegas reported the highest ADR, soaring by 61.9 percent to $301.35, and RevPAR surged by 69.9 percent to $247.44. Markets with the lowest occupancy for the month included Minneapolis, up by 46.1 percent, and Chicago, which rose by 49.4 percent.

Meanwhile, U.S. hotel performance rose in the second week of March compared to the previous week but declined year-over-year. Key metrics, including occupancy, ADR, and RevPAR, all saw increases compared to the prior week.