U.S. HOTEL PERFORMANCE dropped in the first week of July compared to the previous week due to Independence Day on July 4, according to CoStar. Key metrics, including occupancy, ADR, and RevPAR, saw declines over the prior week.

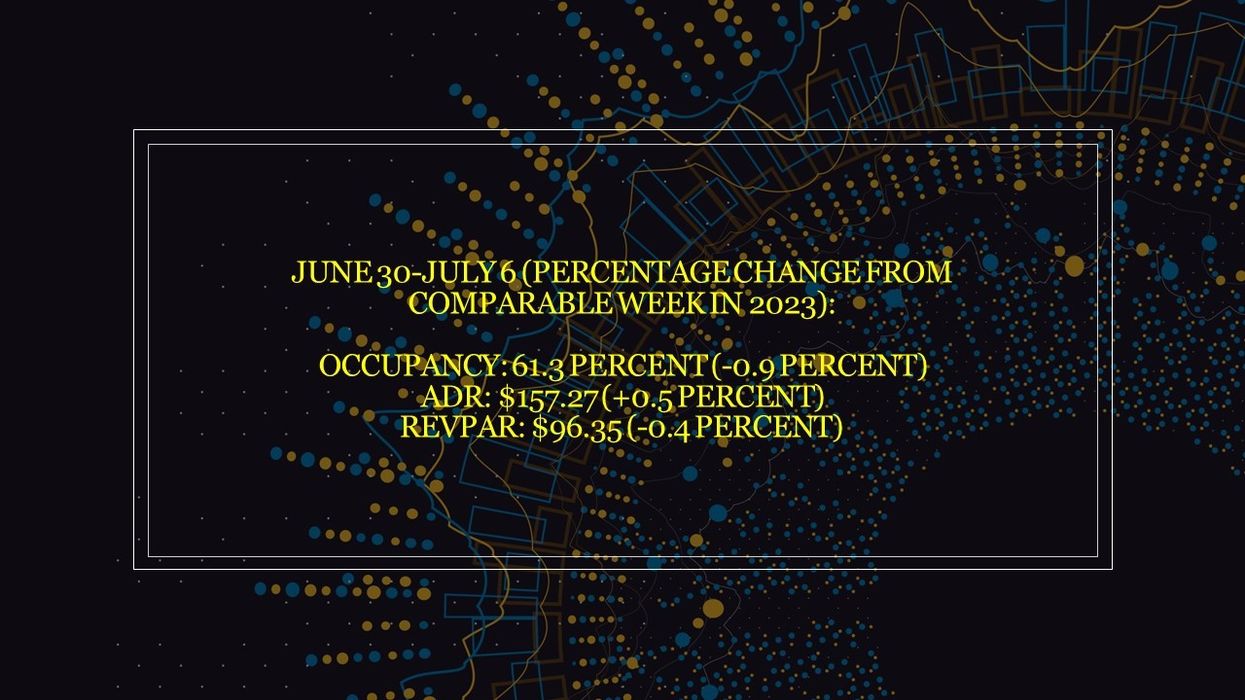

Occupancy was 61.3 percent for the week ending July 6, down from 71.9 percent the previous week, showing a 0.9 percent year-over-year decrease. ADR dropped to $157.27 from $162.81, marking a 0.5 percent increase compared to last year. RevPAR fell to $96.35 from $117.13 the previous week, reflecting a 0.4 percent decrease compared to the same period in 2023.

Among the top 25 markets, New Orleans saw the highest year-over-year increases in each of the three key performance metrics: occupancy rose 15.5 percent to 56.6 percent, ADR increased 35.1 percent to $197.23 and RevPAR grew 56.1 percent to $111.72.

The steepest RevPAR declines were observed in St. Louis, down 25.4 percent to $58.65, and in Tampa, which declined 13.5 percent to $100.65.