Summary:

- U.S. hotel metrics hit weekly and yearly lows for the last week of September, CoStar reports.

- Las Vegas posted the largest year-over-year declines across key metrics.

- Occupancy fell in 21 of the top 25 markets.

U.S. HOTEL METRICS declined for the week ending Sept. 27, hitting weekly and yearly lows, according to CoStar. Overall, 21 of the top 25 markets saw a drop in occupancy.

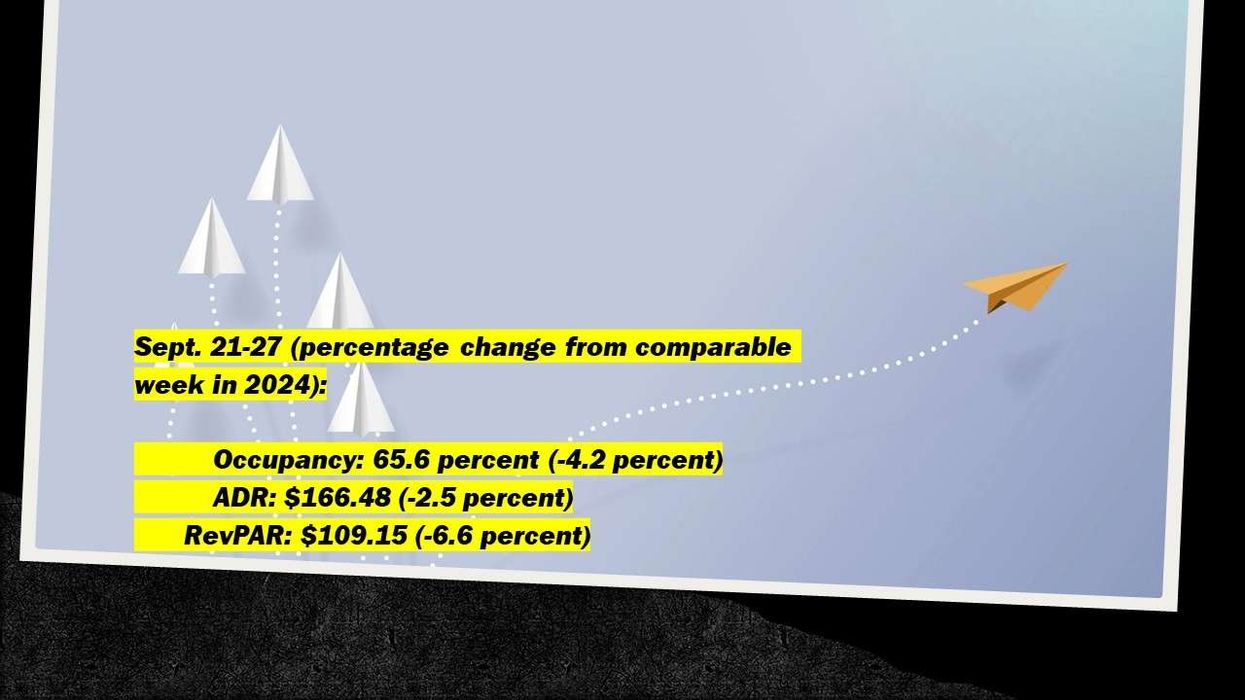

Occupancy fell to 65.6 percent for the week ending Sept. 27, down from 68.1 percent the previous week and 4.2 points lower than the same week last year. ADR declined to $166.48 from $168.98, a 2.5 percent year-over-year decrease. RevPAR fell to $109.15 from $115.12, down 6.6 percent from the same week in 2024.

Among the top 25 markets, Las Vegas posted the largest year-over-year declines across all key metrics: occupancy fell 23 percent to 66.1 percent, ADR dropped 20.1 percent to $195.31 and RevPAR slid 38.5 percent to $129.04.

New Orleans reported the second-largest declines: occupancy fell 21.1 percent to 48.4 percent, ADR dropped 14.9 percent to $131.54 and RevPAR fell 32.8 percent to $63.65.