U.S. HOTELS ARE likely to report improved RevPAR growth in the second half of the year, following a weak first quarter, according to CBRE. International tourism and other economic factors are expected to provide a boost to performance.

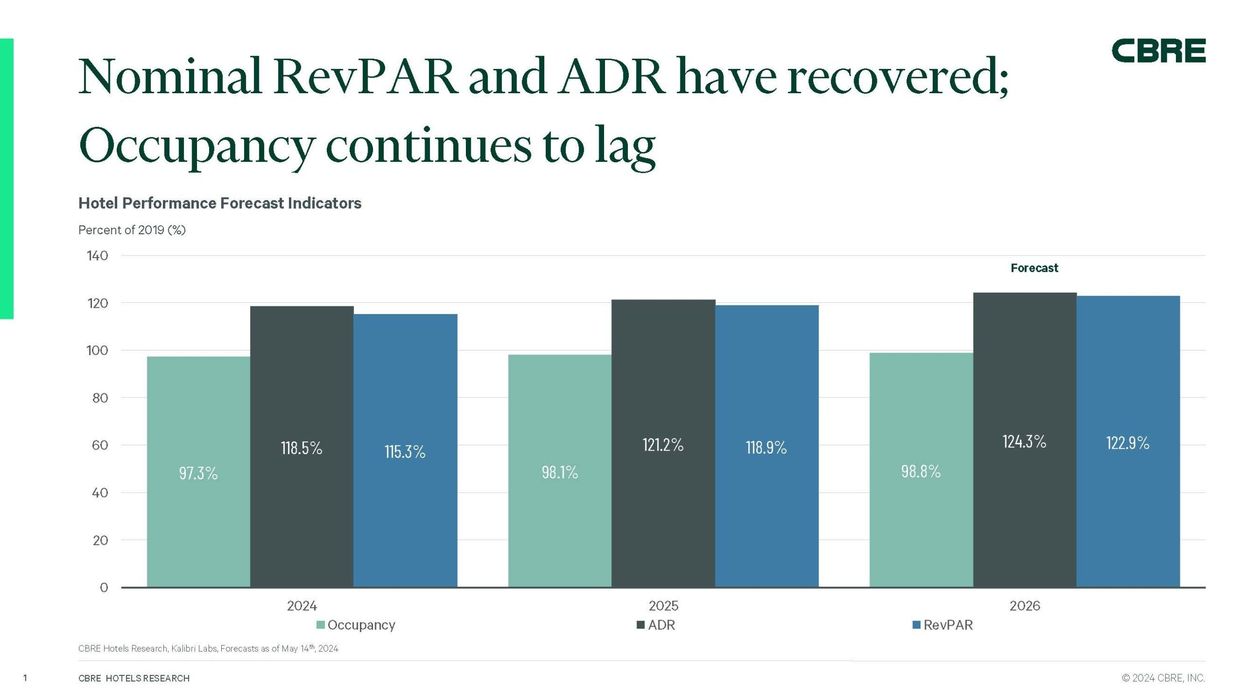

A 2 percent increase in RevPAR growth is forecasted for 2024, down from the 3 percent estimated in February. RevPAR is now expected to grow by 3 percent for the remainder of the year, driven by international tourists, holiday travel, and limited supply growth.

It is projecting GDP growth of 2.3 percent and average inflation of 3.2 percent in 2024.

The performance of the lodging industry is closely tied to the strength of the economy, as there is typically a strong correlation between GDP and RevPAR growth, CBRE said in a statement.

“We anticipate modest growth over the next few quarters, supported by a continued uptick in visitors from overseas and election-related events, such as political party conventions,” said Rachael Rothman, CBRE’s head of hotel research & data analytics.

Meanwhile, CBRE remains optimistic that RevPAR will achieve a nominal record of $101.20 this year, representing 115 percent of pre-pandemic levels in 2019. This outlook is based on projected ADR growth of 1.7 percent and a 0.2 percent increase in occupancy, the report said.

“Slower RevPAR growth reflects softer demand, stickier inflation and high interest rates,” said Michael Nhu, senior economist and CBRE’s head of global hotels forecasting. “People have already spent a significant portion of their pandemic-era savings, and on top of that, the lingering inflationary pressures are putting a strain on discretionary spending, especially for more price-sensitive consumers.”

The company anticipates limited supply growth in the medium term due to high financing and construction costs. For 2024, CBRE projects supply growth of just under 1 percent, with a compound annual growth rate of 0.9 percent over the next three years.

CBRE analysts recently noted that utility costs at U.S. hotels have outpaced total operating revenue in recent years, with expenses rising from 2.9 percent of total revenue in 2019 to an estimated 3.3 percent in 2023. This trend raises concerns for hotel owners and operators amid ongoing pandemic recovery efforts.