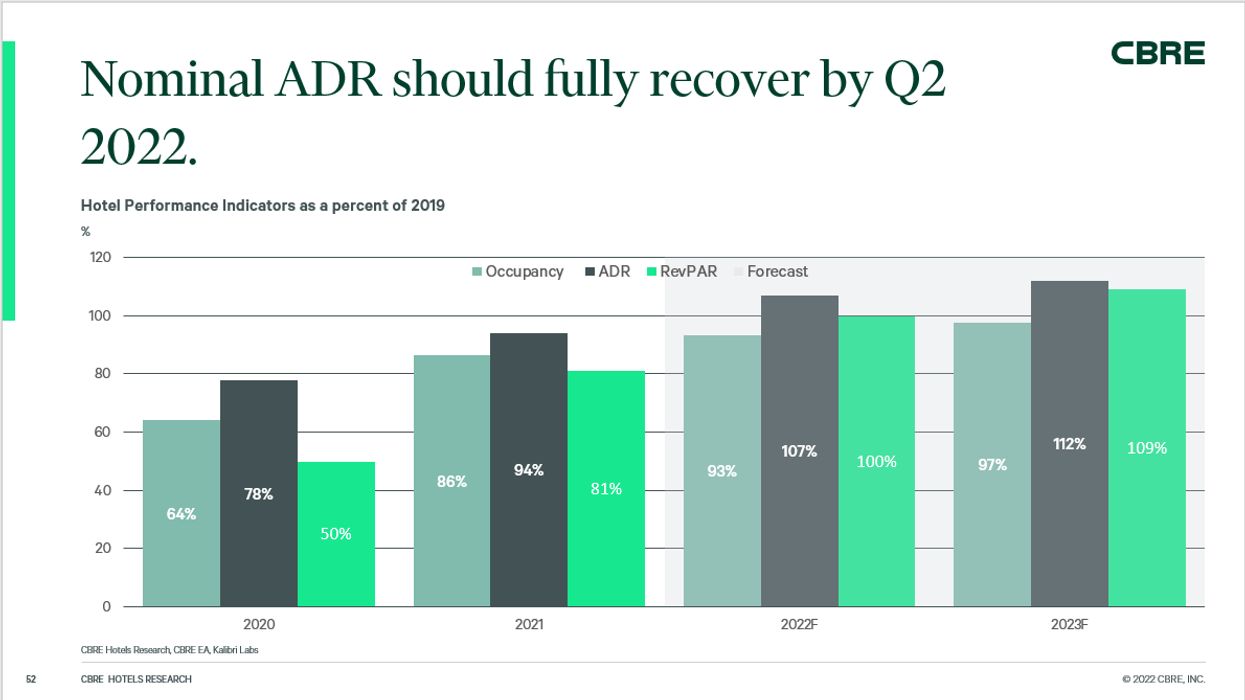

A STRONG PERFORMANCE by U.S. hotels during the first quarter of 2022, along with other factors, are leading CBRE Hotels Research to raise its forecast for the rest of the year. The research firm now expects a full recovery in ADR in 2022 and in demand and RevPAR in 2023.

First quarter RevPAR reached $72.20, up 61 percent from year earlier, despite a surge from the COVID-19 omicron variant, according to CBRE. RevPAR growth was driven by a 39 percent increase in ADR and a 16 percent increase in occupancy.

ADR was 5 percent ahead of 2019’s levels, marking the third consecutive quarter in which levels exceed the same period in 2019. These rising rates demonstrate that travelers aren’t price-sensitive in many peak-demand markets.

Continued slowing of construction activity, higher inflation and continued optimism about employment and economic growth also contributed to CBRE’s consideration for the new forecast. Other issues that have come up since the end of 2021, including the Russia-Ukraine war, high gas prices and the 19 percent pullback in the S&P 500 have increased the risk of a potential slowdown. However, CBRE Econometric Advisors still predicts positive GDP and employment growth and continued elevated Consumer Price Index through 2023.

“To date, there has been no sign that the more than 50 percent increase in gas prices and the stock market’s hovering near bear-market territory are dampening hotel demand,” said Rachael Rothman, CBRE’s Head of hotel research and data analytics. “However, in the past, a steep decline in the S&P 500 and high gas prices have often caused RevPAR growth to decline, which raises the specter of a pullback in RevPAR later this year. Despite this possibility, our outlook remains that the market will continue to recover.”

Drive-to leisure destinations are expected to continue to be popular, particularly among high-end properties where consumers are less price sensitive and the impact of inflation may be less severe. At the same time, higher gas prices, food costs and mortgage rates could reduce travel plans by budget-minded consumers who may otherwise use interstate hotels.

Inflation continues to bolster top-line growth along with longer term, muted supply growth. However, inflation can also suppress margin expansion in light of rising wages, utilities, food and beverage costs, insurance, and capital expenditure increases.

“High construction-material prices, including lumber, steel, and labor, make the development of new projects cost prohibitive. CBRE forecasts that supply will increase at a 1.2 percent compound annual growth rate over the next five years, below the industry’s 1.8 percent long-term historical average,” CBRE said in a statement. “CBRE Hotels Research’s base case scenario forecasts do not contemplate a larger-scale war, a recession, nor a more acute COVID variant. All clients are encouraged to review the scenario analysis for a more comprehensive view of the range of potential outcomes.”

CBRE previously revised its forecast in March.