U.S. HOTEL PERFORMANCE showed mixed year-over-year results in the third week of August compared to the previous week, according to CoStar. Key metrics, including occupancy, RevPAR and ADR, all experienced a decline from the previous week.

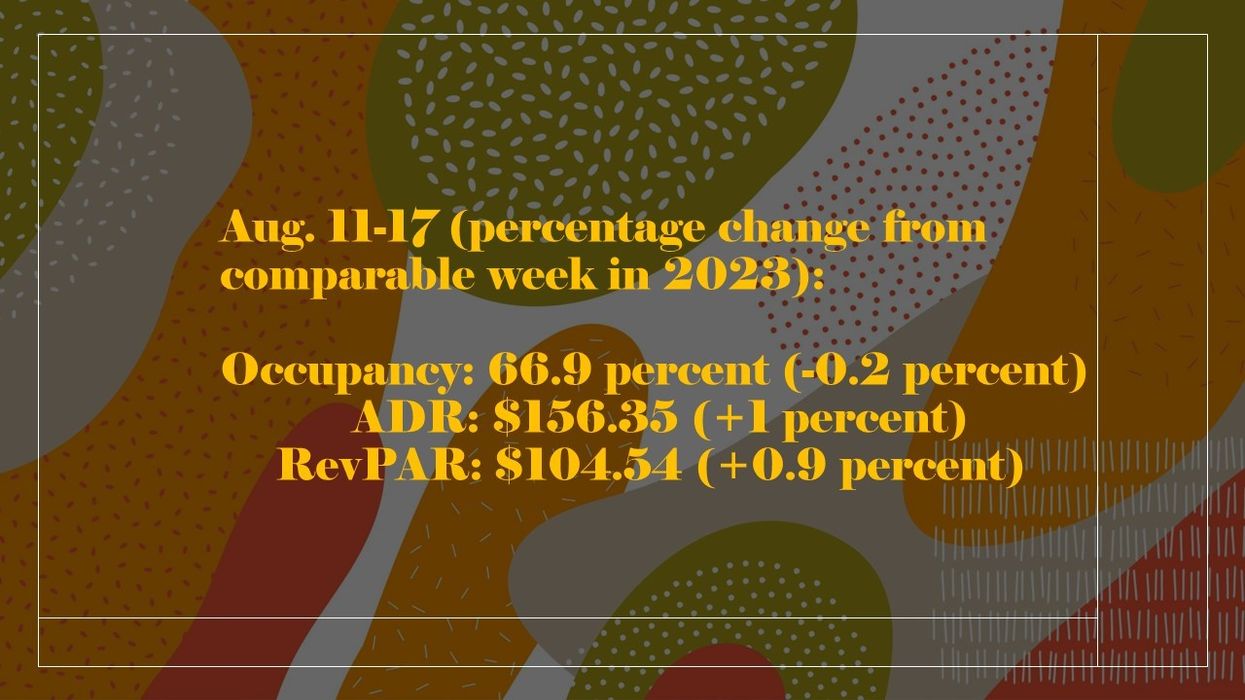

Occupancy dropped to 66.9 percent for the week ending Aug. 17, down from 68.7 percent the previous week, and showed a 0.2 percent decrease year-over-year. The ADR was $156.35, lower than the prior week’s $159.49, but 1 percent higher than the same week last year. RevPAR fell to $104.54 from $109.51 the previous week, yet remained 0.9 percent higher compared to the same period in 2023.

Among the top 25 markets, Houston reported the largest year-over-year increase in all three key performance metrics: occupancy surged 34.3 percent to 75.3 percent, ADR rose 14.5 percent to $121.89, and RevPAR climbed 53.8 percent to $91.73.

The steepest RevPAR declines were observed in San Francisco, which fell 13.8 percent to $143.39, and Atlanta, which decreased 11.3 percent to $69.43.