THE U.S. HOTEL construction pipeline increased year-over-year in September for the seventh straight month, according to STR. Investor sentiment remains positive following the Federal Reserve’s September interest rate cut, as shown by continued double-digit growth in the planning and final planning stages of the pipeline.

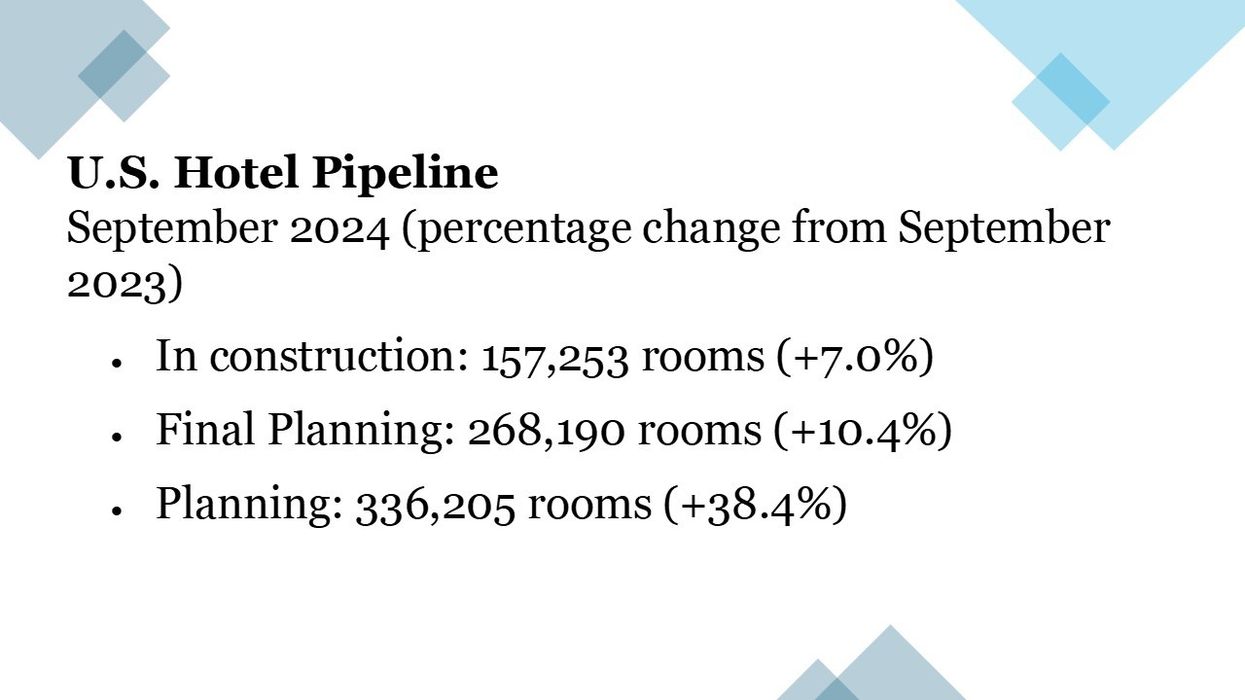

In CoStar’s pipeline, 157,253 rooms were under construction in September, a 7 percent increase from last year. An additional 268,190 rooms were in final planning, up 10.4 percent, while 336,205 rooms were in planning, up 38.4 percent.

“Growth in rooms in construction has accelerated over the last seven months,” said Isaac Collazo, STR’s vice president of analytics. “Despite higher interest rates throughout 2024, developer appetite has remained strong. With the recent rate cut in September and more on the way, investor sentiment remains positive, as evidenced by continued double-digit growth across the planning and final planning stages of the pipeline. Upscale and upper midscale continue to account for about 50 percent of all rooms in the final phase, while luxury and midscale showed the highest growth in rooms in construction, up 48.5 percent and 34.5 percent, respectively.”

Luxury chain scales had the highest percentage of rooms in the in-construction phase relative to existing supply. The overall chain scale rankings for September are:

- Luxury (5.6 percent, 8,508 rooms)

- Upper Upscale (2.6 percent, 18,156 rooms)

- Upscale (4.2 percent, 38,401 rooms)

- Upper Midscale (3.4 percent, 40,255 rooms)

- Midscale (2.9 percent, 14,902 rooms)

- Economy (1.2 percent, 7,653 rooms)

U.S. leads in the Americas

The U.S., with 157,253 rooms, accounts for the majority of rooms in construction in the Americas, CoStar said. Following the U.S., Mexico has 13,986 rooms, Canada has 9,125, and Brazil has 5,964 rooms under construction.

According to CoStar, 209,312 rooms were under construction in September, a 9.5 percent increase from last year. An additional 305,199 rooms were in final planning, up 10.6 percent, while 387,418 rooms were in planning, up 36.1 percent. Approximately 901,929 rooms were under contract, a 20 percent rise.

Meanwhile, hotel pipeline activity increased globally, except in Europe, which is the only region with lower hotel pipeline activity year-over-year.

In July, CoStar reported that the Americas and Asia Pacific saw a year-over-year increase in hotel pipeline activity at the end of the second quarter, with the U.S. leading the Americas at 157,713 rooms under construction and China topping Asia Pacific with 319,012 rooms.